Discover 3 Stocks That May Be Priced Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have experienced volatility, with major indexes like the Nasdaq Composite and S&P 500 seeing fluctuations amid cautious corporate outlooks. As investors navigate these uncertain waters, identifying stocks that may be priced below their intrinsic value can offer opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.85 | US$37.48 | 49.7% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.47 | 50% |

| Arteche Lantegi Elkartea (BME:ART) | €6.10 | €12.20 | 50% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 50% |

| Bangkok Genomics Innovation (SET:BKGI) | THB2.68 | THB5.35 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.72 | CN¥9.39 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.91 | US$546.14 | 49.8% |

Here's a peek at a few of the choices from the screener.

Netcompany Group (CPSE:NETC)

Overview: Netcompany Group A/S is an IT services company that provides business-critical IT solutions to public and private sector clients across several European countries and internationally, with a market cap of DKK15.21 billion.

Operations: The company's revenue is derived from its public sector segment, contributing DKK4.41 billion, and its private sector segment, which accounts for DKK2.04 billion.

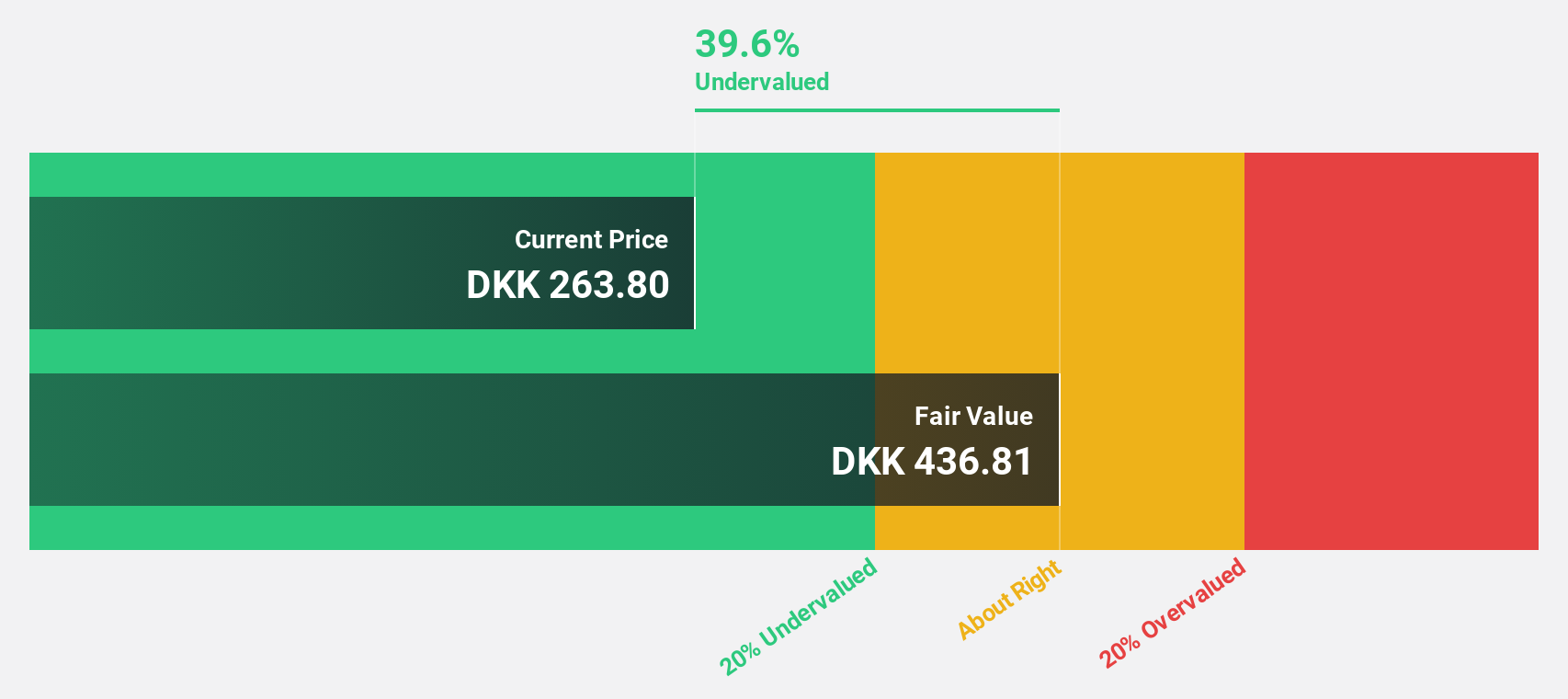

Estimated Discount To Fair Value: 41.5%

Netcompany Group A/S is trading significantly below its estimated fair value of DKK 543.79, with a current price of DKK 318.2, indicating potential undervaluation based on cash flows. Recent earnings reports show strong growth in net income and sales compared to the previous year, enhancing its attractiveness despite high debt levels. Earnings are forecasted to grow at a substantial rate of 29.5% annually over the next three years, outpacing market expectations in Denmark.

- Our expertly prepared growth report on Netcompany Group implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Netcompany Group.

Simplex Holdings (TSE:4373)

Overview: Simplex Holdings, Inc. offers strategic consulting, design and development, and operation and maintenance services to financial institutions, corporations, and public sectors globally with a market cap of ¥144.72 billion.

Operations: The company's revenue is primarily derived from the provision of IT solutions, amounting to ¥43.04 billion.

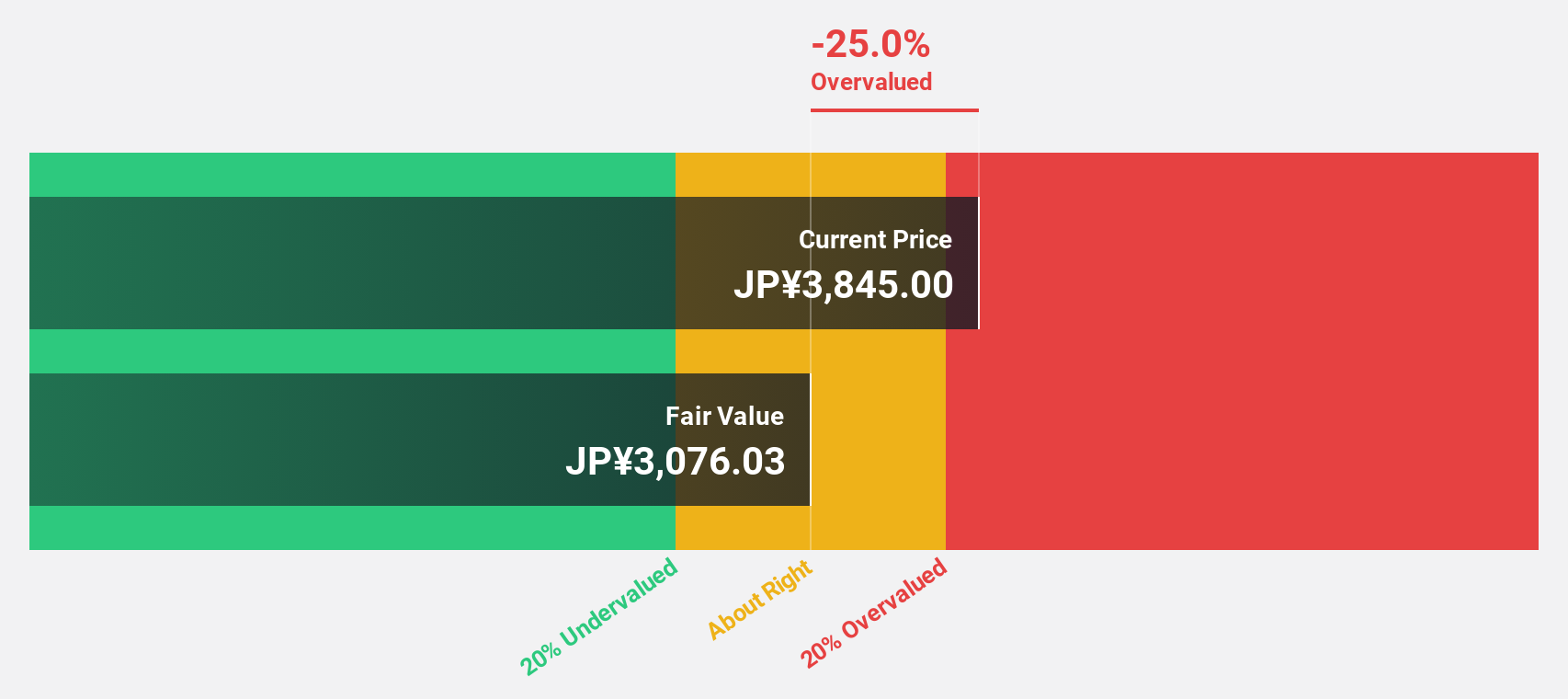

Estimated Discount To Fair Value: 35.3%

Simplex Holdings is trading at ¥2,479, significantly below its estimated fair value of ¥3,831.16, presenting potential undervaluation based on cash flows. Earnings are projected to grow 21% annually over the next three years, surpassing the JP market's growth rate of 8.9%. However, revenue growth is expected to be slower at 14.5% per year compared to earnings. Analysts agree on a potential price rise of 32.2%, despite an unstable dividend track record and low future return on equity forecasts.

- Insights from our recent growth report point to a promising forecast for Simplex Holdings' business outlook.

- Unlock comprehensive insights into our analysis of Simplex Holdings stock in this financial health report.

Aozora Bank (TSE:8304)

Overview: Aozora Bank, Ltd., along with its subsidiaries, offers a range of banking products and services both in Japan and internationally, with a market cap of ¥366.14 billion.

Operations: The bank's revenue segments include the Corporate Sales Group at ¥16.11 billion, Customer Relations Group at ¥8.35 billion, Structured Finance Group at ¥40.97 billion, and International Business Group at ¥18.48 billion.

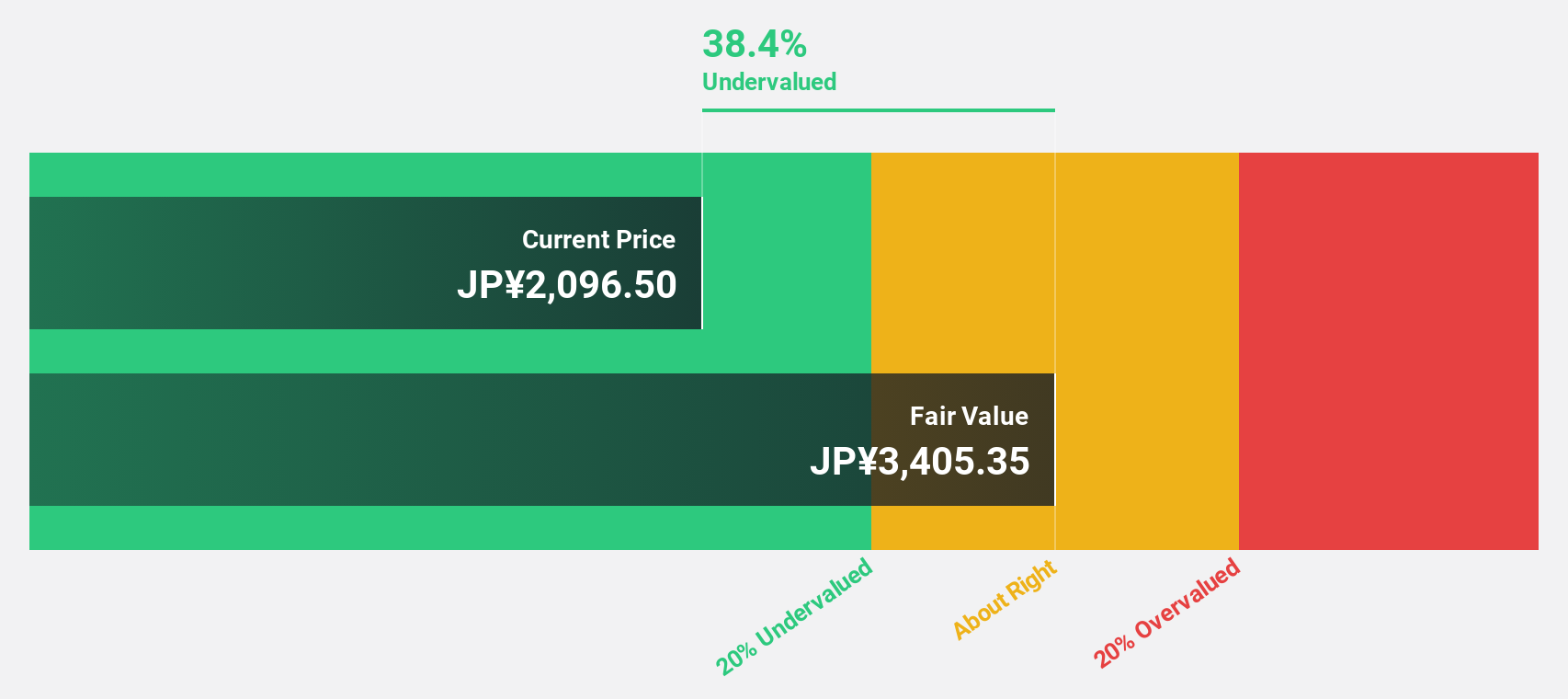

Estimated Discount To Fair Value: 22.3%

Aozora Bank trades at ¥2,647, below its estimated fair value of ¥3,408.82, suggesting undervaluation based on cash flows. Despite a high bad loans ratio of 3.1% and recent shareholder dilution, earnings are forecast to grow significantly by 62.98% annually over the next three years and revenue is expected to outpace the JP market at 10.6%. However, low return on equity forecasts and unsustainable dividend coverage remain concerns.

- According our earnings growth report, there's an indication that Aozora Bank might be ready to expand.

- Take a closer look at Aozora Bank's balance sheet health here in our report.

Taking Advantage

- Click through to start exploring the rest of the 955 Undervalued Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netcompany Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NETC

Netcompany Group

Provides business critical IT solutions to private and public customers in Denmark, Norway, the United Kingdom, the Netherlands, Greece, Belgium, Luxembourg, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives