- United States

- /

- Capital Markets

- /

- NYSE:IVZ

Should Surging September Inflows Into ETFs and Emerging Markets Require Action From Invesco (IVZ) Investors?

Reviewed by Sasha Jovanovic

- Earlier in October, Invesco reported a 3.0% increase in assets under management for September, attributing the growth to significant net long-term inflows and robust performance in its ETF products and key international markets such as China and India.

- Analysts pointed out that the level of net inflows into Invesco products surpassed expectations by a significant margin, highlighting renewed investor confidence in the firm’s global strategy.

- We’ll explore how these stronger-than-expected inflows in September could influence Invesco’s long-term outlook and evolving investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Invesco Investment Narrative Recap

For an investor to believe in Invesco, they need confidence that global ETF leadership, strong product innovation, and international growth can offset ongoing fee pressure and industry disruption. The news of surprising net inflows and AUM growth in September may support near-term optimism, but it does not materially change the biggest ongoing threat: persistent margin compression from the industry-wide shift to passive and intensified competition, especially in the US and core equity segments. The launch of two new actively managed fixed income ETFs in July stands out next to these inflow results, reflecting the company’s effort to boost its ETF offering while diversifying beyond equities, an increasing focus as competition weighs on traditional fees. Developments like these matter, since meaningful ETF asset growth could be a key catalyst to offsetting margin pressure and supporting earnings. However, what investors should also be watching is how, despite international and ETF inflows, risks from margin compression and the shift away from legacy products remain as pronounced as ever…

Read the full narrative on Invesco (it's free!)

Invesco's outlook anticipates $4.8 billion in revenue and $1.1 billion in earnings by 2028. This projection is based on an annual revenue decline of 8.2% and an earnings increase of $677 million from the current earnings of $422.9 million.

Uncover how Invesco's forecasts yield a $24.04 fair value, a 3% upside to its current price.

Exploring Other Perspectives

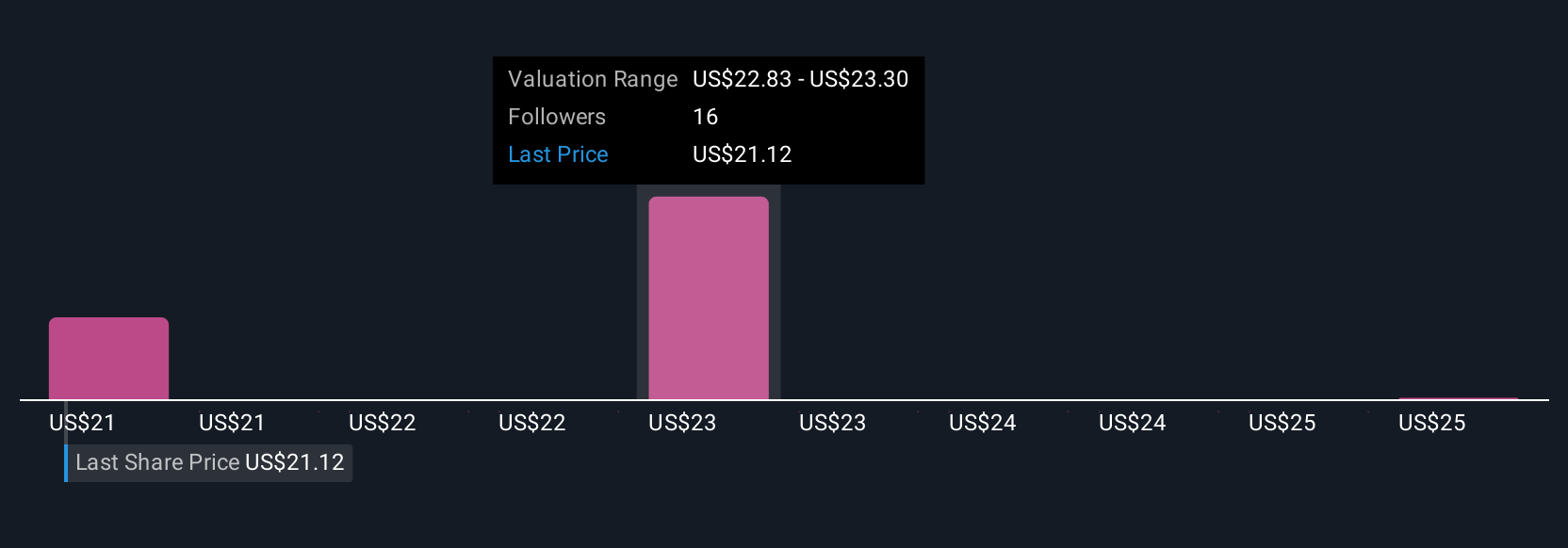

Simply Wall St Community members set fair value for Invesco shares between US$23.46 and US$25.61, across three different estimates. With margin pressure still a central concern for the firm, your view on future profit sustainability may shape whether you agree or disagree with these opinions.

Explore 3 other fair value estimates on Invesco - why the stock might be worth just $23.46!

Build Your Own Invesco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Invesco research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Invesco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Invesco's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026