- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (MS): Taking a Fresh Look at Valuation as Shares Show Steady Momentum

Reviewed by Kshitija Bhandaru

Morgan Stanley (MS) shares have moved modestly this week, catching the eye of investors curious about shifts in the financial sector. The stock's underlying trends remain the focus, particularly in light of recent momentum.

See our latest analysis for Morgan Stanley.

While the past week brought only minor fluctuations to Morgan Stanley’s share price, the bigger story is its steady climb, with a 1-year total shareholder return of 53% and solid momentum continuing into this year. Investors seem increasingly optimistic about the bank’s prospects as market sentiment gradually turns more positive.

If growing momentum in financials has piqued your curiosity, now is a great time to broaden your search and explore fast growing stocks with high insider ownership

But with shares already up this year and trading just above analyst targets, the key question remains: Is Morgan Stanley undervalued, or has the market already factored in all future growth potential?

Most Popular Narrative: 6% Overvalued

Despite Morgan Stanley’s most followed narrative suggesting a fair value below the last close of $155.30, the stock is still trading at a premium. The narrative paints a picture of strong recurring growth but includes notable headwinds investors should weigh.

The ongoing increase in global wealth, combined with the accelerating intergenerational transfer of assets, is boosting demand for comprehensive advisory and wealth management solutions. This is evidenced by record net new assets and a growing client base, which should drive higher recurring fee-based revenue and long-term earnings growth. Rising interest from both retail and institutional clients in innovative and customized sustainable investing and alternative asset products (such as ESG and Parametric portfolios) presents opportunities for new revenue streams and improved client retention, supporting potential margin expansion.

Curious about the bold expectations built into this fair value? Find out which growth metrics and profit assumptions keep the stock under close analyst scrutiny. Only the full narrative reveals how these forecasts stack up to today’s share price.

Result: Fair Value of $145.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a surge in passive investing or sudden regulatory tightening could quickly reduce Morgan Stanley's fee growth and pressure future margins.

Find out about the key risks to this Morgan Stanley narrative.

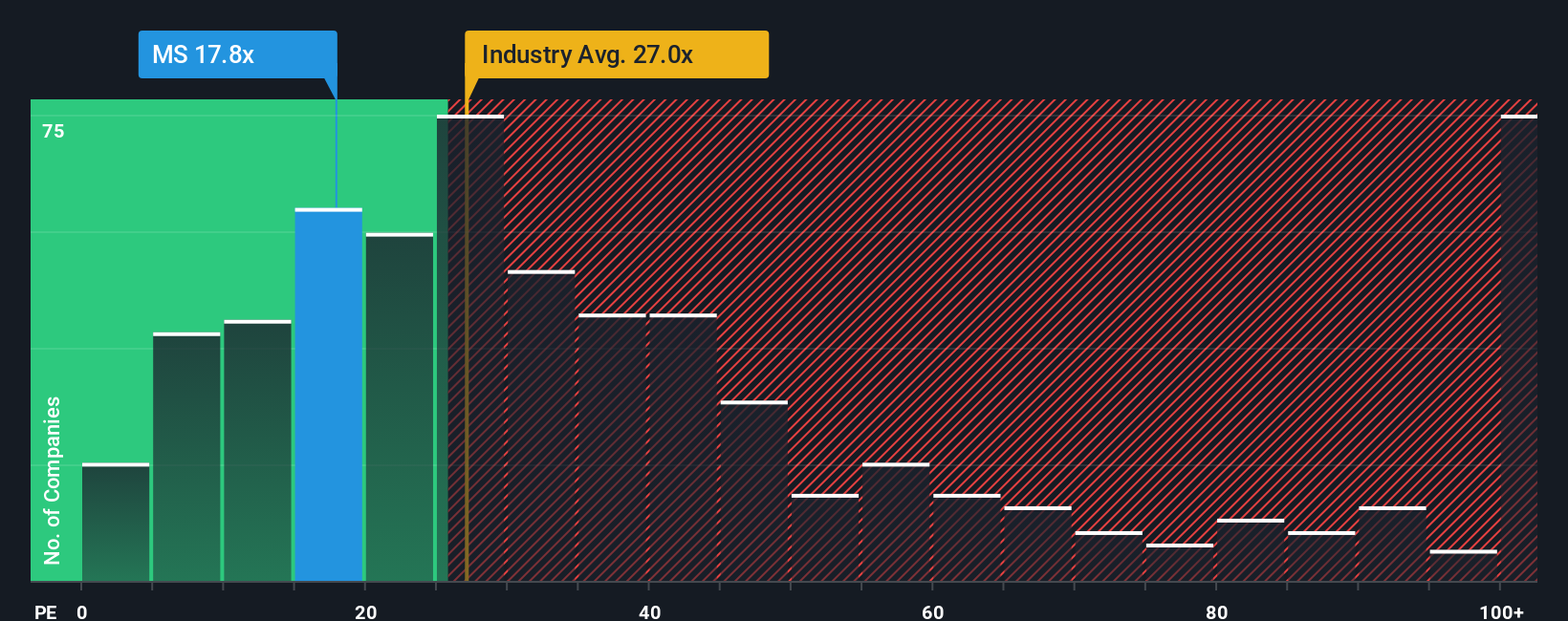

Another View: Comparing Price-to-Earnings

Looking at Morgan Stanley’s valuation through its price-to-earnings ratio, the stock trades at 17.5x, which is well below the US market average of 19.2x and the industry average of 26.2x. The fair ratio is calculated at 20.9x, suggesting the market might eventually close the gap. Does this discount signal opportunity or hidden risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Morgan Stanley Narrative

If you have a different perspective or would like to dig into the details yourself, you can assemble your own Morgan Stanley narrative in just a few minutes. Get started with Do it your way.

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait to give your portfolio a fresh spark. Expand your opportunities with stock picks built for today’s fastest-moving markets using our powerful screeners.

- Tap into tomorrow’s biggest winners with these 909 undervalued stocks based on cash flows, designed to help you spot undervalued plays before the crowd.

- Grow your income stream by scanning these 19 dividend stocks with yields > 3%, offering high yields and consistent dividend performance above 3%.

- Ride the artificial intelligence wave and seize your edge with these 24 AI penny stocks, fueling cutting-edge innovation in every major sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives