- United States

- /

- Capital Markets

- /

- NYSE:HLI

Is It Too Late to Consider Houlihan Lokey Stock After Its Two Hundred Percent Jump?

Reviewed by Bailey Pemberton

If you are considering what to do with Houlihan Lokey stock right now, you are not alone. After all, this is a company that has rewarded its shareholders handsomely, with the stock rising an impressive 26.9% over the past year and a whopping 246.1% over the last five years. Even so, not every week is smooth sailing, as seen by the recent 2.3% dip over the past seven days. But zooming out, the longer-term picture leans strongly toward growth, with a hefty 17.4% gain since the start of the year and triple-digit returns since 2021.

What is driving these price moves? Much of the positive momentum has been linked to robust demand for the company’s financial advisory expertise. In a market environment where navigating complex deals and restructuring has become increasingly valuable, Houlihan Lokey has positioned itself as a go-to partner, fueling investor enthusiasm and, in turn, share price appreciation.

Now, all this buzz might have you wondering if the current price still offers an attractive entry point, or if the market has already baked in all the good news. That is where valuation comes in. By taking an objective look at how the market is pricing the company, we can get a clearer sense of whether shares look compelling or stretched. Interestingly, according to a scoring system that measures six major valuation checks—adding one point for each that signals undervaluation—Houlihan Lokey clocks in with a value score of zero out of six.

So, what do the different valuation yardsticks say, and is there perhaps a smarter way to look at things? Let us dive into the key approaches analysts use to assess value and discover if they tell us the whole story, or if something even more insightful lies just around the corner.

Houlihan Lokey scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Houlihan Lokey Excess Returns Analysis

The Excess Returns valuation model is designed to evaluate how much value a company generates above its cost of equity. It essentially measures how efficiently the company reinvests shareholder capital. This approach highlights whether a company's returns are truly creating wealth beyond what shareholders could expect from similar risk investments elsewhere.

For Houlihan Lokey, the model shows a Book Value of $30.96 per share and a Stable EPS of $6.13, calculated using the median Return on Equity over the past five years. The Cost of Equity stands at $2.88 per share, implying every share is generating an Excess Return of $3.25. An average Return on Equity of 17.40% suggests Houlihan Lokey has maintained healthy profitability on its investments. Looking ahead, analyst estimates point to a Stable Book Value of $35.24 per share, based on a weighted average of projected future values.

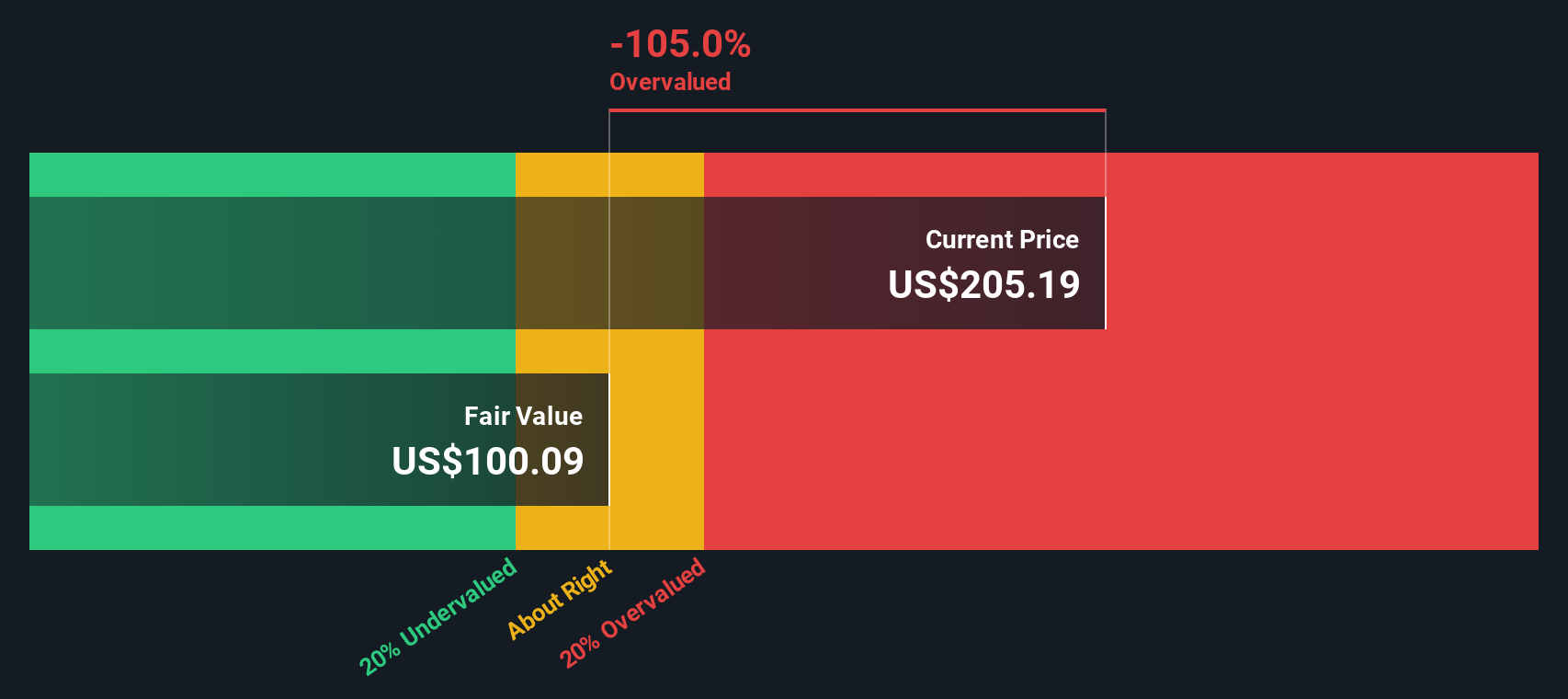

Using these figures, the Excess Returns model determines an intrinsic value that is notably lower than the current market price. Specifically, the model signals the stock is trading at a 103.0% premium over its implied value. This means Houlihan Lokey appears significantly overvalued by this method.

Result: OVERVALUED

Our Excess Returns analysis suggests Houlihan Lokey may be overvalued by 103.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Houlihan Lokey Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as a strong valuation metric for established, profitable businesses. Because earnings are central to a company's ability to generate shareholder value, the PE ratio provides a clear picture of how much investors are willing to pay for each dollar of current profits. A higher PE can often be justified by the expectation of faster growth, stronger margins, or greater stability, while riskier or slower-growth stocks tend to command a lower multiple.

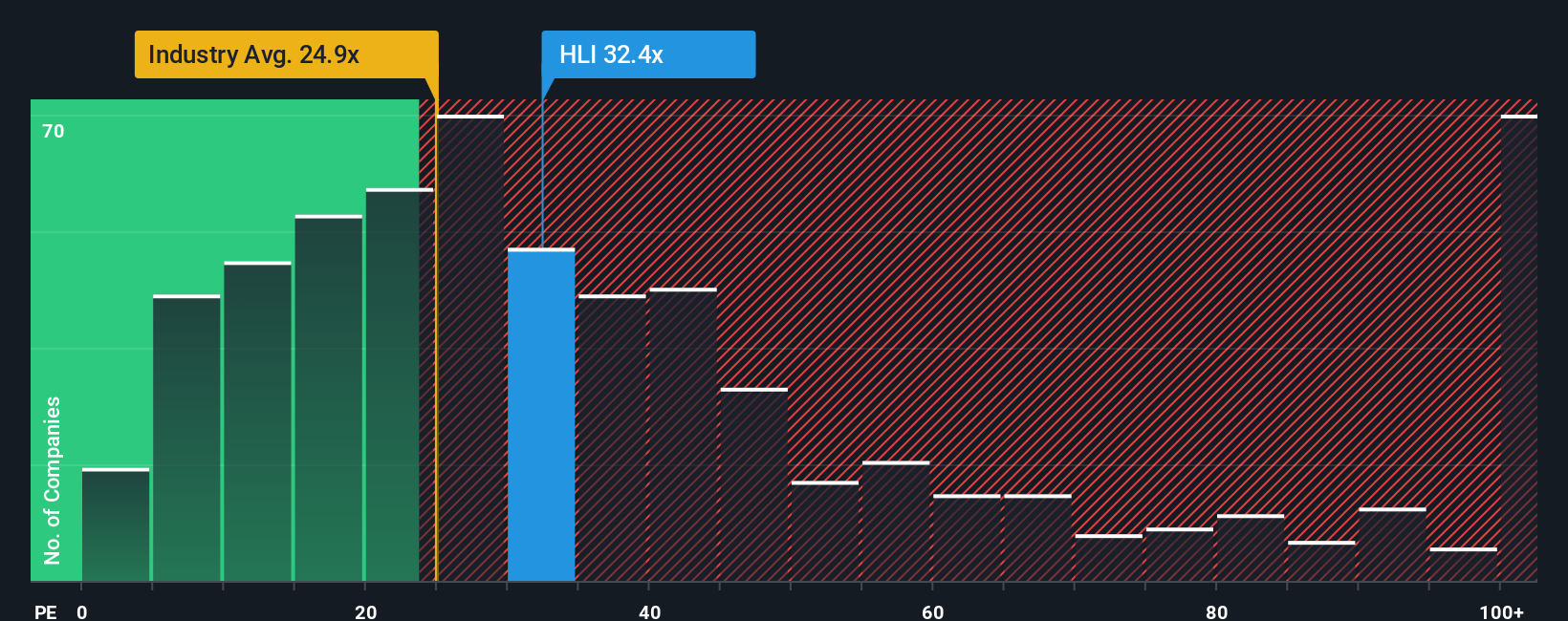

Houlihan Lokey's current PE ratio stands at 34.7x, which is noticeably higher than the peer average of 19.3x and also higher than the Capital Markets industry average of 27.1x. However, comparing to averages alone may miss the bigger picture. That is where Simply Wall St's proprietary "Fair Ratio" comes into play. It predicts a fair PE for Houlihan Lokey of 17.9x. The Fair Ratio considers not just market averages, but also incorporates company-specific growth prospects, profitability, market cap, and inherent risks. By customizing the benchmark, it offers a more tailored, accurate sense of what multiple Houlihan Lokey truly deserves.

Since Houlihan Lokey’s actual PE is well above its fair PE, the stock appears overvalued based on this multiple-driven approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

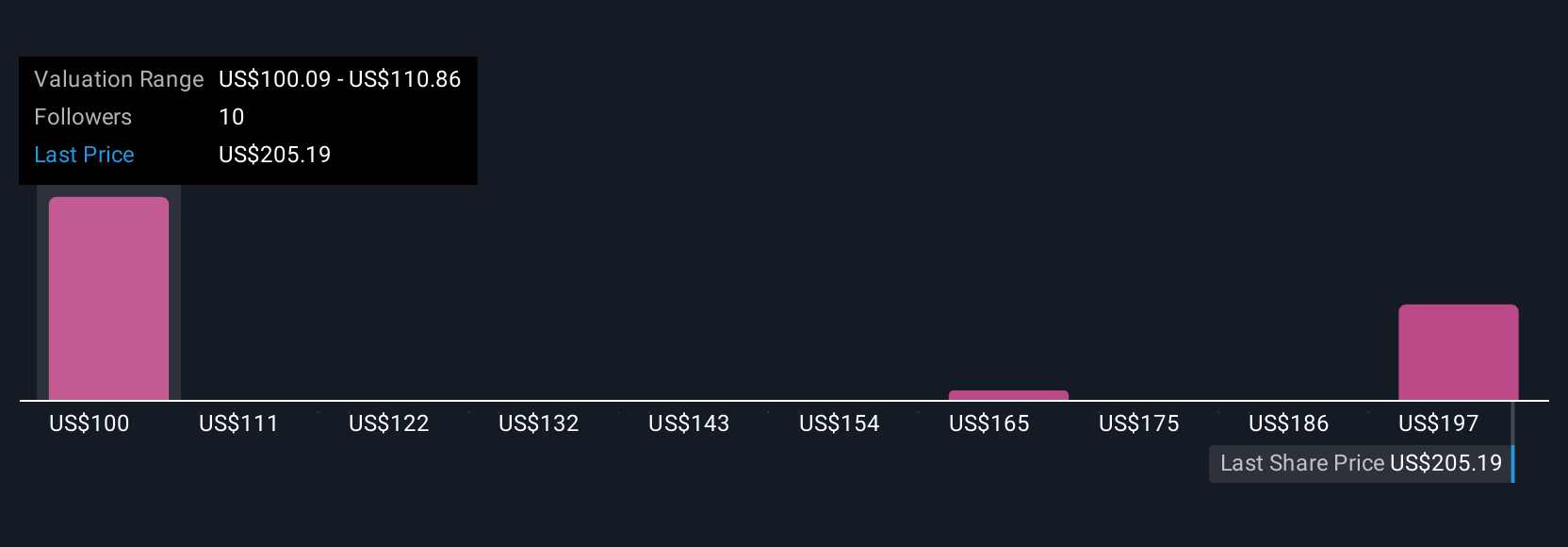

Upgrade Your Decision Making: Choose your Houlihan Lokey Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal perspective or story about a company, capturing how you think Houlihan Lokey will perform in the future, what its fair value could be, and how well it can deliver on its promises. Narratives go beyond simple ratios by linking your outlook on the business, such as anticipated revenue, profit margins, and industry trends, with a specific financial forecast and a corresponding fair value. They make this process easy and accessible; on Simply Wall St’s Community page, millions of investors exchange, compare, and update their Narratives, helping everyone spot new opportunities or risks in real time. Narratives assist you in making practical decisions: you can see when your fair value is meaningfully higher or lower than the current price, giving clear signals on whether to buy, hold, or sell, with instant updates when news or company results change the story. For example, some investors currently expect Houlihan Lokey’s value to reach $232.0 based on strong global expansion, while others see it closer to $166.0 due to concerns about cost structure and market dependence. This shows just how dynamic and insightful Narratives can be for investors like you.

Do you think there's more to the story for Houlihan Lokey? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Houlihan Lokey might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLI

Houlihan Lokey

An investment banking company, provides merger and acquisition (M&A), capital market, financial restructurings and liability management, and financial and valuation advisory services worldwide.

Solid track record with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives