- United States

- /

- Mortgage REITs

- /

- NYSE:KREF

KKR Real Estate Finance Trust's (NYSE:KREF three-year decrease in earnings delivers investors with a 29% loss

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term KKR Real Estate Finance Trust Inc. (NYSE:KREF) shareholders, since the share price is down 49% in the last three years, falling well short of the market return of around 21%. The last week also saw the share price slip down another 8.5%. However, this move may have been influenced by the broader market, which fell 5.6% in that time.

After losing 8.5% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

KKR Real Estate Finance Trust became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

It's quite likely that the declining dividend has caused some investors to sell their shares, pushing the price lower in the process. The revenue decline, at an annual rate of 39% over three years, might be considered salt in the wound.

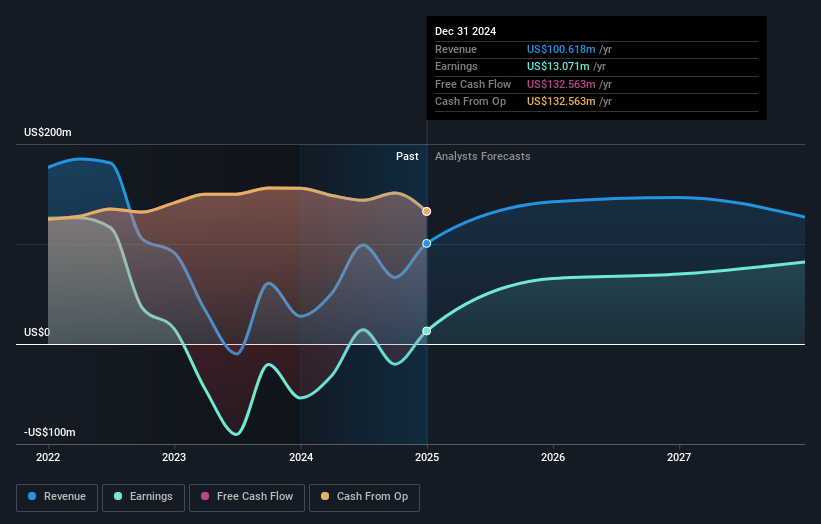

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for KKR Real Estate Finance Trust in this interactive graph of future profit estimates .

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of KKR Real Estate Finance Trust, it has a TSR of -29% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that KKR Real Estate Finance Trust has rewarded shareholders with a total shareholder return of 15% in the last twelve months. That's including the dividend. That's better than the annualised return of 1.0% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - KKR Real Estate Finance Trust has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

But note: KKR Real Estate Finance Trust may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KKR Real Estate Finance Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KREF

KKR Real Estate Finance Trust

A mortgage real estate investment trust, focuses primarily on originating and acquiring transitional senior loans secured by commercial real estate (CRE) assets in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

M&A machine with a relentless focus on operational excellence

Britam Holdings will navigate a 2.43 fair value journey to growth

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion