- United States

- /

- Consumer Finance

- /

- NYSE:LC

How Should Investors Value LendingClub After Its Recent 10% Price Decline?

Reviewed by Bailey Pemberton

Thinking about LendingClub and what it means for your portfolio? You are not alone. With so much conversation swirling around growth stocks and the evolving fintech space, investors are wondering if now is the time to buy, sell, or simply watch from the sidelines. LendingClub’s recent share price tells an interesting story: dropping 10.8% in the past week and losing 11.1% over the past month, which might have some people nervous. But if you zoom out, the picture changes. The stock is still up 27.4% over the last year, and an impressive 179.5% gain over five years shows that investors who held on through volatility have been rewarded.

Market sentiment has shifted recently as investors weigh the potential for rising interest rates to impact lending businesses. Yet LendingClub continues to draw attention from those who follow digital banking trends and shifting consumer behaviors. As the fintech sector adapts to new regulatory environments and consumer expectations, LendingClub’s unique model could be positioned for long-term growth or, at minimum, less risk than some of its flashier peers.

Is the stock cheap, expensive, or right in the middle? Valuation tools can help shed light. LendingClub scores a 3 out of 6 on our undervaluation checklist, passing half of the main measures investors look at. But numbers only tell part of the story. Up next, we will break down what those valuation scores really mean, compare LendingClub to its peers, and explore a few smart ways to think about company value that go even deeper than the usual metrics.

Approach 1: LendingClub Excess Returns Analysis

The Excess Returns model helps investors gauge whether LendingClub is generating returns on shareholders’ equity above its cost of equity, which is a key measure of value creation over time. In this approach, we look at how efficiently the company reinvests profits to grow book value, focusing on return on equity (ROE) and related projections provided by analysts.

According to recent estimates, LendingClub has a book value of $12.25 per share and is expected to generate a stable earnings per share (EPS) of $1.39 going forward. These projections are based on weighted future ROE estimates from six analysts and suggest an average ROE of 10.05%. Compared to LendingClub’s cost of equity, which stands at $1.08 per share, the company is generating an excess return of $0.31 per share on an ongoing basis. The stable book value is projected to rise to $13.84 per share, reflecting the company’s ability to steadily grow shareholder equity.

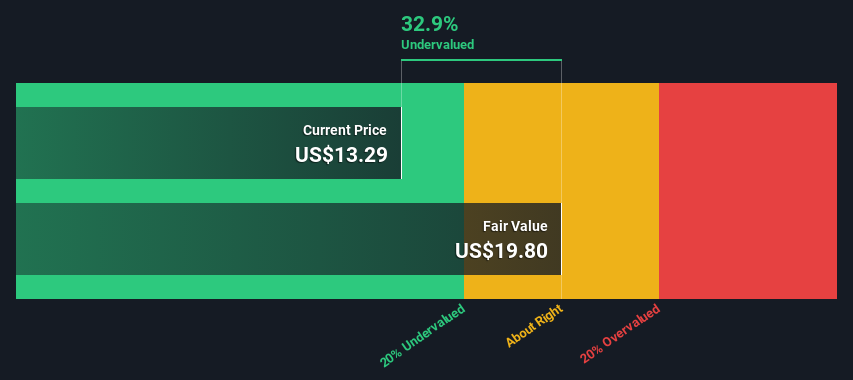

Using this model, the estimated intrinsic value for LendingClub is $20.54 per share. With the current share price roughly 28.1% below this value, the Excess Returns approach suggests that the stock is meaningfully undervalued relative to its long-term potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests LendingClub is undervalued by 28.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: LendingClub Price vs Earnings

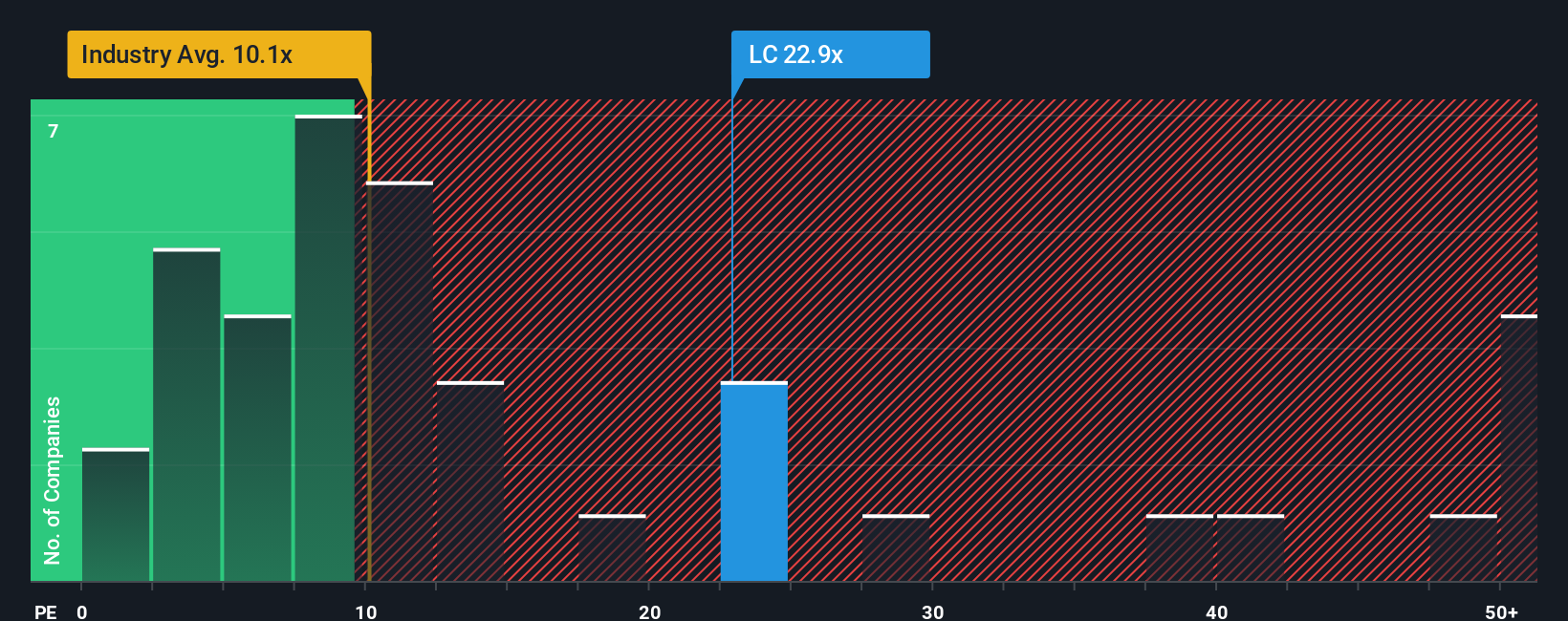

For profitable companies like LendingClub, the price-to-earnings (PE) ratio is often the most insightful valuation metric. It tells investors how much they are paying for each dollar of earnings today and helps set expectations for future growth. Higher growth companies can typically support higher PE ratios, while increased risk or weaker growth tends to lower what investors are willing to pay.

LendingClub currently trades at 22.9x earnings, well above the Consumer Finance industry average of 10.1x and its peer group’s average of 6.4x. This premium suggests investors expect robust earnings growth or see the company as having a stronger market position than rivals. Simply Wall St's proprietary Fair Ratio for LendingClub is set at 21.3x, which factors in the company’s growth outlook, profit margins, business risk, industry trends, and market capitalization. The Fair Ratio goes beyond simple peer or industry comparisons because it considers what makes LendingClub unique, accounting for both opportunities and challenges ahead.

Since LendingClub’s current PE of 22.9x is just modestly above its Fair Ratio of 21.3x, the stock appears valued about right based on its earnings and growth outlook using our most holistic metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your LendingClub Narrative

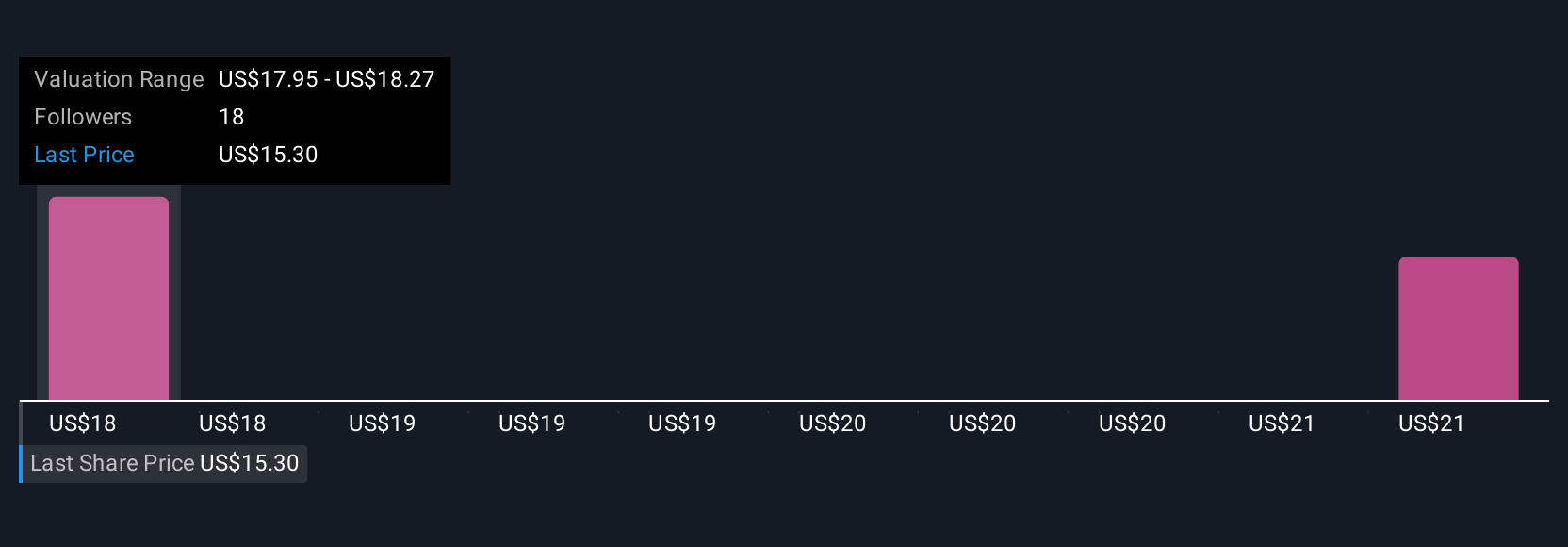

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is simply the story you believe about a company, how you think its future will unfold, and it brings together your personal outlook with key numbers, linking everything from revenue growth and profit margins all the way to your own assessment of fair value.

Narratives make investing more intuitive and dynamic, letting you go beyond surface-level ratios by connecting a company’s story directly to a financial forecast and resulting valuation. With Simply Wall St's Narratives tool, available to millions of investors on the Community page, you can easily create, update, and compare your perspective with others as new news or earnings are released. Your valuation stays fresh and relevant as a result.

Narratives help you decide when to buy or sell by directly comparing your (or the community’s) calculated Fair Value to the current market Price, making your decisions clearer and more personal. For instance, in LendingClub’s case, one user might see digital innovation propelling the business to a fair value of $21.00, while another, concerned about industry risks, might set theirs as low as $15.50. Whichever Narrative fits your view, you’ll always know exactly how your story measures up to today’s price.

Do you think there's more to the story for LendingClub? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LC

LendingClub

Operates as a bank holding company, that provides range of financial products and services in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives