- United States

- /

- Capital Markets

- /

- NYSE:MS

What Morgan Stanley (MS)'s $1 Dividend Hike and $20B Buyback Mean for Shareholders

Reviewed by Simply Wall St

- In July 2025, Morgan Stanley announced it will raise its quarterly dividend to $1.00 per share and authorized a share repurchase program of up to $20 billion with no set expiration date, following recent index changes that saw the company dropped from several Russell growth benchmarks and added to the Russell Top 50 Index.

- This combination of a higher dividend and substantial buyback plan, announced shortly after shifts in index inclusions, reflects active capital management and board confidence in the company's near-term outlook.

- We'll look at how the $20 billion share buyback program underscores Morgan Stanley's capital priorities amid evolving index status and analyst expectations.

Morgan Stanley Investment Narrative Recap

To be a Morgan Stanley shareholder today, you need to believe in the company's ability to deliver stable earnings through its market leadership in wealth management and global equities, while actively managing capital returns to support shareholder value. The recent dividend hike and US$20,000 million buyback show ongoing board confidence, which may reinforce the most important short-term catalyst, client engagement in wealth management. However, these announcements do not materially reduce key risks like recession-driven declines in banking revenues.

The standout recent announcement is the authorized US$20,000 million share repurchase program. This directly connects to Morgan Stanley’s focus on capital returns and may provide flexibility if fee-based revenues from capital markets and advisory activities fluctuate in response to macroeconomic uncertainties or volatility in deal activity.

Yet, investors should also be aware that, unlike capital returns, the risk of commercial real estate loan vulnerabilities is not addressed by these updates…

Read the full narrative on Morgan Stanley (it's free!)

Morgan Stanley's outlook projects $71.8 billion in revenue and $15.5 billion in earnings by 2028. This implies a 3.9% annual revenue growth and an earnings increase of $1.8 billion from current earnings of $13.7 billion.

Exploring Other Perspectives

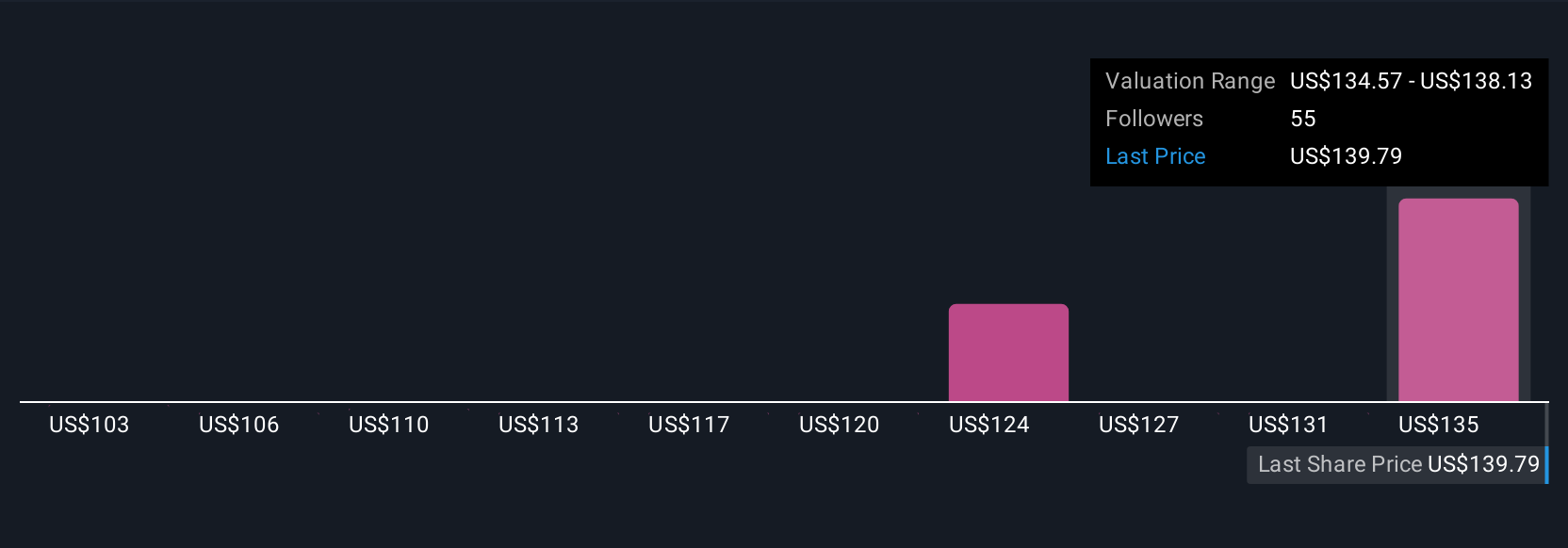

Five fair value estimates from the Simply Wall St Community range from US$102.53 to US$131.66 per share. While views differ, ongoing volatility in market cycles could weigh on performance and shape future sentiment, be sure to consider several viewpoints.

Build Your Own Morgan Stanley Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Morgan Stanley research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morgan Stanley's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives