- United States

- /

- Capital Markets

- /

- NYSE:LAZ

Investors Continue Waiting On Sidelines For Lazard, Inc. (NYSE:LAZ)

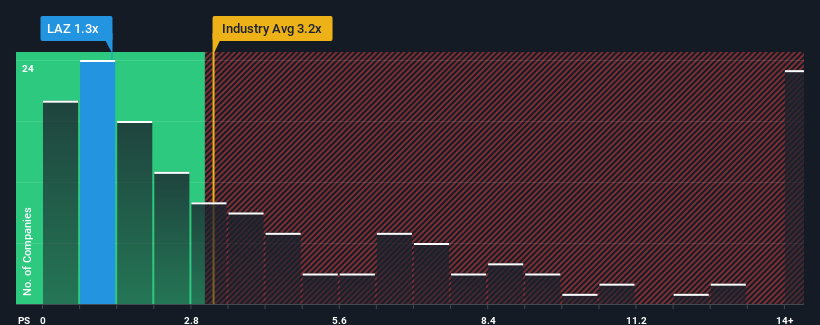

You may think that with a price-to-sales (or "P/S") ratio of 1.3x Lazard, Inc. (NYSE:LAZ) is a stock worth checking out, seeing as almost half of all the Capital Markets companies in the United States have P/S ratios greater than 3.2x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Lazard

How Has Lazard Performed Recently?

Recent times haven't been great for Lazard as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Lazard's future stacks up against the industry? In that case, our free report is a great place to start.How Is Lazard's Revenue Growth Trending?

In order to justify its P/S ratio, Lazard would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.6%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 9.1% as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.6%, which is not materially different.

With this in consideration, we find it intriguing that Lazard's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Lazard's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Lazard remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Lazard that you need to be mindful of.

If these risks are making you reconsider your opinion on Lazard, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LAZ

Lazard

Operates as a financial advisory and asset management firm in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives