- United States

- /

- Capital Markets

- /

- NYSE:KKR

KKR (NYSE:KKR) Eyes Leixir Acquisition Amid 19% Share Decline Last Week

Reviewed by Simply Wall St

KKR (NYSE:KKR) experienced a 19% decline in its share price over the last week, amidst several potential strategic changes and broader market turmoil. The company has been active in acquisitions, including discussions to purchase Leixir Dental Laboratory Group, as well as a potential bid for Nestlé S.A.'s water business. Market forces played a significant role, with the Dow and S&P 500 indices suffering sharp declines of 8% and 9%, respectively, due to fears of a trade war and resultant economic slowdown. These macroeconomic pressures overshadowed KKR's strategic maneuvers, contributing to the overall decline.

Be aware that KKR is showing 1 possible red flag in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent 19% decline in KKR's share price highlights significant market pressure, impacting immediate investor sentiment, despite broader strategic initiatives. Over the past five years, KKR's total return, including dividends, stands at a substantial 286.50%, illustrating strong long-term performance. However, recent developments and market turmoil have caused KKR to underperform against the US Capital Markets industry, which had a 2.8% return over the past year. The integration of Global Atlantic and a focus on expanding product offerings remain focal points of KKR's growth story, yet these initiatives must contend with current economic challenges.

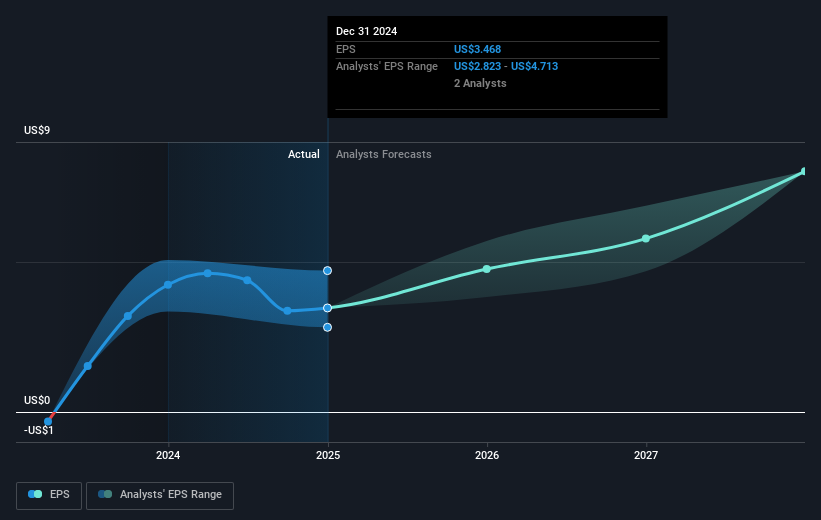

The impact of recent strategic maneuvers, such as acquisitions and structural changes, pose uncertainties for KKR's revenue and earnings forecasts. While revenue is forecasted to decline 30.4% annually over the next three years, there is an expectation of profitability improvements with profit margins projected to rise to 44.6% from the current 11.6%. Despite a share price currently trading at US$117.84, below the analyst consensus fair value estimate of US$121.17, KKR's shares are still seen as undervalued when compared to the consensus analyst price target of US$166.59. This target suggests a potential rise of 29.3%, reflecting future growth expectations dependent on sustained earnings increases and strategic execution.

Assess KKR's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KKR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KKR

KKR

A private equity and real estate investment firm specializing in direct and fund of fund investments.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives