- United States

- /

- Diversified Financial

- /

- NYSE:KLAR

What Klarna’s Recent 9.9% Rally Means for Its 2025 Valuation

Reviewed by Bailey Pemberton

If you’re weighing what to do with Klarna Group stock right now, you’re certainly not alone. With fintech innovation moving at breakneck pace, Klarna has always been a contender that draws eyes and inspires debate whenever its share price stirs. In just the past week, Klarna’s stock has bounced up by 9.9%, a notable jump for anyone tracking potential growth stories. Yet year-to-date it is down by 7.8%. The swings have been prompting investors to ask if something fundamentally changed in Klarna’s outlook or if we are just seeing broader market volatility ripple through.

Recent moves in the digital payments sector have refocused attention on companies like Klarna, as competitors shift strategies and new payment trends have begun emerging across Europe and North America. While these headlines capture the imagination, they have also introduced added uncertainty, leading to fluctuating risk perceptions in the market.

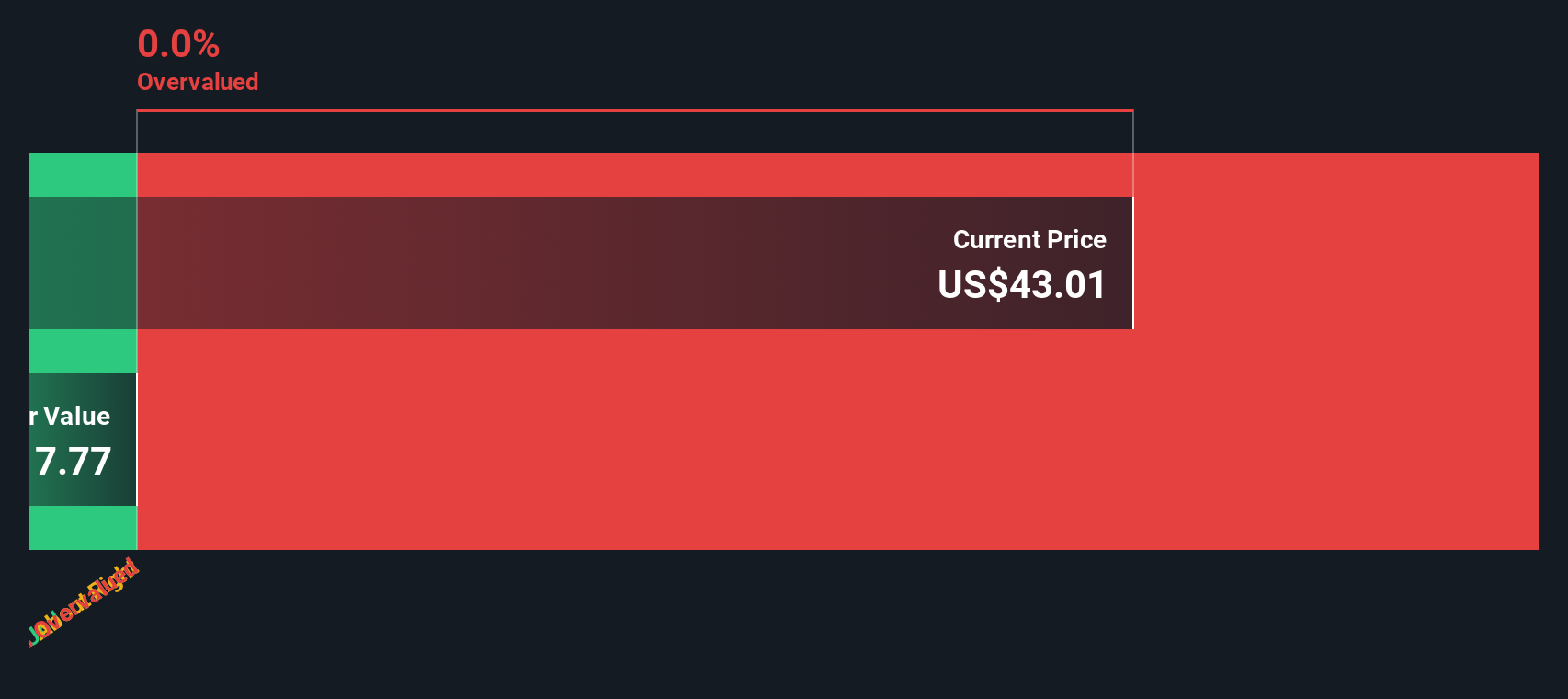

Now, if you’re digging into Klarna’s fundamentals to find some clarity, here’s what stands out: on our six-point valuation check, each point recognizing undervaluation on a key financial metric, Klarna scores a 0. In other words, none of these traditional methods currently suggest Klarna is trading below its intrinsic value. So, how should savvy investors interpret these numbers, and what are the valuation approaches that matter most when making your next move? Let’s walk through the core methods, and then, at the end of this analysis, I’ll show you an even sharper lens for assessing what Klarna’s stock is really worth.

Klarna Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Klarna Group Excess Returns Analysis

The Excess Returns valuation model measures whether a company is creating value above the minimum required return for its shareholders. It compares the returns generated on invested equity capital with the company’s cost of equity, highlighting whether management is delivering efficient growth or simply increasing risk for investors.

For Klarna Group, the key inputs are as follows:

- Book Value: $6.32 per share

- Stable Earnings Per Share (EPS): $0.47 per share

(Source: Weighted future Return on Equity estimates from 6 analysts.) - Cost of Equity: $0.49 per share

- Excess Return: $-0.02 per share

- Average Return on Equity: 7.60%

- Stable Book Value: $6.15 per share

(Source: Median Book Value from the past 5 years.)

Because the excess return is slightly negative at -$0.02 per share, Klarna is not generating sufficient profit above its cost of equity. The intrinsic value indicated by this approach suggests Klarna stock is substantially overvalued, currently about 640.3% above its implied worth by this model. This disconnect means that, according to this methodology, Klarna is not a value buy at this time.

Result: OVERVALUED

Our Excess Returns analysis suggests Klarna Group may be overvalued by 640.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Klarna Group Price vs Sales

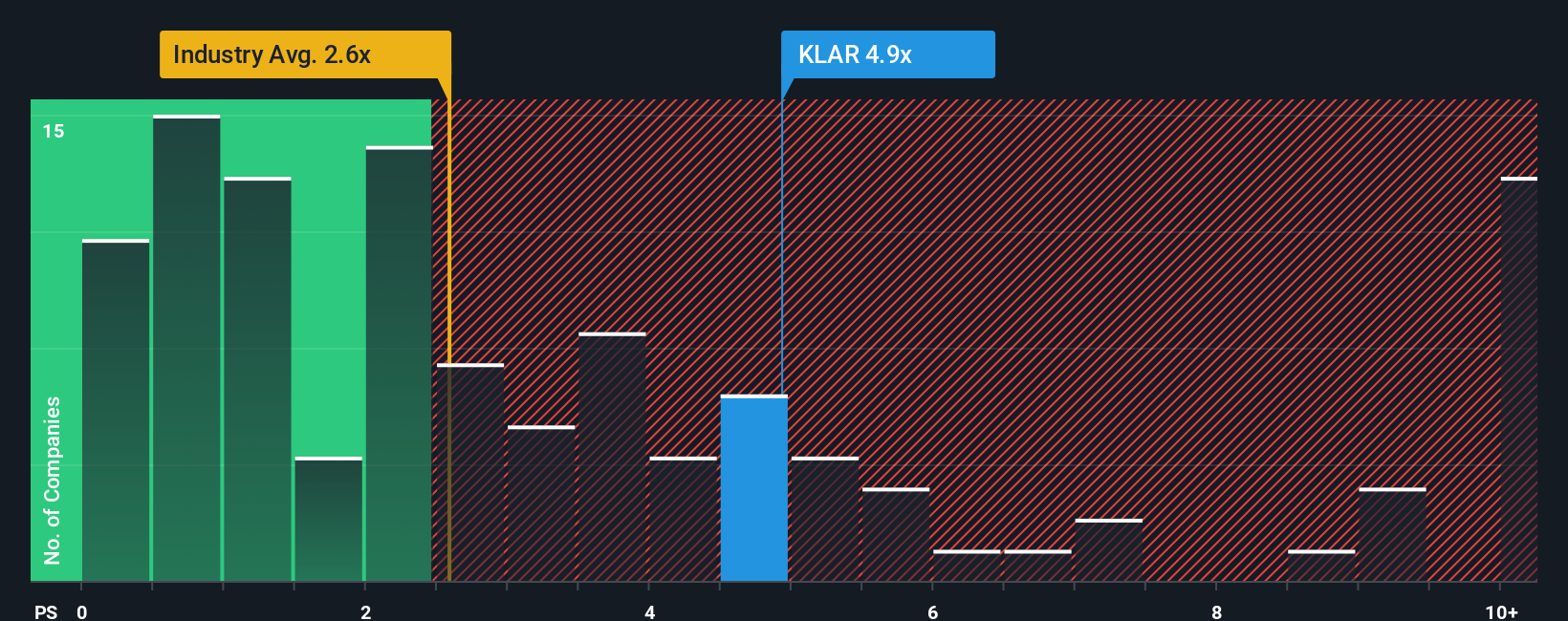

The Price-to-Sales (P/S) ratio is often favored when valuing fintech companies like Klarna Group, particularly those yet to achieve strong profitability but generating significant top-line growth. For companies with rapidly expanding revenues, the P/S ratio can provide insight into how much investors are willing to pay for each dollar of sales, offering a useful measure when earnings are volatile or negative.

Growth expectations and business risk play a major role in what is considered a "normal" or “fair” P/S ratio for any given company. Higher expected revenue growth or lower risk can, in theory, justify a higher multiple. Slower growth or higher risks push the fair value lower. Against this backdrop, Klarna Group currently trades at a P/S ratio of 5.30x, just slightly above the peer average of 5.24x and significantly higher than the Diversified Financial industry average of 2.86x. The relatively close alignment with peer levels suggests that Klarna is being valued in line with other companies that share similar business models and market opportunities.

Simply Wall St’s proprietary “Fair Ratio” builds on this by tailoring the ideal multiple to Klarna’s individual forecast growth, margin profile, industry norms, market capitalization, and risk factors. This provides a more precise benchmark than blanket industry averages or peer group comparisons. Since the Fair Ratio specifically accounts for Klarna’s actual prospects and risks, it can provide a much more relevant guide to value than generic benchmarks ever could.

In this case, the difference between Klarna’s actual P/S multiple and the Fair Ratio is narrow, landing the stock in “about right” territory. There’s little to suggest Klarna is notably above or below where you’d expect it to trade, given its fundamentals and sector positioning.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

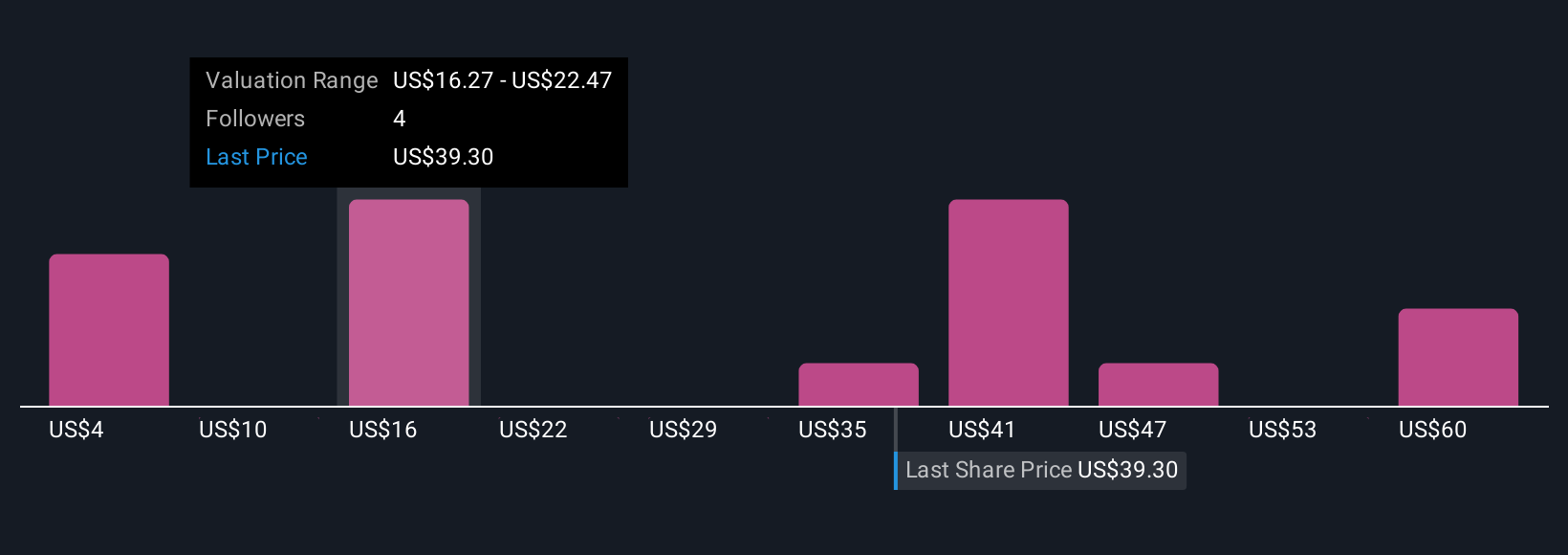

Upgrade Your Decision Making: Choose your Klarna Group Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. Put simply, a Narrative is your investment story for Klarna Group. It’s how you connect your perspective about the company’s future with your own financial forecast and, ultimately, your sense of fair value. Narratives help you go beyond the numbers by tying Klarna’s outlook and potential risks or opportunities directly to your revenue, earning, and margin assumptions. Available right within Simply Wall St's Community page (trusted by millions of investors), Narratives make it easy for anyone to lay out their thesis and see how their view compares against others.

With Narratives, you can instantly see if your fair value estimate signals Klarna is a buy, sell, or hold compared to the current price. Since they update dynamically whenever new information drops, your view can always stay relevant. For example, one investor might see Klarna’s fair value as much higher based on optimistic growth assumptions, while another takes a more cautious view and lands well below the current market price. Narratives bring these perspectives together, helping you make smarter, well-informed investment decisions in real time.

Do you think there's more to the story for Klarna Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Klarna Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KLAR

Klarna Group

Operates as a technology-driven payments company in the United Kingdom, the United States, Germany, Sweden, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives