- United States

- /

- Capital Markets

- /

- NYSE:MIAX

Miami International Holdings (MIAX): Evaluating Valuation Following Strong Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Miami International Holdings (MIAX) is drawing attention as investors take a closer look at its recent stock moves. After a month of double-digit gains, there is fresh interest in how the company’s momentum could impact its valuation.

See our latest analysis for Miami International Holdings.

Momentum in Miami International Holdings has clearly been building, with a 15% 1-month share price return and a strong 40% year-to-date rise, putting the stock firmly on investors’ radars. While recent days have brought a modest pullback, the surge over the past few weeks suggests confidence in the company’s growth prospects or a shift in risk perception is fueling this attention.

If you’re watching these rapid climbs and want fresh discovery ideas, it could be the perfect time to broaden your search and check out fast growing stocks with high insider ownership.

But with annual revenue declining even as net income accelerates, and shares now just shy of analyst targets, the real question is whether Miami International Holdings represents an overlooked bargain or if future gains are already reflected in the current price.

Price-to-Sales of 3x: Is it justified?

MIAX trades at a price-to-sales ratio of 3x, well below the average for its peers and the US Capital Markets industry. With the last close price at $43.11, this multiple suggests the market currently values the company’s revenues much more conservatively compared to others in the sector.

The price-to-sales ratio measures how much investors are willing to pay per dollar of sales. This makes it especially relevant for financial firms like MIAX, where earnings can be volatile but sales provide a baseline for comparison. A low multiple can either signal overlooked value or underlying concerns about future growth.

Here, MIAX’s 3x price-to-sales stands out against both its peer average (9.2x) and the broader industry average (3.9x), highlighting a significant discount. The gap may close if market confidence in its growth prospects strengthens or if earnings forecasts are realized.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 3x (UNDERVALUED)

However, persistent annual revenue declines or a market re-rating that moves closer to analyst targets could challenge the undervalued thesis going forward.

Find out about the key risks to this Miami International Holdings narrative.

Another View: What Does Our DCF Model Say?

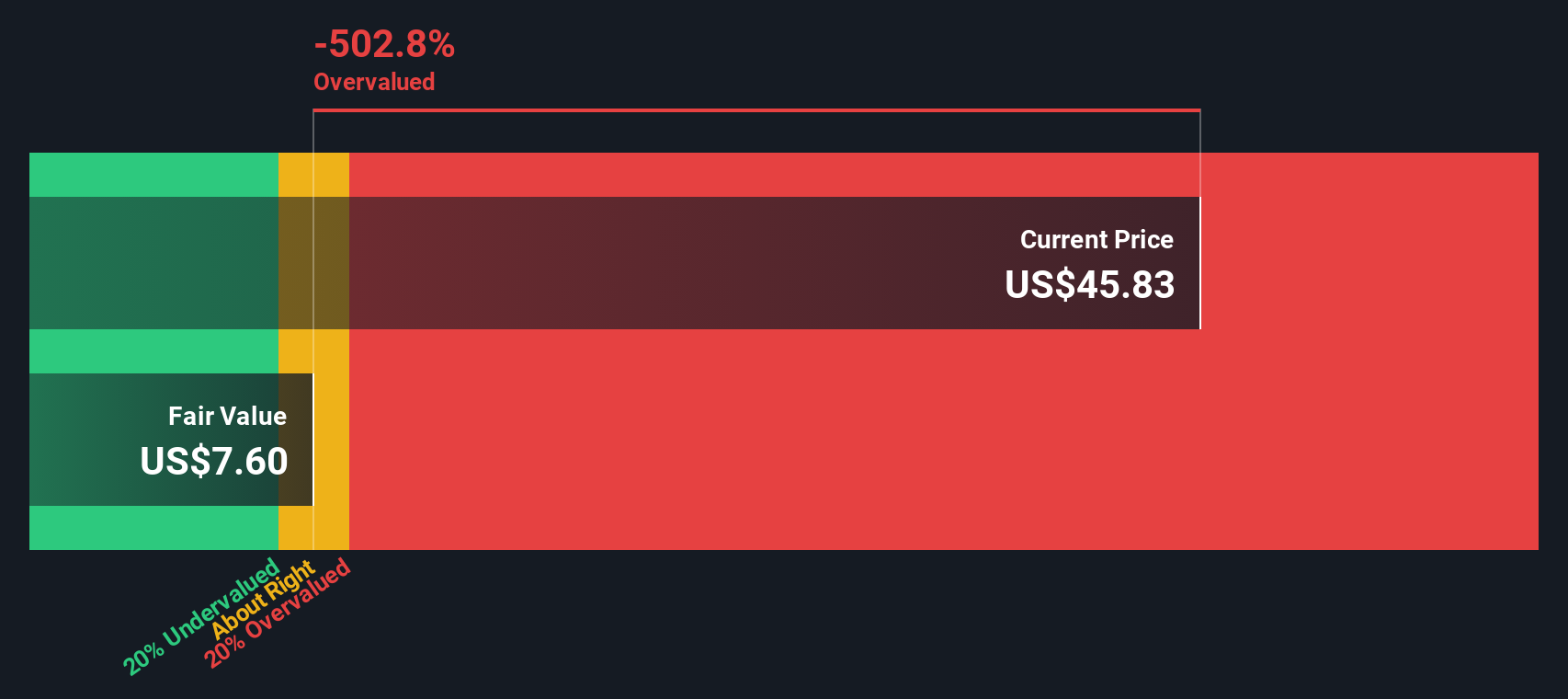

Looking at MIAX using the SWS DCF model provides a much less optimistic perspective. The stock’s last close at $43.11 is significantly higher than our estimated fair value of $7.49. On this basis, shares would appear overvalued, not undervalued. Is the market pricing in something beyond current expectations, or is caution warranted here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Miami International Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Miami International Holdings Narrative

If you want to dig deeper or chart your own course, you can analyze the numbers for yourself and have a narrative ready in minutes. Do it your way.

A great starting point for your Miami International Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by. Tap into fresh stock picks and cutting-edge growth stories using these tailored Simply Wall Street screeners:

- Boost your passive income potential by checking out these 18 dividend stocks with yields > 3%, which consistently deliver strong yields above 3%.

- Capitalize on the newest healthcare breakthroughs by reviewing these 33 healthcare AI stocks, which are shaping how medicine meets artificial intelligence.

- Tap into tomorrow’s disruptors by exploring these 3576 penny stocks with strong financials with proven financial strength and standout momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIAX

Miami International Holdings

Through its subsidiaries, operates various markets across options, futures, and cash equities.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives