- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (MS): Evaluating Valuation After Strong Q3 Earnings, Dividends, and Share Buybacks

Reviewed by Simply Wall St

Morgan Stanley (MS) reported a jump in third-quarter earnings, posting higher net income and earnings per share than last year. At the same time, the firm continued its share buybacks and announced another quarterly dividend.

See our latest analysis for Morgan Stanley.

Morgan Stanley’s recent string of positive updates, from higher third-quarter earnings to steady dividends and a wave of bond offerings, has caught the market’s attention. The latest 29.8% year-to-date share price return, along with a robust one-year total shareholder return of almost 41%, shows that momentum is clearly building, supported by growth in core businesses and investor confidence in management’s capital allocation.

If you’re interested in what else is gaining traction, now’s a great moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with shares near record highs following a 55% rally in just seven months, the key question now is whether Morgan Stanley is still attractively valued or if the market has already fully priced in its future growth prospects.

Most Popular Narrative: 4.7% Overvalued

The latest widely followed narrative puts Morgan Stanley’s fair value at $154.75, with shares last closing at $161.97. This gap spotlights potential optimism in the current price, as the consensus view prices in ongoing growth and efficiency gains. Here is a direct catalyst from the narrative’s main argument:

*Morgan Stanley's continued investment in technology (AI, digital platforms, E*TRADE enhancements) and workplace channel expansion are yielding improved operating efficiencies and productivity, which are likely to support net margin improvement over time.*

Curious about what is fueling those operating margins? The details lie in ambitious forecasts about the next wave of digital wealth management and global expansion. Want to see exactly how bold these future projections get? Take a look behind the headline valuation and uncover the drivers for this market-defying price target.

Result: Fair Value of $154.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if passive investing continues to outpace advisory services or if regulatory shifts tighten, Morgan Stanley’s projected growth and margins could quickly come under pressure.

Find out about the key risks to this Morgan Stanley narrative.

Another View: Strong Value Signals from Market Multiples

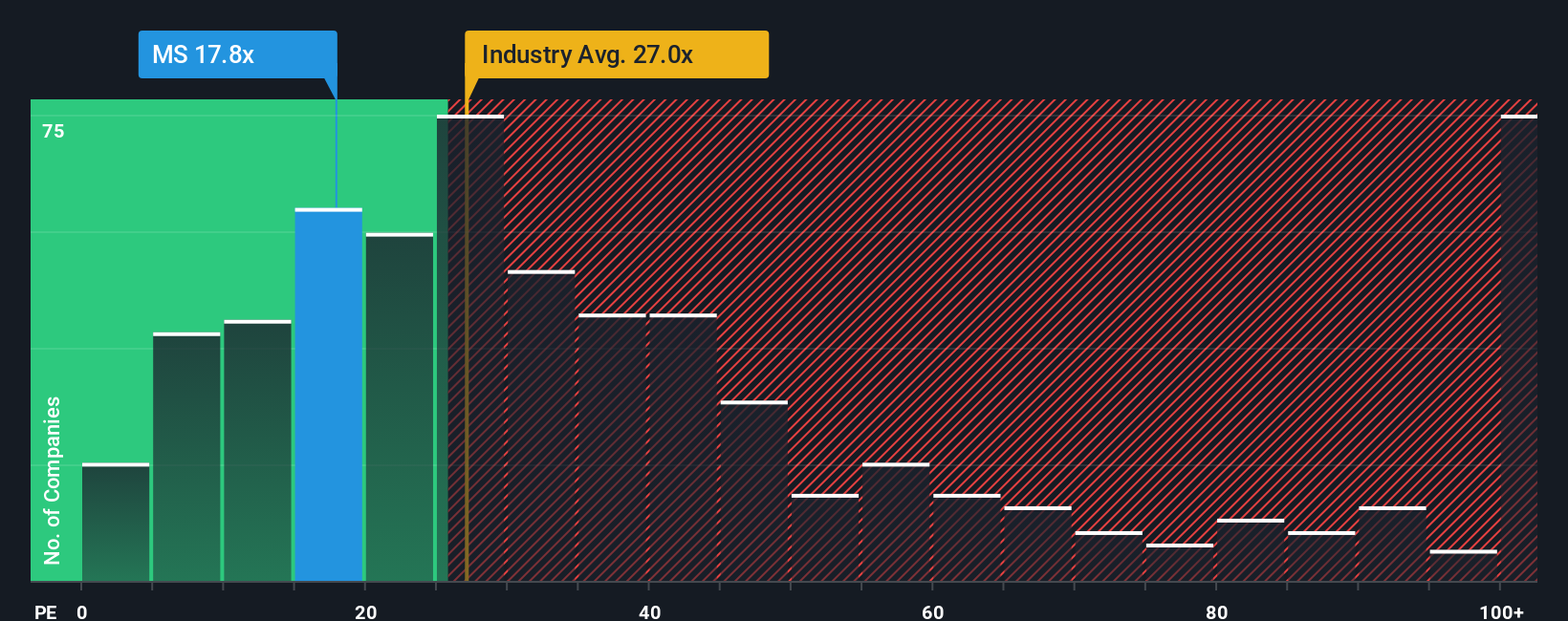

While the narrative model suggests Morgan Stanley is trading above fair value, the market’s current valuation using the price-to-earnings ratio tells a different story. At 16.6x, it sits well below both the industry average (25.7x) and the peer average (34.4x). It is also under the fair ratio of 20.6x. This gap highlights a potential opportunity for investors, but does it mean the market is underestimating future risks or missing an edge others see?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Morgan Stanley Narrative

Not convinced by the popular view or want to dive deeper into the numbers yourself? You can analyze the data and shape your own story in just a few minutes, and Do it your way.

A great starting point for your Morgan Stanley research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize every edge. Step beyond the obvious and uncover powerful opportunities hidden in the stock market using uniquely tailored screens. Don’t let the best ideas pass you by.

- Earn potential passive income by tapping into these 17 dividend stocks with yields > 3%, which delivers yields above 3% and is built for consistent returns.

- Join the surge into the future by uncovering these 24 AI penny stocks, which shape tomorrow with breakthroughs in artificial intelligence.

- Capture value that others might overlook as you seek out these 875 undervalued stocks based on cash flows, using strong cash flow signals to spotlight standout options.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives