- United States

- /

- Consumer Finance

- /

- NYSE:LU

How Lufax Holding's Board Diversity Initiative May Shape Governance and Investor Focus (LU)

Reviewed by Simply Wall St

- On August 14, 2025, Lufax Holding announced that Mr. Weidong Li resigned as independent non-executive director and key committee member, with Ms. Wai Ping Tina Lee appointed as his replacement to bolster board diversity in line with updated governance standards.

- Ms. Lee brings over four decades of legal and banking experience to the board at a time when regulatory changes are driving greater female representation in corporate leadership.

- We'll examine how the focus on enhanced board diversity could influence Lufax Holding's investment narrative and corporate governance outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Lufax Holding's Investment Narrative?

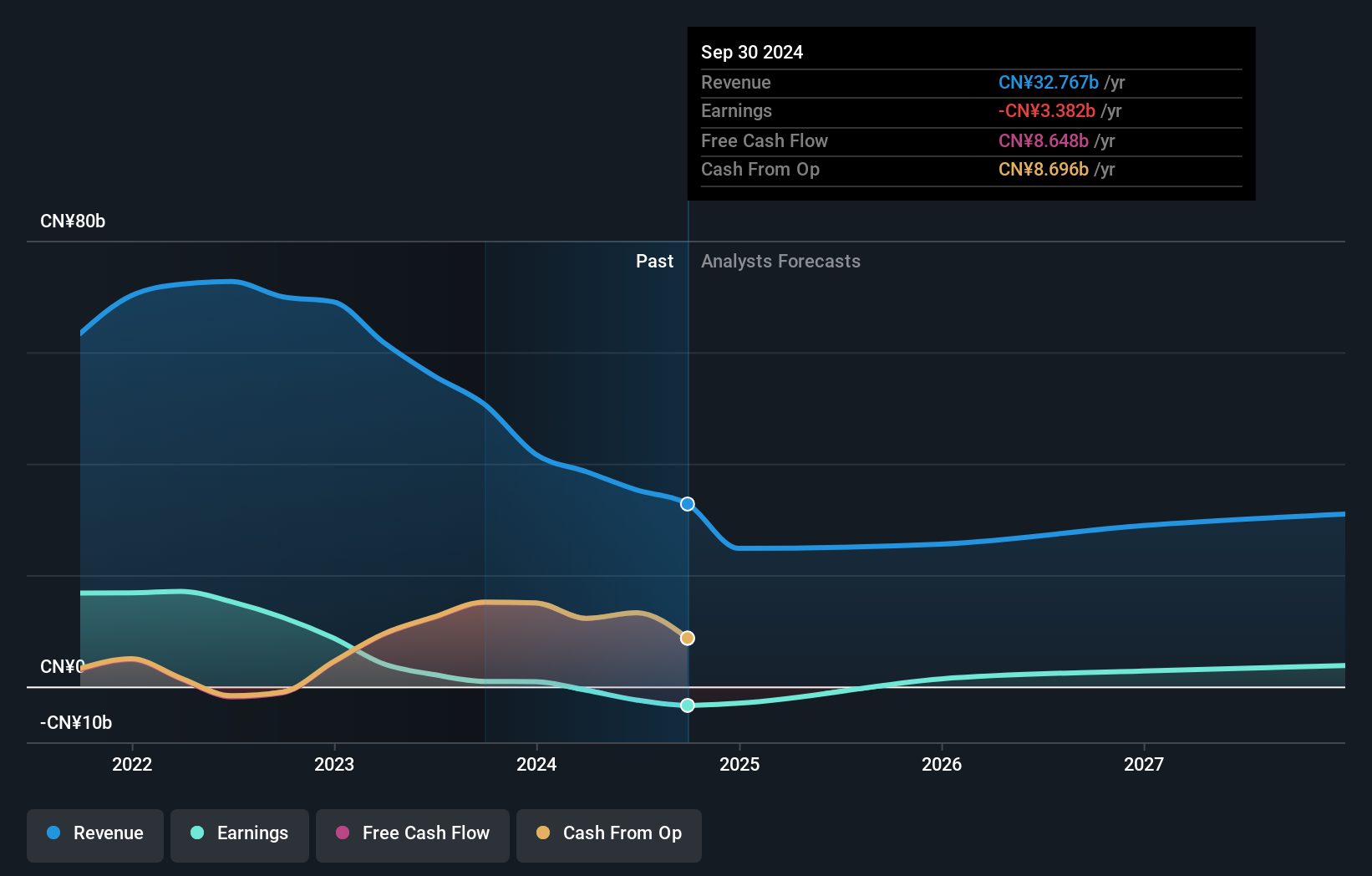

To own shares in Lufax Holding right now, you’d need to believe in a multi-year recovery story that hinges on management stability, improving profitability, and strategic board decisions. Recent executive departures, ongoing auditor changes, and continued net losses have kept risk elevated despite a low price-to-sales ratio indicating potential value. The board refresh, with Ms. Wai Ping Tina Lee’s appointment to enhance diversity, aligns with new governance codes but likely won’t shift near-term catalysts or risks, profitability and regulatory compliance still top the list. While the company’s experienced new director may improve board oversight over the long run, the biggest short-term challenges remain unchanged: stemming revenue decline, finalizing financial audits, and restoring market confidence. Board changes are positive for optics and future resilience but may not materially affect immediate performance or risk outlook.

But with frequent turnover and ongoing earnings delays, governance risk is still very much in play. Our comprehensive valuation report raises the possibility that Lufax Holding is priced lower than what may be justified by its financials.Exploring Other Perspectives

Explore 2 other fair value estimates on Lufax Holding - why the stock might be worth as much as $2.51!

Build Your Own Lufax Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lufax Holding research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Lufax Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lufax Holding's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LU

Lufax Holding

Operates as a financial service empowering institution for small and micro businesses in China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives