Stock Analysis

June 2024 Insights Into Three Stocks Estimated As Undervalued

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by political uncertainties and varying economic signals, investors are keenly observing trends that could hint at potential opportunities. In such an environment, identifying stocks that appear undervalued becomes crucial, offering a strategic avenue for those looking to potentially enhance their portfolios amidst ongoing volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YanKer shop FoodLtd (SZSE:002847) | CN¥47.38 | CN¥94.36 | 49.8% |

| Selective Insurance Group (NasdaqGS:SIGI) | US$91.91 | US$183.61 | 49.9% |

| Smart Parking (ASX:SPZ) | A$0.48 | A$0.96 | 49.8% |

| Calian Group (TSX:CGY) | CA$55.42 | CA$110.42 | 49.8% |

| Guerbet (ENXTPA:GBT) | €35.75 | €71.39 | 49.9% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥14.82 | CN¥29.55 | 49.8% |

| INKON Life Technology (SZSE:300143) | CN¥7.34 | CN¥14.64 | 49.9% |

| Humble Group (OM:HUMBLE) | SEK9.72 | SEK19.44 | 50% |

| Kanto Denka Kogyo (TSE:4047) | ¥977.00 | ¥1950.27 | 49.9% |

| Gigasun (OM:GIGA) | SEK3.77 | SEK7.53 | 49.9% |

Let's explore several standout options from the results in the screener

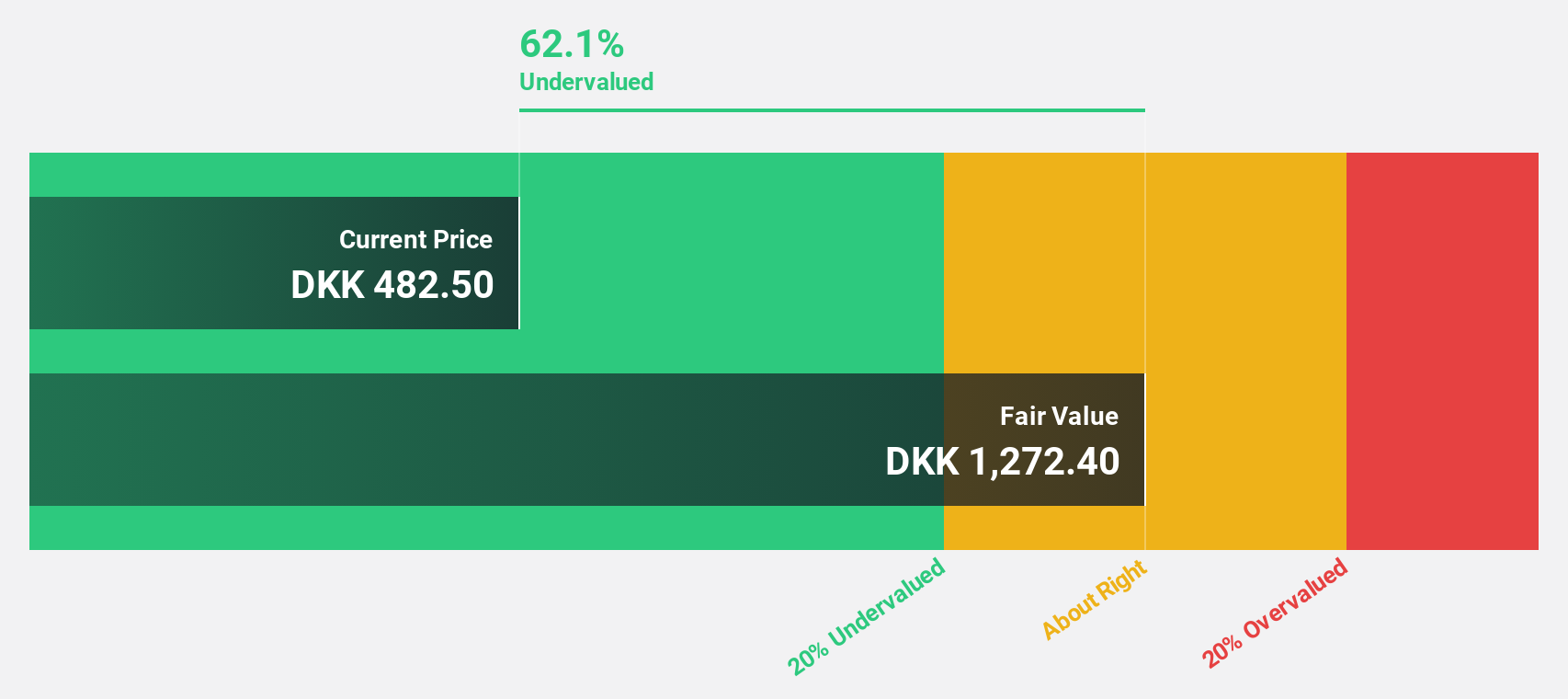

Novo Nordisk (CPSE:NOVO B)

Overview: Novo Nordisk A/S operates globally, focusing on the development, manufacturing, and distribution of pharmaceutical products, with a market capitalization of approximately DKK 4.37 trillion.

Operations: The company generates revenue primarily from two segments: Rare Disease, which brought in DKK 16.97 billion, and Diabetes and Obesity Care, accounting for DKK 227.27 billion.

Estimated Discount To Fair Value: 12%

Novo Nordisk, trading at DKK 981.20, is perceived as undervalued based on a discounted cash flow estimate of DKK 1,114.50. Despite significant insider selling in the past quarter, its financial health remains robust with a forecasted earnings growth of 13.34% per year and revenue growth projected to surpass the Danish market at 13.8% annually. The company's return on equity is expected to be very high at 85.6% in three years, highlighting efficient management and profitability potential despite not being deeply undervalued.

- Our expertly prepared growth report on Novo Nordisk implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Novo Nordisk.

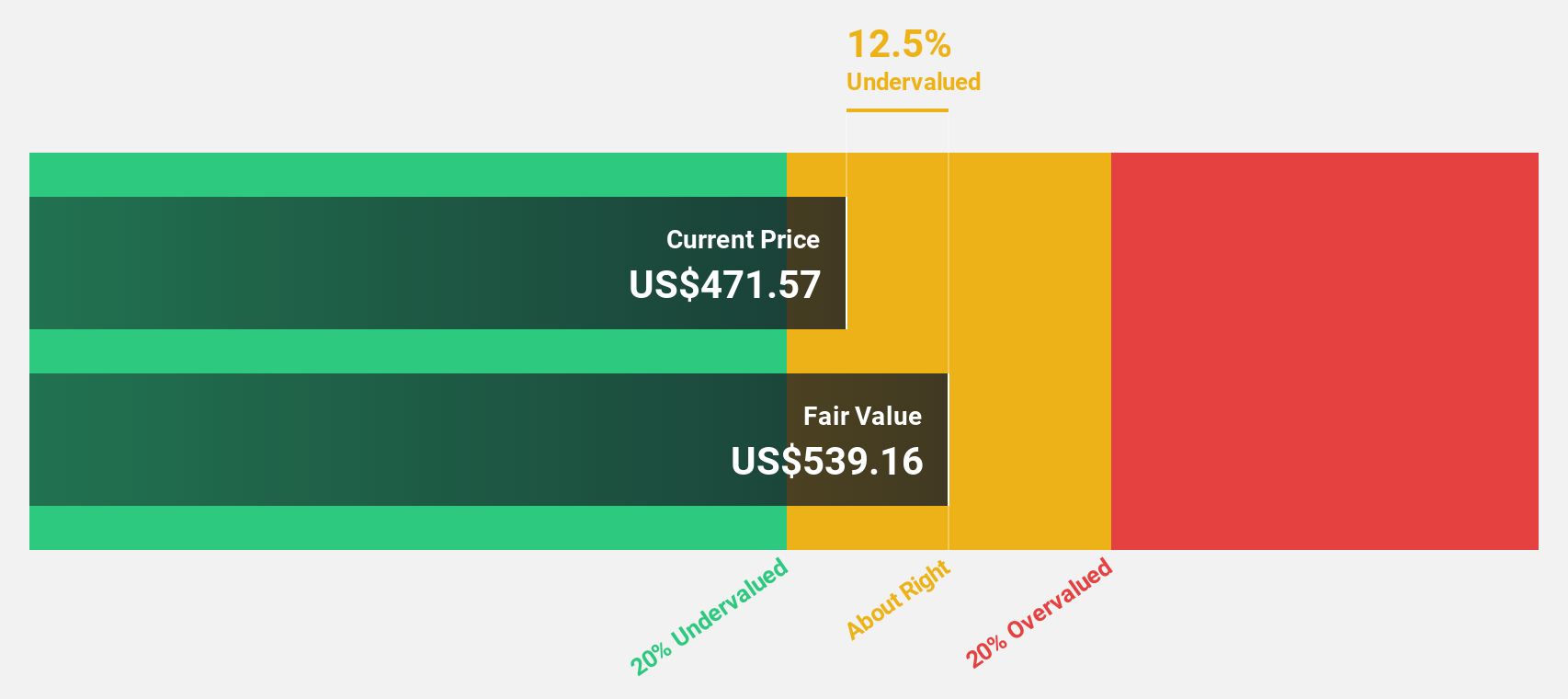

Duolingo (NasdaqGS:DUOL)

Overview: Duolingo, Inc. is a mobile learning platform that offers language education services across the United States, the United Kingdom, and other international markets, with a market capitalization of approximately $9.14 billion.

Operations: The company generates its revenue primarily from its educational software segment, which amounted to $583.00 million.

Estimated Discount To Fair Value: 48.1%

Duolingo, with a current price of US$211.83, is valued below its estimated fair value of US$408.29, indicating a potential undervaluation by over 20%. Recent financials show a shift to profitability in Q1 2024 with significant net income growth compared to the previous year's loss. Revenue forecasts suggest robust growth significantly above the market average, expected at 20.1% annually over the next few years. However, shareholder dilution occurred last year and Return on Equity is anticipated to be low at 19.9% in three years' time.

- In light of our recent growth report, it seems possible that Duolingo's financial performance will exceed current levels.

- Dive into the specifics of Duolingo here with our thorough financial health report.

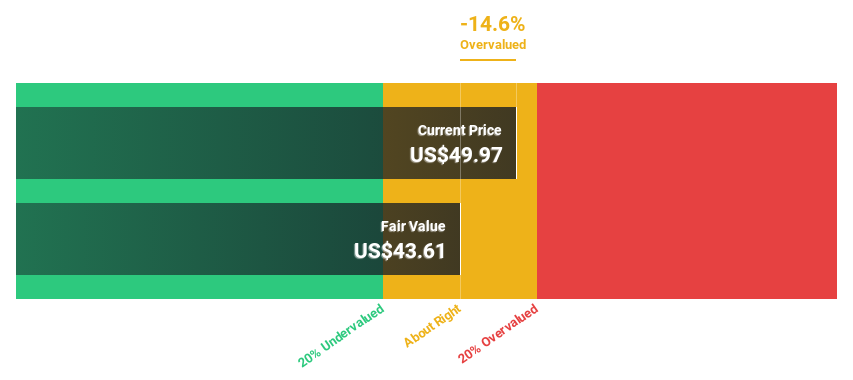

Jefferies Financial Group (NYSE:JEF)

Overview: Jefferies Financial Group Inc. is an investment banking and capital markets firm operating in the Americas, Europe, the Middle East, and Asia-Pacific with a market capitalization of approximately $9.53 billion.

Operations: The firm's revenue is primarily derived from investment banking and capital markets, generating $4.74 billion, followed by asset management with revenues of $393.20 million.

Estimated Discount To Fair Value: 21.2%

Jefferies Financial Group, priced at US$46.5, trades 21.2% below its estimated fair value of US$59.04, suggesting undervaluation based on discounted cash flow analysis. While revenue and earnings are forecasted to grow at 15.4% and 37.57% per year respectively—outpacing the market—the company's profit margins have declined from 10.4% to 5.5%. Recent aggressive fixed-income offerings could impact future financial flexibility amidst significant insider selling over the past quarter, raising concerns about its cash flow sustainability for dividends.

- Our earnings growth report unveils the potential for significant increases in Jefferies Financial Group's future results.

- Click here to discover the nuances of Jefferies Financial Group with our detailed financial health report.

Taking Advantage

- Click this link to deep-dive into the 974 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Novo Nordisk is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Solid track record with reasonable growth potential.