- United States

- /

- Capital Markets

- /

- NYSE:KKR

Should You Reassess KKR After Its $7B Pembina Stake Sale Talks?

Reviewed by Bailey Pemberton

If you have been keeping an eye on KKR, you might be wondering what to make of its recent stock movements and whether now is the right time to take action. Over the past week, shares dipped 5.7%, and over the past month, they are down 6.4%. That might sound discouraging, but take a step back and you will notice this stock still boasts a 189% return over three years and a stunning 266.3% increase over five years. Even with a tough year-to-date performance, dropping 15%, there are signs of underlying strength and continued investor interest.

Much of the recent volatility can be pinned on broader market shifts, along with a few company-specific headlines. For instance, KKR's price target was recently lowered by Piper Sandler, reflecting a bit of cooling in analyst expectations. Meanwhile, talk of a possible $7 billion sale of their stake in Pembina Gas Infrastructure has stirred the pot, and their $609.8 million offer for Nissan's headquarters hints at bold, opportunistic moves that could shape future growth. Collectively, these stories suggest a company recalibrating risk and opportunity as market conditions evolve.

But what about value? Based on six major valuation checks, KKR is undervalued in just one. Its value score of 1 suggests the stock is reasonably priced by most traditional measures, neither standing out as a bargain nor looking particularly overheated. But not all valuation snapshots capture the full picture. Next, we will walk through the most common approaches to valuation, how KKR stacks up, and why there might be an even more insightful way to judge the company's true worth.

KKR scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: KKR Excess Returns Analysis

The Excess Returns valuation model looks at how much value a company generates over and above its cost of equity. Rather than focusing solely on cash flows or dividends, this approach estimates what investors actually get in return for the capital they provide by using key profitability and growth metrics.

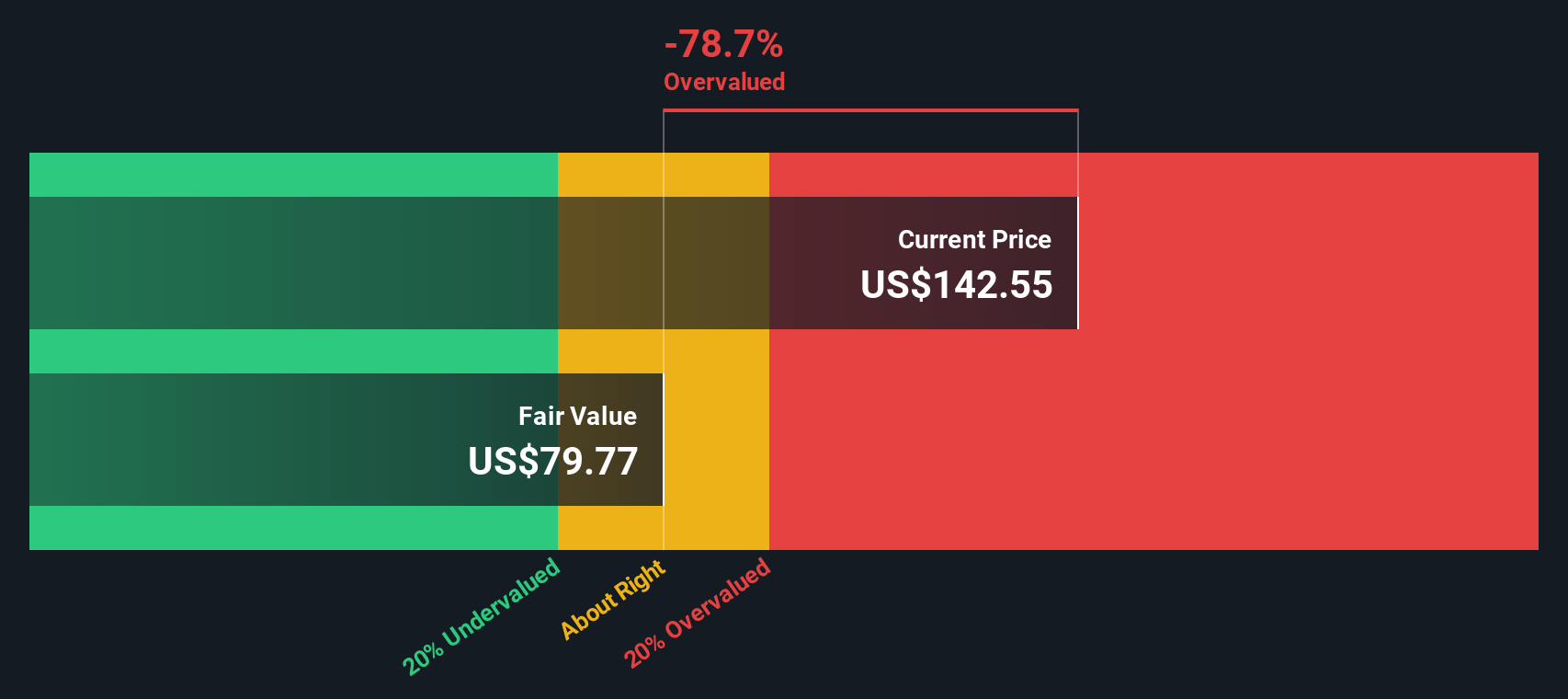

For KKR, the average return on equity is 12.18%. With a book value of $28.82 per share and a projected stable book value of $48.77 per share, KKR is producing a stable earnings per share of $5.94, according to estimates from seven analysts. The cost of equity is $4.58 per share, which means KKR’s excess return—the value created above the required return for capital providers—is $1.36 per share.

While this model highlights profitability metrics, it is important to link these numbers back to the stock’s valuation. The intrinsic value estimate suggests that KKR is currently 80.3% overvalued versus its current share price, according to Simply Wall St’s calculation using the Excess Returns approach.

This sizable valuation gap signals investors are paying a heavy premium for future growth, which may be hard to justify based on current returns alone.

Result: OVERVALUED

Our Excess Returns analysis suggests KKR may be overvalued by 80.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: KKR Price vs Earnings

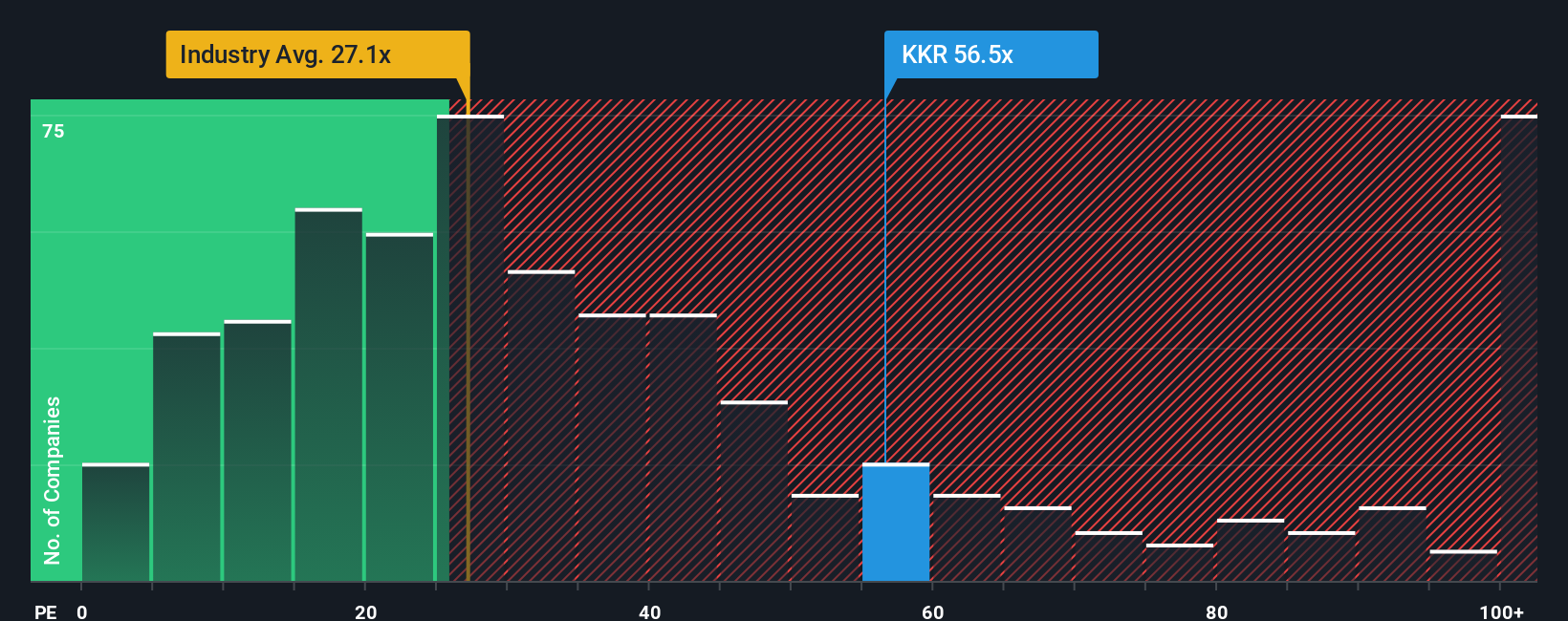

For profitable companies like KKR, the Price-to-Earnings (PE) ratio is a widely accepted method for valuation because it directly relates the company's share price to its earnings. A PE ratio helps investors understand how much they are paying for each dollar of earnings, which is crucial for comparing investment opportunities across companies.

Of course, the right PE ratio is not one size fits all, as it can be heavily influenced by growth expectations and the risk profile of the business. Higher anticipated growth typically justifies a higher PE, while greater risk or volatile earnings might drive the ratio lower compared to the broader sector.

Currently, KKR trades at a PE ratio of 56.5x. This is substantially above the Capital Markets industry average of 27x and even higher than the average of its closest peers, which sits at 40.5x. To dig deeper, Simply Wall St calculates a “Fair Ratio” for KKR at 27.5x. This metric is tailored to the company, considering factors beyond mere earnings, such as KKR’s growth prospects, margin profile, market capitalization, and unique risk exposures. Unlike basic peer or sector averages, this Fair Ratio gives a more nuanced, apples-to-apples comparison, making it a more meaningful benchmark for decision-making.

Comparing the actual PE to the Fair Ratio, KKR's share price seems to be priced considerably higher than what would be justified on fundamentals alone, suggesting the market is still willing to pay a significant premium for its future growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your KKR Narrative

Earlier we mentioned there is an even better way to approach valuation, and that is by using Narratives. A Narrative is simply your own investment story for a company, combining your personal view of its future, assumptions about revenue, earnings, margins, and risks, into a forecast that leads to a fair value estimate. Narratives make it easy to connect your beliefs about where a company is headed with its financial outlook and a target price, so investment decisions are grounded in both the numbers and the bigger picture.

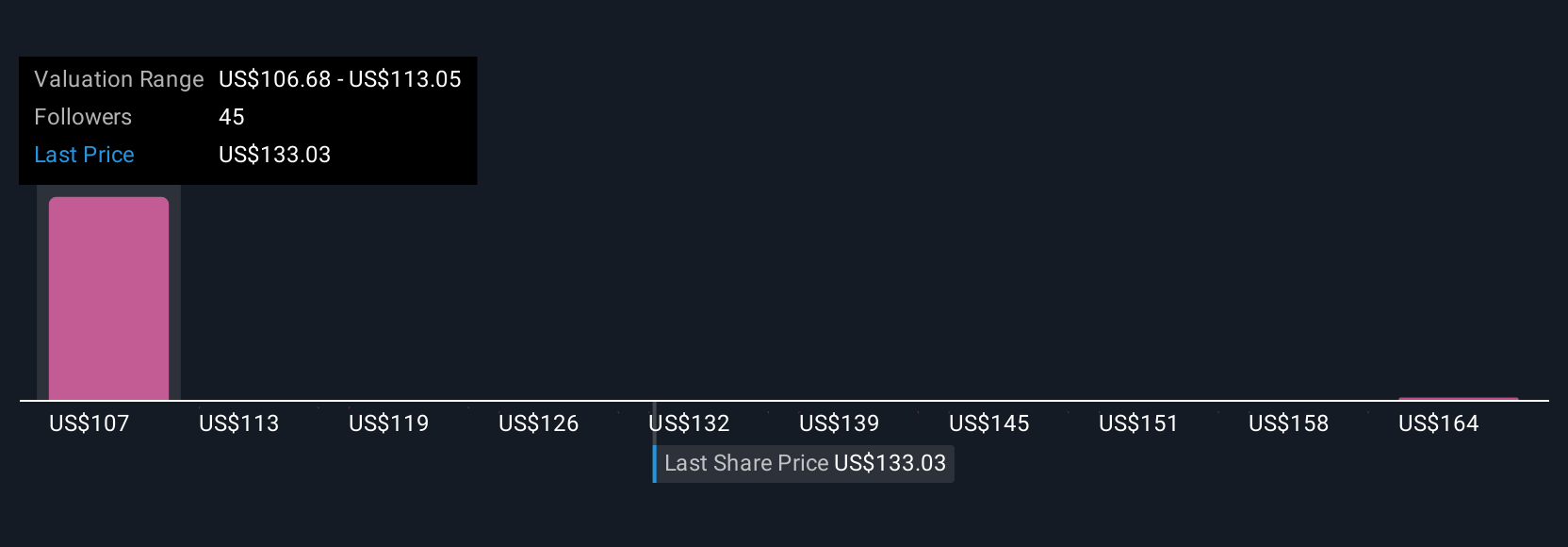

With Simply Wall St, you can create, update, and compare Narratives right from the Community page, just like millions of other investors do. Narratives help you decide when it makes sense to buy, sell, or hold by showing you the gap between your Fair Value and the market price. They update dynamically as new news and earnings come in, so your analysis is always relevant. For example, with KKR, some investors currently project a price target as high as $187 based on optimistic growth and margin improvement, while others see fair value nearer $135, reflecting more conservative expectations. This highlights how Narratives put the power of valuation in your hands, not the market’s.

Do you think there's more to the story for KKR? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives