- United States

- /

- Capital Markets

- /

- NYSE:MCO

Moody's (MCO): Assessing Valuation After New Pegasystems and Entegra Data Integration Partnerships

Reviewed by Simply Wall St

Moody's (MCO) is back in the spotlight after new collaborations with Pegasystems and Entegra plugged its data directly into client workflows, quietly strengthening its role at the core of financial infrastructure.

See our latest analysis for Moody's.

Against that backdrop, Moody's share price has been fairly steady this year. A modest year to date share price return suggests momentum has cooled, even as the three year total shareholder return above 70% underlines how strong the longer term story has been.

If these data driven partnerships have you thinking more broadly about financial infrastructure plays, it could be worth exploring fast growing stocks with high insider ownership as a source of the market's next compounders.

With earnings still growing double digits and the share price treading water this year, is Moody's an underappreciated infrastructure linchpin for the next decade, or is the market already baking in years of compounding growth?

Most Popular Narrative Narrative: 10.6% Undervalued

Compared with Moody's last close at $487.84, the most followed narrative points to a higher fair value, framing the current price as a potential discount.

The company's investment in advanced analytics, AI, and machine learning, including 40% of Moody's Analytics products now featuring GenAI enablement and GenAI-related spending growing at twice the rate of MA overall, positions Moody's to capture a larger share of the data-driven risk management market, resulting in higher recurring revenues and improved net margins through automation and operational efficiency.

Want to see the full math behind that optimism, from rising margins to richer earnings power and a premium future multiple, without the headline numbers spelled out?

Result: Fair Value of $545.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened regulatory scrutiny of private credit and faster moving AI enabled competitors could compress margins and chip away at Moody's long term pricing power.

Find out about the key risks to this Moody's narrative.

Another Lens on Value

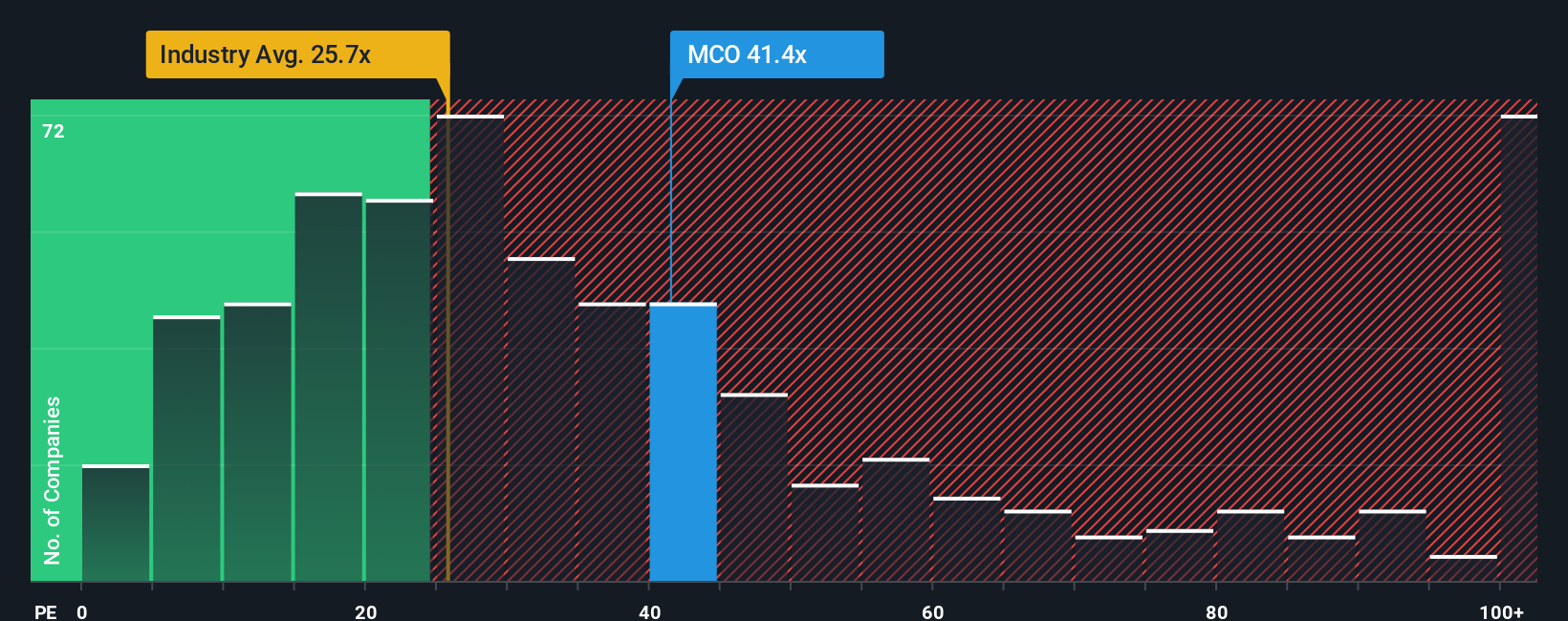

While the consensus narrative sees around 10% upside, our earnings based yardsticks look harsher. At 38.8 times earnings versus peers at 30.3 times and a fair ratio of just 17.7 times, Moody's trades on a rich premium that could unwind quickly if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moody's Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh Moody's view in minutes, Do it your way.

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more smart investment ideas?

Put your research momentum to work by using the Simply Wall St Screener to uncover fresh, data backed ideas that could quietly become your next standout winners.

- Target dependable income by scanning these 14 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash flows while others chase riskier stories.

- Capitalize on mispricing by zeroing in on these 927 undervalued stocks based on cash flows where strong cash flows and solid fundamentals may not yet be fully recognized by the market.

- Seize innovation early by tracking these 24 AI penny stocks before the crowd fully appreciates how AI driven business models can reshape long term earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCO

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026