- United States

- /

- Capital Markets

- /

- NYSE:KKR

KKR (NYSE:KKR) Eyes Strategic Alliances to Boost Growth Despite Internal and External Challenges

Reviewed by Simply Wall St

Get an in-depth perspective on KKR's performance by reading our analysis here.

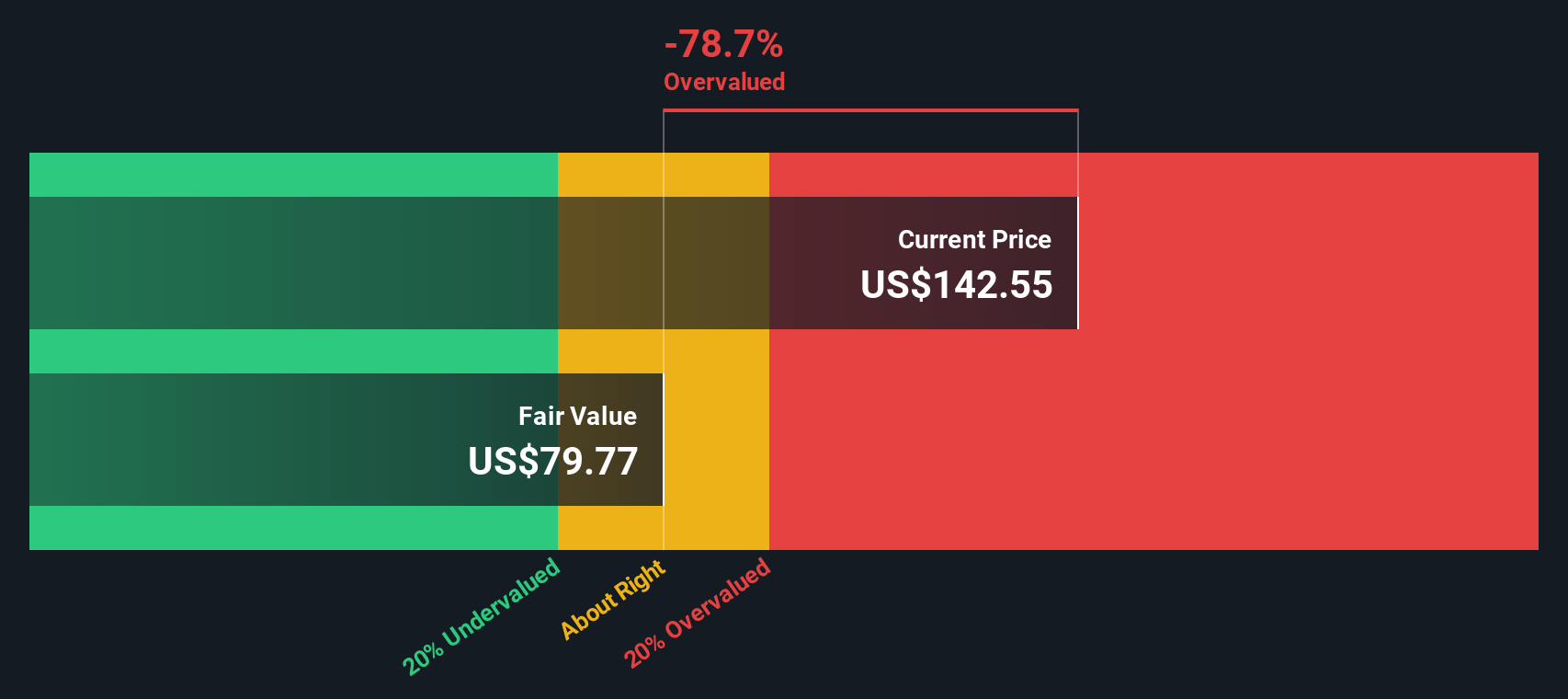

Key Assets Propelling KKR Forward

KKR's financial performance is evident with its fee-related earnings reaching $0.84 per share, marking a 25% increase from the previous year. This achievement highlights the firm's strong operational capabilities and strategic initiatives. The company has also seen a 13% year-over-year rise in management fees, driven by extensive fundraising activities. KKR's private equity portfolio appreciated by 4% in the quarter and 18% over the past year, showcasing its investment acumen. Moreover, its inclusion in the S&P 500 underscores the firm's market credibility and investor confidence. Although KKR is trading above its estimated fair value of $112.6, it remains competitive compared to its peers, with a Price-To-Earnings Ratio of 30.2x, below the peer average of 32.7x.

Internal Limitations Hindering KKR's Growth

KKR faces some internal challenges. The company's Return on Equity (ROE) for Q2 was below expectations, as highlighted by CFO Rob Lewin, due to strategic long-term investments. Additionally, operating expenses were reported at $158 million, which may impact profitability. KKR's Price-To-Earnings Ratio of 30.2x is considered expensive compared to the US Capital Markets industry average of 20.9x. Furthermore, the firm's reliance on higher-risk external borrowing for funding, with a debt-to-equity ratio of 85.8%, poses potential financial risks.

Emerging Markets Or Trends for KKR

KKR is well-positioned to capitalize on emerging opportunities through its strategic partnerships and fundraising initiatives. The firm anticipates raising over $300 billion in new capital from 2024 to 2026, as mentioned by CFO Rob Lewin. The growth of the K-Series vehicles, which have increased assets under management to over $11 billion, presents further expansion potential. Strategic alliances, such as the partnership with Capital Group, aim to introduce innovative investment solutions. Additionally, investments in infrastructure, like the Labrador Island Link, align with KKR's focus on sustainable growth.

External Factors Threatening KKR

Market volatility remains a significant concern, as noted by Co-CEO Scott Nuttall, potentially impacting KKR's investment strategies. The competitive environment in the global credit space, valued at $40 trillion, presents challenges in maintaining market share. Regulatory risks are also a factor, with changes in the regulatory environment potentially affecting operations. Furthermore, shareholder dilution, with a 3.5% increase in shares outstanding, may impact investor sentiment. These external pressures necessitate strategic agility to sustain KKR's growth trajectory.

To gain deeper insights into KKR's historical performance, explore our detailed analysis of past performance.To dive deeper into how KKR's valuation metrics are shaping its market position, check out our detailed analysis of KKR's Valuation.Conclusion

KKR's impressive fee-related earnings growth and private equity portfolio appreciation underscore its operational strength and strategic foresight, fostering investor confidence as evidenced by its inclusion in the S&P 500. Despite trading above its estimated fair value of $112.6, KKR offers a competitive edge with a Price-To-Earnings Ratio of 30.2x, which is attractive relative to peers but higher than the US Capital Markets industry average of 20.9x. This suggests that while KKR is a strong competitor, it must manage its internal challenges, such as high operating expenses and reliance on external borrowing, to maintain profitability. Looking ahead, KKR's strategic initiatives in emerging markets and partnerships position it well for future growth, but it must navigate external pressures like market volatility and regulatory changes to sustain its performance trajectory.

Where To Now?

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Mediocre balance sheet with questionable track record.