- United States

- /

- Capital Markets

- /

- NYSE:GS

Is Strong Q3 Performance and Leadership Praise Changing the Investment Narrative for Goldman Sachs (GS)?

Reviewed by Sasha Jovanovic

- Goldman Sachs recently reported third-quarter net income of US$4.10 billion, up from US$2.99 billion a year earlier, as part of a strong set of earnings results and confirmed a quarterly dividend of US$4.00 per share for December 2025.

- Heightened investor confidence was further supported by widely shared positive commentary regarding CEO David Solomon’s leadership and a consistent stream of new fixed-income offerings, highlighting active capital markets engagement.

- We’ll now examine how these strong earnings and leadership recognition may influence Goldman Sachs’s investment narrative, especially given the recent uptick in fixed-income activity.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Goldman Sachs Group Investment Narrative Recap

To take a long-term view as a Goldman Sachs shareholder, you need to believe in the firm’s ability to deliver consistent earnings growth from robust capital markets activity, resilient fee streams, and trusted leadership. This quarter’s sharp rise in net income and continued momentum in fixed-income offerings reinforce the short-term catalyst of active client demand in debt capital markets, while ongoing regulatory changes remain the most important risk. For now, these news events appear to boost the investment case, while the regulatory risk profile is unchanged.

One announcement that captures investor focus is the affirmed US$4.00 per share quarterly dividend, signaling confidence in the company’s earnings power and capital position. This payout, in light of strong results and increasing fixed-income activity, directly ties to shareholder returns and highlights the importance of stable margins and steady capital deployment. Yet, unlike dividend affirmations, some risks could have a more significant effect...

Read the full narrative on Goldman Sachs Group (it's free!)

Goldman Sachs Group's outlook forecasts $61.4 billion in revenue and $17.0 billion in earnings by 2028. This assumes a 3.9% annual revenue growth rate and a $2.3 billion increase in earnings from the current $14.7 billion level.

Uncover how Goldman Sachs Group's forecasts yield a $781.79 fair value, a 5% upside to its current price.

Exploring Other Perspectives

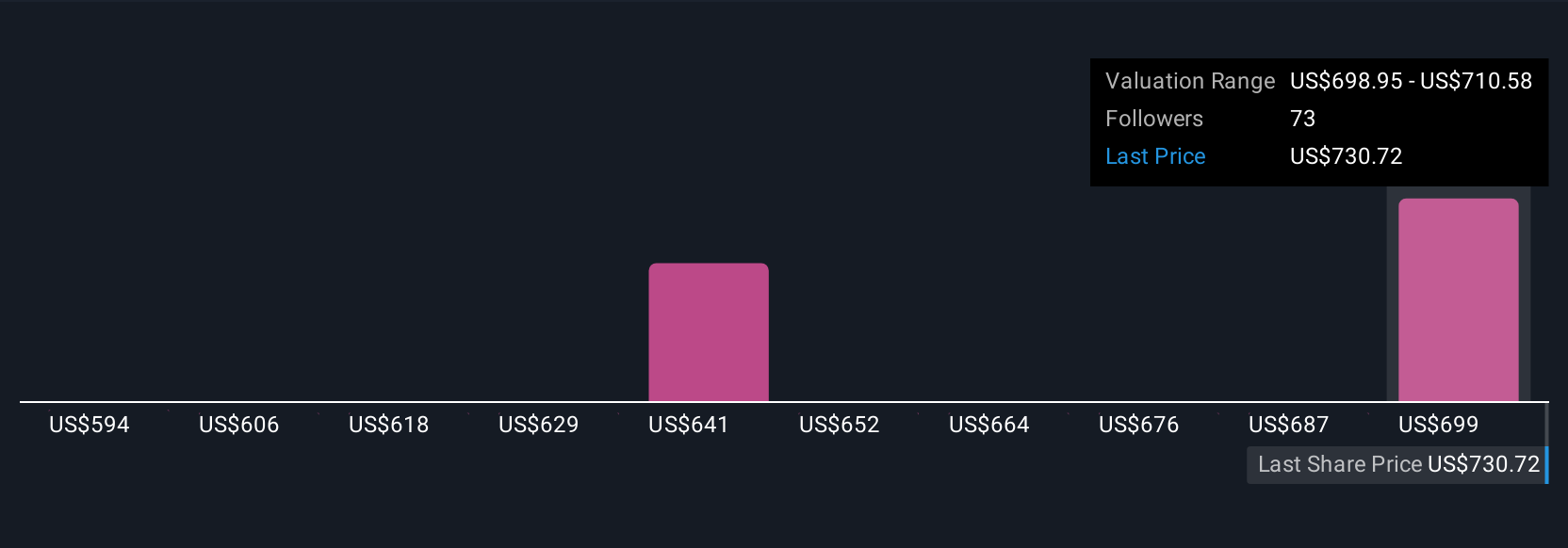

Fair value estimates from seven Simply Wall St Community members range from US$610 to US$815 per share. While most see regulatory headwinds as a key risk, opinions vary greatly on how these could impact Goldman Sachs’s ability to maintain long-term earnings and capital flexibility.

Explore 7 other fair value estimates on Goldman Sachs Group - why the stock might be worth 18% less than the current price!

Build Your Own Goldman Sachs Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goldman Sachs Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goldman Sachs Group's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives