- United States

- /

- Consumer Finance

- /

- NYSE:ML

US Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

As of September 2024, the U.S. stock market is experiencing a notable upswing, with the S&P 500 and Dow Jones Industrial Average closing at record highs, driven by gains in major companies like Tesla and Intel. This positive momentum comes amid a series of economic data releases and Federal Reserve comments that investors are closely monitoring for signs of continued growth. In this favorable market environment, growth companies with high insider ownership can be particularly appealing to investors. High insider ownership often signals strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.8% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

Here's a peek at a few of the choices from the screener.

Westrock Coffee (NasdaqGM:WEST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Westrock Coffee Company, LLC operates as an integrated provider of coffee, tea, flavors, extracts, and ingredients solutions both in the United States and internationally with a market cap of $593.47 million.

Operations: The company's revenue segments include Beverage Solutions at $673.25 million and Sustainable Sourcing & Traceability at $168.53 million.

Insider Ownership: 13.1%

Revenue Growth Forecast: 16.2% p.a.

Westrock Coffee is forecast to become profitable within the next three years, with earnings expected to grow 107.76% annually. Despite a recent net loss of US$17.76 million for Q2 2024, revenue is projected to grow at 16.2% per year, outpacing the US market average of 8.7%. Insider activity shows more shares bought than sold in the past three months, and analysts agree on a potential stock price increase of nearly 80%.

- Click to explore a detailed breakdown of our findings in Westrock Coffee's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Westrock Coffee shares in the market.

Loar Holdings (NYSE:LOAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Loar Holdings Inc. designs, manufactures, and markets aerospace and defense components and systems for aircraft both in the United States and internationally, with a market cap of $6.68 billion.

Operations: Revenue Segments (in millions of $): Aerospace & Defense: 358.10

Insider Ownership: 18.5%

Revenue Growth Forecast: 15.3% p.a.

Loar Holdings is experiencing robust growth, with earnings projected to increase 63.1% annually and revenue expected to grow at 15.3% per year, outpacing the US market average of 8.7%. Recent additions to multiple indices, including the S&P Global BMI Index and Russell Midcap Growth Index, reflect its rising prominence. Despite a low forecasted return on equity (8.7%), Loar's recent debt financing for acquisitions and raised earnings guidance underscore its aggressive expansion strategy.

- Unlock comprehensive insights into our analysis of Loar Holdings stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Loar Holdings shares in the market.

MoneyLion (NYSE:ML)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MoneyLion Inc., a financial technology company, offers personalized financial products and content for American consumers, with a market cap of $476.91 million.

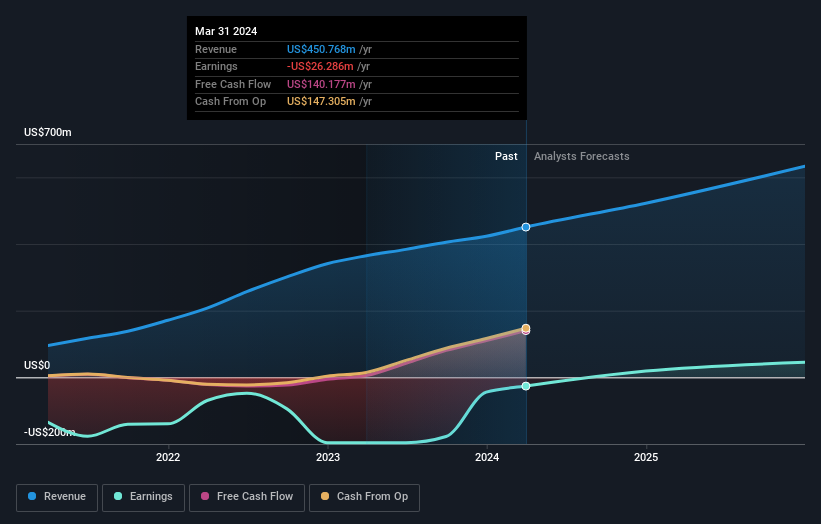

Operations: MoneyLion's revenue primarily comes from its Data Processing segment, which generated $475.07 million.

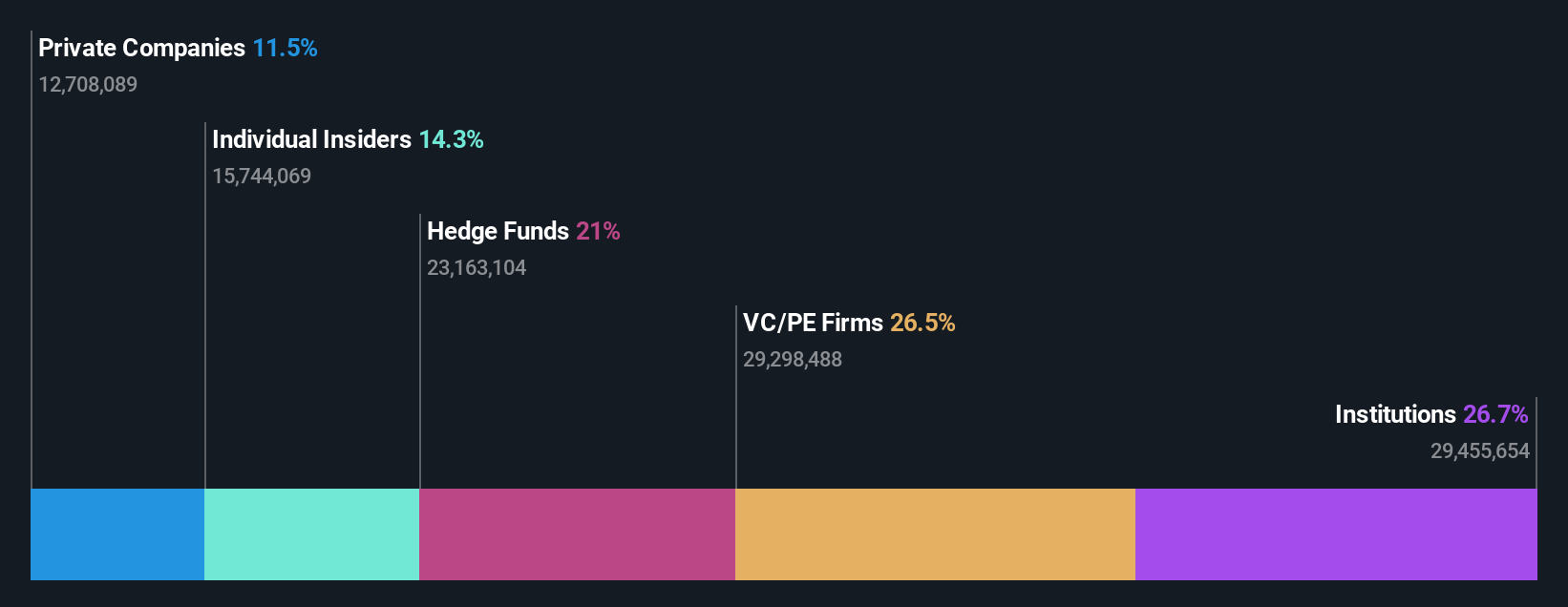

Insider Ownership: 19.4%

Revenue Growth Forecast: 19.4% p.a.

MoneyLion's earnings are forecast to grow 133.8% annually, significantly outpacing the US market average of 15.2%. Insiders have been substantially buying shares over the past three months, reflecting strong internal confidence. Despite recent volatility and past shareholder dilution, MoneyLion has become profitable this year and announced a $20 million share repurchase program. Revenue is expected to grow by 19.4% per year, faster than the US market rate of 8.7%.

- Click here to discover the nuances of MoneyLion with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that MoneyLion is priced higher than what may be justified by its financials.

Seize The Opportunity

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 176 more companies for you to explore.Click here to unveil our expertly curated list of 179 Fast Growing US Companies With High Insider Ownership.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ML

MoneyLion

A financial technology company, provides personalized products and financial content for American consumers.

Reasonable growth potential with adequate balance sheet.