- United States

- /

- Consumer Finance

- /

- NYSE:LC

LendingClub (LC): Gauging Valuation After Investor Day Unveils New Strategy and Rebranding Plans

Reviewed by Simply Wall St

LendingClub recently hosted its Investor Day, following strong third-quarter results. Investors tuned in as the company introduced new medium-term goals and outlined plans for a rebrand next year.

See our latest analysis for LendingClub.

LendingClub’s strategic updates have clearly captured investor attention, with the share price climbing more than 12% year-to-date. The recent medium-term targets and rebranding plans have added to the stock’s momentum and reflect renewed confidence after strong third-quarter results. These factors have contributed to an impressive three-year total shareholder return of nearly 78%.

If you’re looking to expand your portfolio beyond the usual picks, now’s a great time to discover fast growing stocks with high insider ownership.

With shares up this year and ambitious new targets on the table, is LendingClub trading at a bargain relative to its growth prospects, or has the market already priced in all of the upside ahead?

Most Popular Narrative: 17% Undervalued

With LendingClub closing at $18.10, the most trusted narrative places fair value at $21.91, suggesting more upside than the recent rally implies. Investors are watching how ambitious growth targets and digital innovation feed into this valuation perspective.

The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue, and the latter building durable recurring net interest income. This dual engine offers operating leverage for sustained growth in earnings and tangible book value.

Are you wondering which financial levers could power LendingClub’s next leap? Behind this valuation are bold profit margin forecasts and a future earnings trajectory that sets it apart in the sector. Curious how digital transformation has been factored into this price? Uncover the catalyst that could send expectations even higher. See what could keep fueling this valuation story.

Result: Fair Value of $21.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from new fintech entrants and LendingClub’s reliance on personal loans could present challenges to its path to sustained growth and higher margins.

Find out about the key risks to this LendingClub narrative.

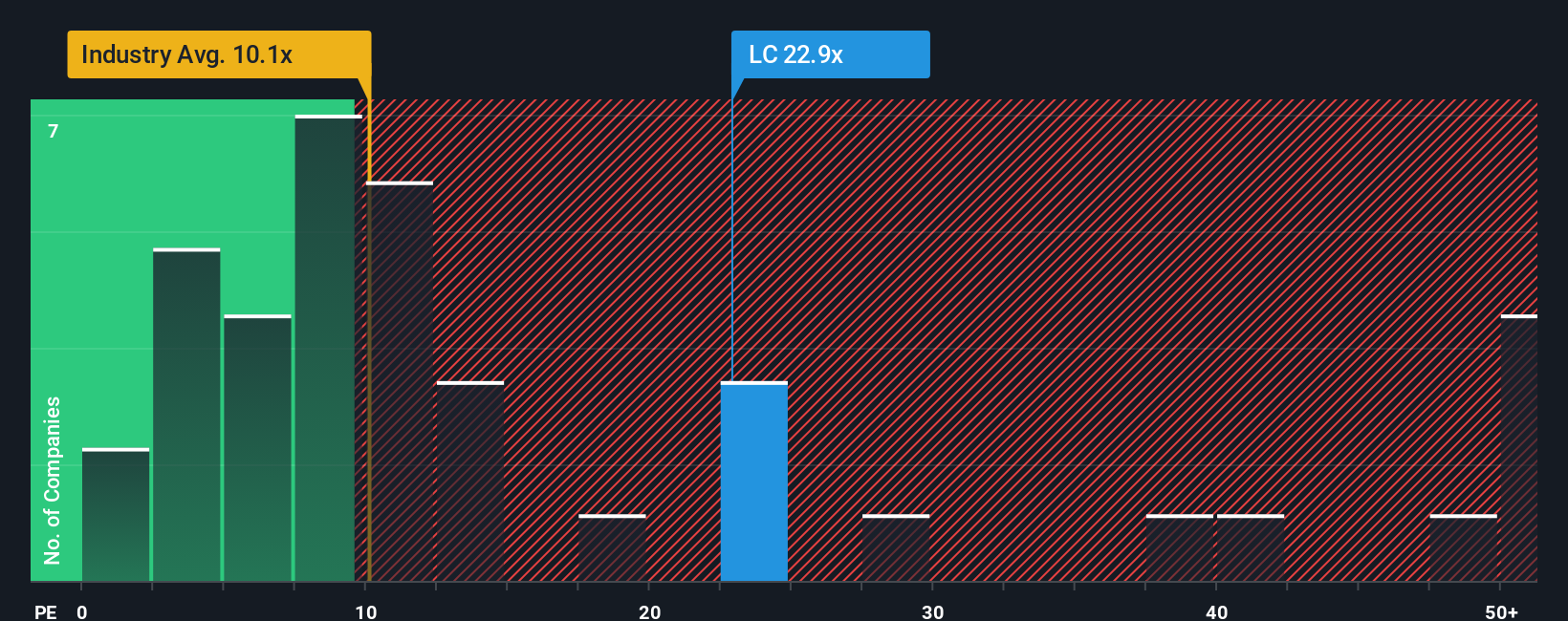

Another View: Market Multiples Tell a Different Story

While the fair value narrative paints LendingClub as undervalued, a look at the market’s preferred metric, a price-to-earnings ratio, raises questions. With shares trading at 20.1 times earnings, well above both the industry average of 9.8x and the peer average of 5.9x, there is a risk investors might be overpaying relative to rivals. That said, the market could yet move closer to LendingClub’s fair ratio of 22.7x, which would offer support at current levels. Is the premium justified, or should caution prevail?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

Whether you want to do a deeper dive or reach your own conclusions, it's easy to examine the data firsthand and share your perspective in just a few minutes. Do it your way.

A great starting point for your LendingClub research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. The smartest investors search far and wide for the next big winner, and our screeners can put you ahead of the crowd.

- Unlock potential returns with these 919 undervalued stocks based on cash flows that have strong upside based on future cash flows and overlooked potential.

- Capture income growth by targeting these 15 dividend stocks with yields > 3% offering attractive yields above 3%. This option is designed for investors seeking steady payouts.

- Capitalize on market momentum by reviewing these 25 AI penny stocks that are driving innovation in artificial intelligence and future tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026