- United States

- /

- Capital Markets

- /

- NYSE:IVZ

Can Invesco’s Momentum Continue After 36% YTD Rally in 2025?

Reviewed by Bailey Pemberton

If you’ve been keeping an eye on Invesco, you’ve seen the headlines and felt that little jolt every time the numbers moved. Maybe you’re wondering if this is the right time to jump in, double down, or stay on the sidelines. That question is front and center for a lot of investors right now, especially considering Invesco’s stock has climbed 3.9% in the last week and is sporting a healthy 9.1% return over the last month. Year-to-date, the gains stack up to an impressive 36.0%, with a robust 41.4% return over the past year. Zooming out even further, the stock has more than doubled in the past three and five years, up 100.1% and 111.0%, respectively. These are not numbers you can ignore, and they have caught the attention of both value hunters and growth seekers alike.

What is driving this momentum? Recent shifts in market sentiment toward financial stocks, combined with a change in risk perception, have led investors to reconsider businesses like Invesco. Broader optimism in capital markets has certainly played a part in pushing the share price higher, and it is a reminder that market developments can quickly change how we see a company’s prospects. However, as always, the big question lingers: how much of this growth is justified by Invesco’s true value?

Right now, our valuation score for the company stands at 1 out of 6, indicating that Invesco passes only one major undervaluation check. Over the next sections, we will dig into the details of what’s behind this score by examining several widely used valuation approaches. As we wrap up, we will introduce a perspective that might change the way you think about what counts as "undervalued" for a company like Invesco.

Invesco scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Invesco Excess Returns Analysis

The Excess Returns valuation model evaluates how effectively a company generates returns on its invested capital compared to what investors require for taking on equity risk. Instead of focusing solely on growth, this approach examines whether each dollar invested in Invesco outpaces its cost of capital over time and how efficiently future growth is expected to be reinvested.

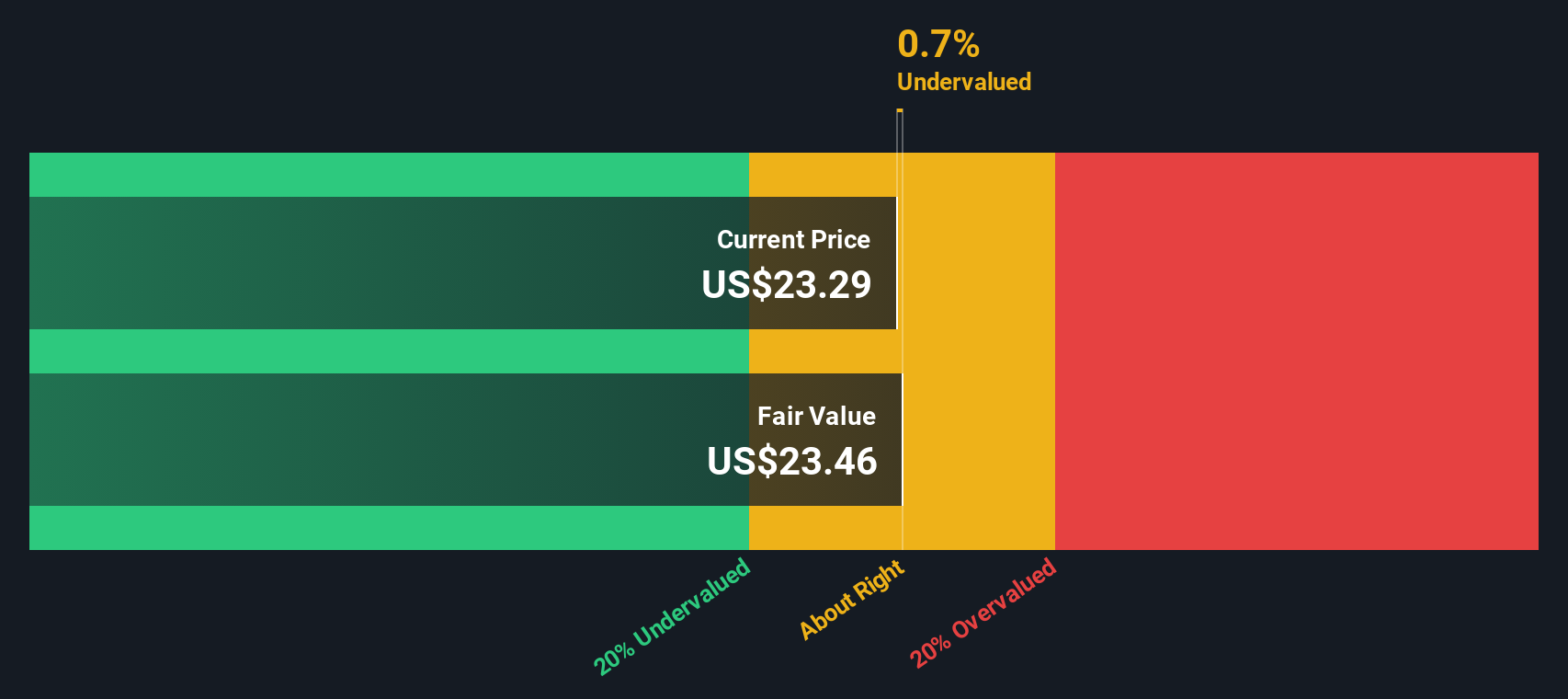

For Invesco, the figures are telling. The Book Value stands at $24.36 per share, with a Stable EPS projected at $2.27 per share. This earnings estimate is drawn from weighted future Return on Equity projections by six analysts. The company’s Cost of Equity is $2.78 per share, which implies that the excess return, defined as profit generated beyond investors’ required rate, is currently negative at $-0.51 per share. The Stable Book Value is estimated at $32.52 per share based on data from three analysts, while the average future Return on Equity sits at 6.98%.

Given these numbers, the Excess Returns model calculates an intrinsic value close to Invesco’s current share price. With an implied discount of just 3.5% above fair value, the stock appears reasonably priced based on its ability to generate future economic profits. It is neither clearly overvalued nor undervalued by this approach.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Invesco's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Invesco Price vs Earnings

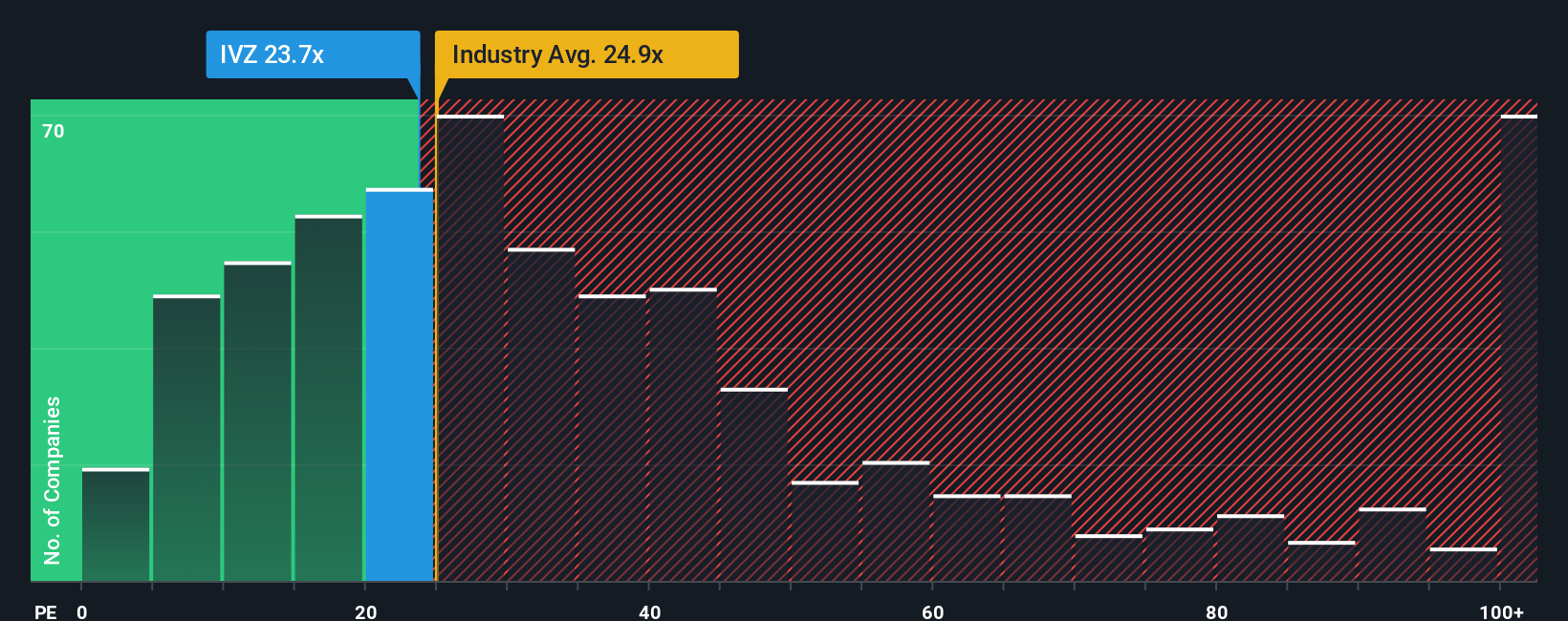

The Price-to-Earnings (PE) ratio remains a go-to metric for analyzing profitable companies like Invesco because it directly connects the company's valuation to its ability to generate earnings for shareholders. For businesses with steady profits, it provides a quick sense of how much investors are paying for each dollar of earnings. A higher PE can reflect growth optimism, while a lower one may suggest skepticism or risk.

Growth expectations and risk factors play a big role in shaping what a “normal” or “fair” PE should be. If investors expect robust profit expansion with manageable risks, they may be willing to pay a premium, pushing the PE ratio higher. When future growth or stability is uncertain, the fair multiple drops to account for those concerns.

Currently, Invesco is trading at a PE of 25.3x. For context, the Capital Markets industry averages 25.7x while Invesco’s peers are around 23.3x. To go a step further, Simply Wall St calculates a “Fair Ratio” for Invesco at 18.2x. This Fair Ratio weighs not just industry comparisons but also factors in the company’s growth forecasts, profit margins, size, and unique risk profile for a more tailored benchmark than generic peer groupings. Comparing the Fair Ratio to the actual PE, Invesco’s shares are trading at a premium, suggesting they may be somewhat expensive relative to their fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Invesco Narrative

Earlier we mentioned that there's an even better way to understand valuation. Let's introduce you to Narratives. A Narrative distills your perspective about a company’s future into a story that links its real-world prospects to a financial forecast and, ultimately, to a fair value. Rather than relying solely on traditional ratios, Narratives allow you to combine your assumptions about Invesco’s future revenue, earnings, and margins into your own big-picture outlook, making clear the story behind the numbers.

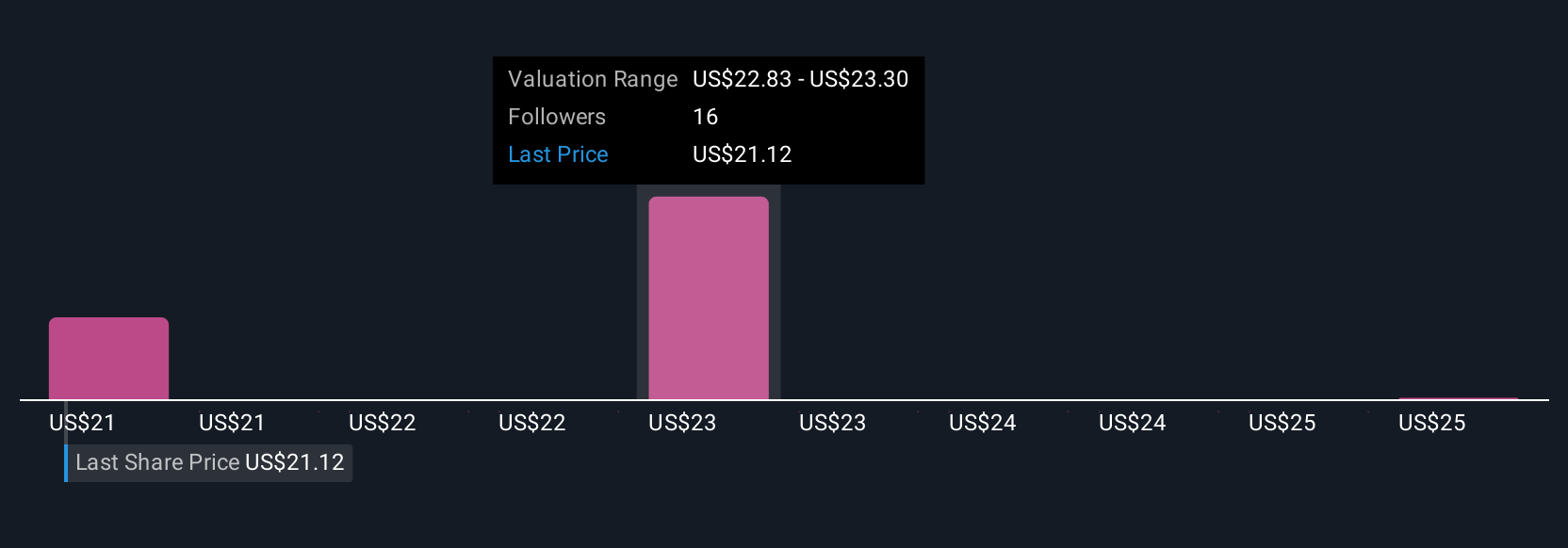

Narratives on Simply Wall St’s Community page (used by millions of investors) are easy to access and effortlessly updated whenever major news or earnings are released, so your investment view stays relevant. These Narratives help bridge the gap between a company's market price and your assessment of fair value, empowering you to spot when to buy, sell, or wait. For instance, looking at Invesco, one investor might see digital modernization and ETF innovation as the foundation for a bullish $29 price target, while another, more cautious, might set theirs at $17, emphasizing risks of fee compression and competition. Narratives make it simple to understand, compare, and act on these differing viewpoints, so you can invest with conviction and clarity.

Do you think there's more to the story for Invesco? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IVZ

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives