- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs (GS): Evaluating Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Goldman Sachs Group (GS) stock has seen some ups and downs over the past month, drifting roughly 5% lower despite holding onto double-digit gains for the year. Investors remain attentive to sector movements and potential catalysts for the bank’s shares.

See our latest analysis for Goldman Sachs Group.

Goldman Sachs Group’s share price has pulled back about 5% over the last month, even as investors have welcomed a strong run this year and considered the bank’s broader sector role. Momentum has cooled a bit lately, yet the stock still shows a year-to-date share price return of over 30% and a remarkable 1-year total shareholder return of nearly 45%. This suggests that longer-term holders continue to see strength in the company’s performance and prospects.

If financials like Goldman have piqued your interest, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With Goldman Sachs riding high on impressive returns and recent profit growth, the question is whether its stock remains undervalued at current levels, or if the recent gains mean markets have already priced in future growth potential.

Most Popular Narrative: 4% Undervalued

With Goldman Sachs Group trading at $750.77 and the most popular narrative assigning a fair value around $781.79, current prices sit just below expectations. This keeps investors intrigued as to whether further upside might lie ahead.

Strategic deployments of AI (such as internal AI assistants and software automation) and ongoing digital transformation initiatives are expected to yield meaningful operational efficiencies. These efforts may improve productivity and lower expense ratios, which could enhance operating leverage and bottom-line earnings.

Wondering what other big levers drive this verdict? The narrative's calculation hinges on ambitious profit expansion and a future earnings multiple leaner than industry norms. Take a peek inside the forecast to see which bold assumptions powered this sharper valuation.

Result: Fair Value of $781.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued regulatory uncertainty or prolonged geopolitical instability could challenge Goldman's positive outlook. This may potentially impact growth forecasts and valuation assumptions.

Find out about the key risks to this Goldman Sachs Group narrative.

Another Perspective

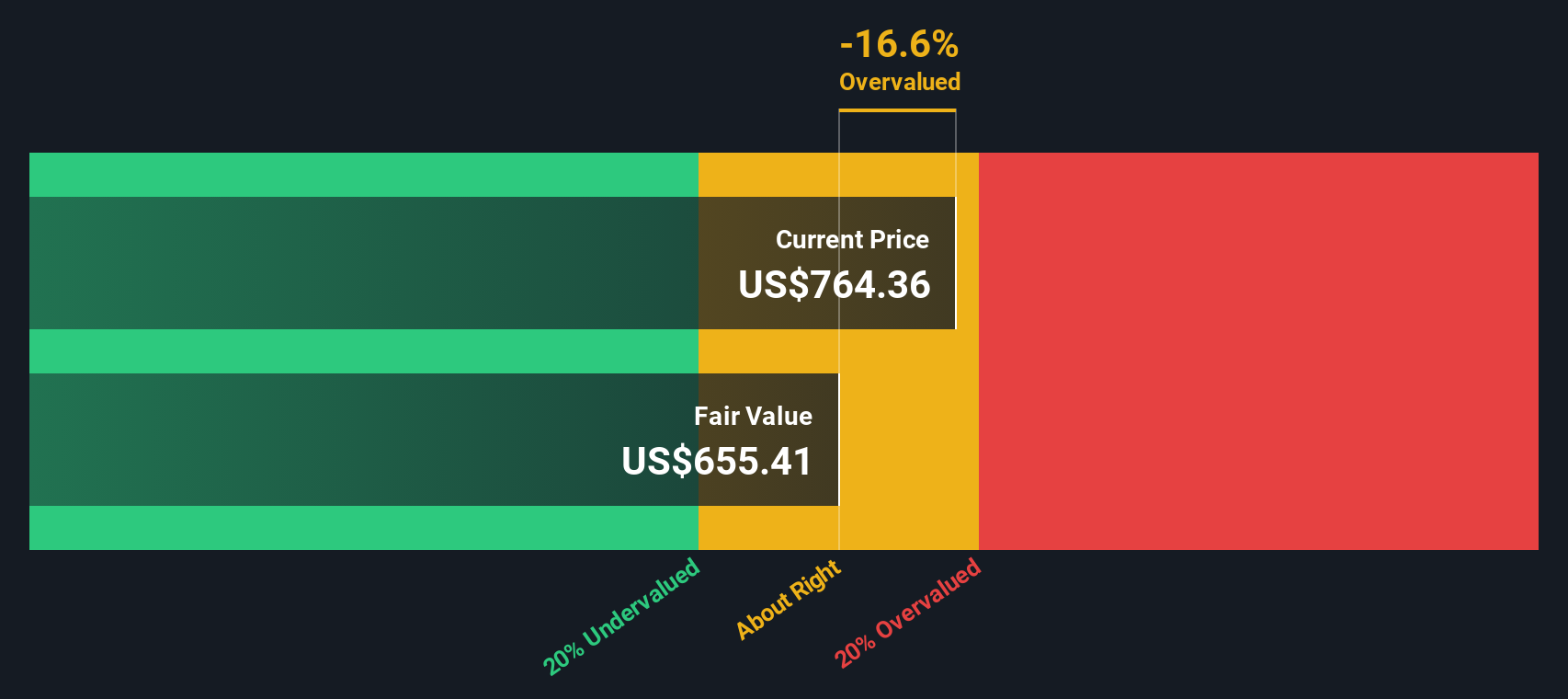

Looking at Goldman Sachs through the lens of our SWS DCF model, a different story appears. The DCF valuation points to the stock trading above its estimated fair value, suggesting it may be slightly overvalued right now instead of undervalued. Does the market have a better read on Goldman's true value, or is sentiment running ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Goldman Sachs Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Goldman Sachs Group Narrative

If you have your own perspective or want to dive into the details yourself, it only takes a few minutes to build a narrative based on your unique insights. Do it your way

A great starting point for your Goldman Sachs Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for just one great pick when you could be catching tomorrow’s leaders early. Smart investors like you are constantly seizing fresh opportunities. Make sure you’re ahead of the curve by expanding your watchlist with these hand-picked strategies:

- Tap into the future of healthcare as breakthrough companies harness artificial intelligence by checking out these 33 healthcare AI stocks.

- Boost your passive income with reliable businesses offering strong yields. Start with these 18 dividend stocks with yields > 3% delivering over 3% returns.

- Uncover overlooked bargains poised for growth by reviewing these 878 undervalued stocks based on cash flows built on real cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives