- United States

- /

- Diversified Financial

- /

- NYSE:MA

A Fresh Look at Mastercard (MA) Valuation Following Recent Pullback and Growth Trends

Reviewed by Kshitija Bhandaru

Mastercard (MA) stock has edged lower over the past week and month. Many investors are weighing its steady annual growth against recent price dips. They are watching for signals about where the payment giant may head next.

See our latest analysis for Mastercard.

Despite a recent pullback, Mastercard’s share price has still posted a 6.7% year-to-date gain and an impressive 11.6% total shareholder return over the past year. This highlights its ability to deliver long-term value even as short-term momentum fades a little.

If Mastercard’s recent moves have you thinking about broader financial trends, now could be a good time to discover fast growing stocks with high insider ownership

The real question now is whether Mastercard is trading at a compelling valuation, or if all its future growth is already reflected in the current share price. Could this be a buying opportunity, or is the market a step ahead?

Most Popular Narrative: 14% Undervalued

Mastercard’s most widely discussed narrative puts its fair value at $648, about 14% above its latest close of $557.48. The gap suggests the market may not fully appreciate the company’s earnings trajectory amid persistent innovation in digital payments.

Mastercard’s expanded value-added services in cybersecurity, data analytics, and consulting, highlighted by the acquisition of Recorded Future and investments in AI-driven fraud solutions, support higher-margin, recurring revenue streams and net margin expansion.

What’s behind this valuation jump? The narrative is built around aggressive projections for surging digital transactions, greater profitability, and a shrinking share count. But what assumptions do analysts make about Mastercard’s growth runway and profit margins? Get the inside story on the financial forecasts shaping this price target.

Result: Fair Value of $648 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts such as rapid adoption of local real-time payment systems or tighter regulations could dampen Mastercard’s growth and challenge bullish forecasts.

Find out about the key risks to this Mastercard narrative.

Another View: The Multiples Perspective

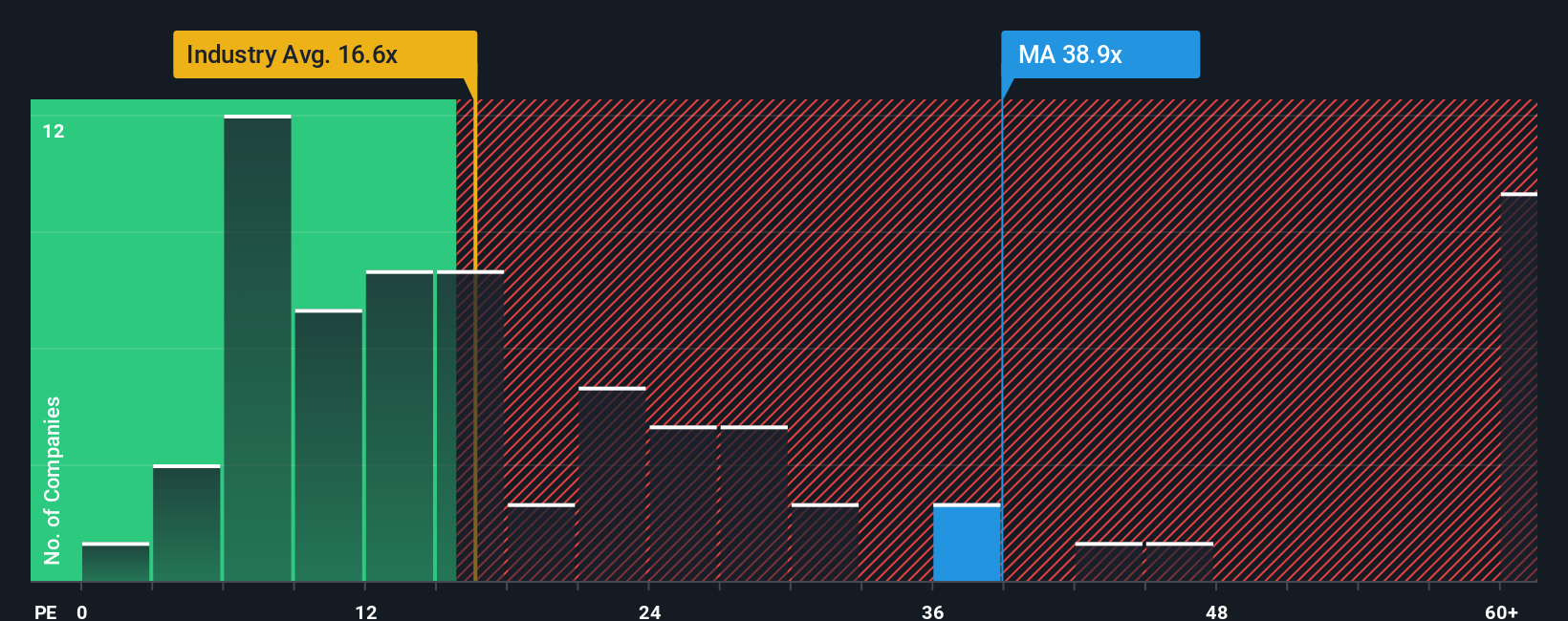

While analyst models show Mastercard as undervalued, a look at valuation ratios paints a more cautious picture. The company is trading at a price-to-earnings ratio of 37.1x, which is much higher than the industry average of 16.1x and the peer average of 20.6x. Even the estimated fair ratio for Mastercard is just 22.9x, suggesting the market is pricing in a lot of optimism. Does this present extra risk or reflect justified expectations for its future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mastercard Narrative

Of course, if you have a different take or want to dig into the details yourself, you can quickly craft your own perspective in just a few minutes, and Do it your way.

A great starting point for your Mastercard research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at one opportunity. Open doors to new possibilities by using these handpicked screens. Your next big win could be waiting there.

- Boost your potential returns by tapping into high-yield income with these 19 dividend stocks with yields > 3% offering attractive yields above 3% and proven financial discipline.

- Seize an edge in tomorrow’s disruptive finance by searching among these 79 cryptocurrency and blockchain stocks shaping transformative changes in the blockchain and digital asset space.

- Uncover value-priced stocks that the market may have overlooked by checking out these 898 undervalued stocks based on cash flows, all based on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MA

Mastercard

A technology company, provides transaction processing and other payment-related products and services in the United States and internationally.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives