- Denmark

- /

- Electrical

- /

- CPSE:VWS

3 Undervalued Stocks With Intrinsic Discounts Ranging From 26.7% To 47.9%

Reviewed by Simply Wall St

As global markets exhibit mixed signals with modest gains in some regions and cautious consumer behavior in others, investors are keenly observing market trends for potential opportunities. In such a landscape, identifying undervalued stocks becomes crucial as they may offer intrinsic value that isn't fully recognized by the broader market yet.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥55.42 | CN¥110.58 | 49.9% |

| Calian Group (TSX:CGY) | CA$55.40 | CA$110.53 | 49.9% |

| Componenta (HLSE:CTH1V) | €3.05 | €6.08 | 49.8% |

| USCB Financial Holdings (NasdaqGM:USCB) | US$11.88 | US$23.66 | 49.8% |

| Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49635.61 | 49.8% |

| Musti Group Oyj (HLSE:MUSTI) | €25.40 | €50.68 | 49.9% |

| BeiGene (NasdaqGS:BGNE) | US$159.15 | US$317.72 | 49.9% |

| Galderma Group (SWX:GALD) | CHF74.86 | CHF149.48 | 49.9% |

| 3R Petroleum Óleo e Gás (BOVESPA:RRRP3) | R$25.92 | R$51.62 | 49.8% |

| eEnergy Group (AIM:EAAS) | £0.055 | £0.11 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener

Vestas Wind Systems (CPSE:VWS)

Overview: Vestas Wind Systems A/S is a global leader in the design, manufacture, installation, and servicing of wind turbines, with a market capitalization of approximately DKK 179.33 billion.

Operations: The company generates revenue primarily through two segments: Power Solutions (€11.57 billion) and Service (€3.66 billion).

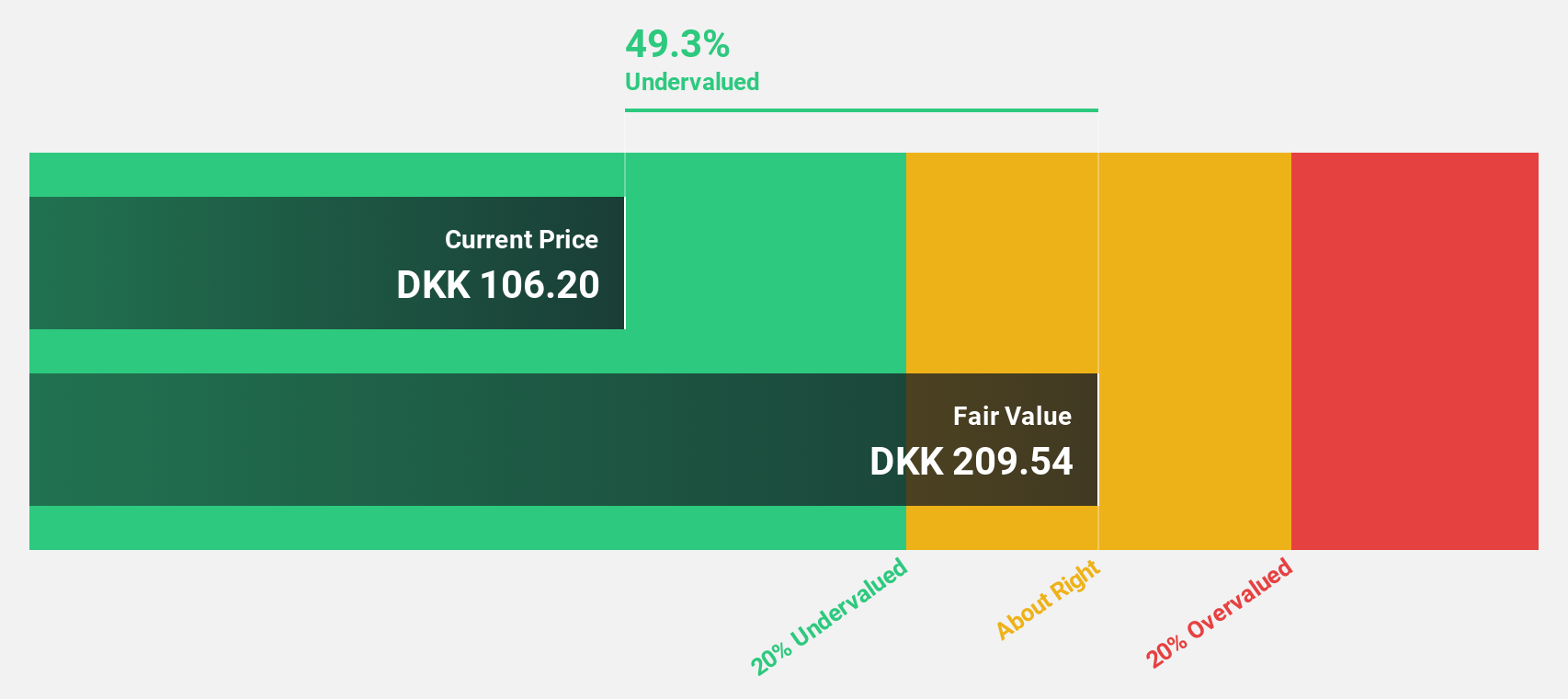

Estimated Discount To Fair Value: 40.6%

Vestas Wind Systems, priced at DKK178.2, is notably undervalued based on a discounted cash flow valuation of DKK300.1, representing a 40.6% discount. With expected annual profit growth positioned above the market average and projected robust revenue increases of 11.6% per year, Vestas is poised for significant financial improvement. Recent strategic EPC contracts and expansions into large-scale projects globally underscore its growing operational footprint and commitment to enhancing energy production capacities efficiently.

- Upon reviewing our latest growth report, Vestas Wind Systems' projected financial performance appears quite optimistic.

- Dive into the specifics of Vestas Wind Systems here with our thorough financial health report.

Koç Holding (IBSE:KCHOL)

Overview: Koç Holding A.S. operates in various sectors including energy, automotive, consumer durables, and finance, both in Turkey and internationally, with a market capitalization of approximately TRY 562.97 billion.

Operations: The company's revenue is primarily derived from its energy (TRY 1.06 billion), automotive (TRY 0.75 billion), finance (TRY 0.44 billion), and consumer durables sectors (TRY 0.30 billion).

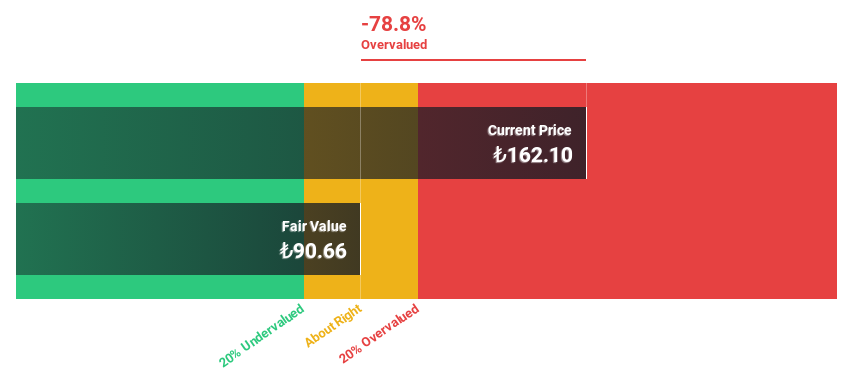

Estimated Discount To Fair Value: 47.9%

Koç Holding, priced at TRY223.2, is considerably undervalued with a fair value estimation of TRY428.69, trading 47.9% below this mark. Despite its debt not being well covered by operating cash flow, the company is forecasted to experience substantial earnings growth at 35.8% annually over the next three years and revenue growth at 25.2% annually, outpacing many peers but slightly under the Turkish market's revenue growth rate of 26.2%. Recent M&A discussions around its banking unit highlight valuation challenges but also underline its strategic market positioning.

- In light of our recent growth report, it seems possible that Koç Holding's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Koç Holding stock in this financial health report.

Medpace Holdings (NasdaqGS:MEDP)

Overview: Medpace Holdings, Inc. operates as a full-service clinical contract research organization, offering drug and medical device development services across North America, Europe, and Asia, with a market capitalization of approximately $12.49 billion.

Operations: The company generates revenue primarily through the development, management, and execution of clinical trials, totaling $1.96 billion.

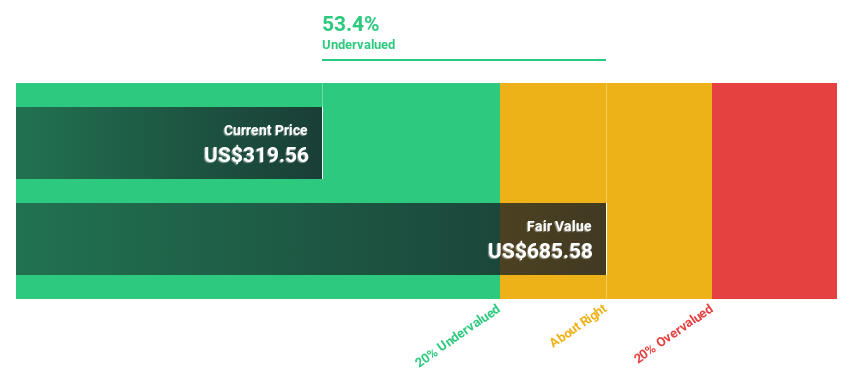

Estimated Discount To Fair Value: 26.7%

Medpace Holdings, valued at US$408.08, trades 26.7% below its estimated fair value of US$556.79, indicating potential undervaluation based on discounted cash flow models. With a robust forecasted annual earnings growth of 14.9%, slightly above the US market average, and an impressive projected return on equity of 33.3% in three years, Medpace shows strong financial health and growth prospects despite significant insider selling recently reported over the past three months which could signal caution among investors.

- Insights from our recent growth report point to a promising forecast for Medpace Holdings' business outlook.

- Get an in-depth perspective on Medpace Holdings' balance sheet by reading our health report here.

Where To Now?

- Delve into our full catalog of 959 Undervalued Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

High growth potential with adequate balance sheet.