- United States

- /

- Capital Markets

- /

- NYSE:LAZ

Lazard (NYSE:LAZ) pulls back 6.3% this week, but still delivers shareholders 30% return over 1 year

While Lazard, Inc. (NYSE:LAZ) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 11% in the last quarter. But that fact in itself shouldn't obscure what are quite decent returns over the last year. Indeed the stock is up 24% over twelve months, compared to a market return of about 23%.

While the stock has fallen 6.3% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Lazard

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Lazard went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We haven't seen Lazard increase dividend payments yet, so the yield probably hasn't helped drive the share higher. Rather, we'd posit that the revenue increase of 25% might be more meaningful. Revenue growth often does precede earnings growth, so some investors might be willing to forgo profits today because they have their eyes fixed firmly on the future.

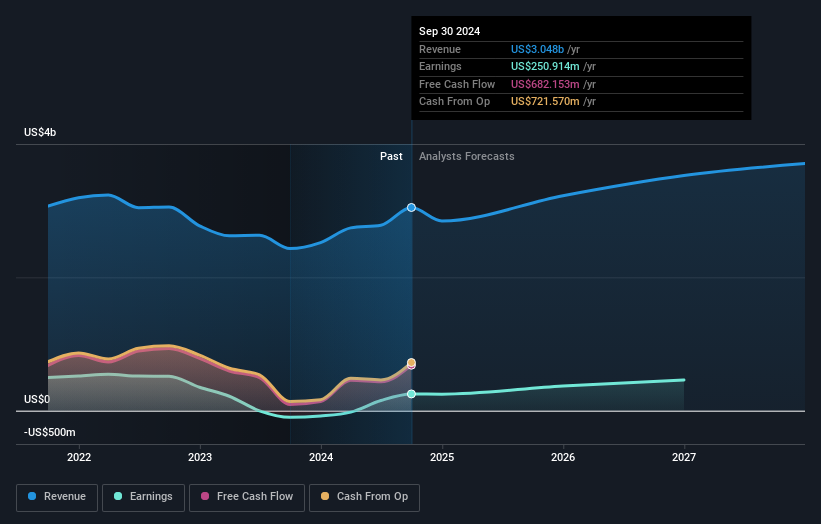

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Lazard has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Lazard will earn in the future (free profit forecasts).

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Lazard the TSR over the last 1 year was 30%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Lazard shareholders have received a total shareholder return of 30% over the last year. That's including the dividend. That's better than the annualised return of 7% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Lazard .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LAZ

Lazard

Operates as a financial advisory and asset management firm in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives