- United States

- /

- Capital Markets

- /

- NYSE:GS

Goldman Sachs Group (GS) Advises F&F Co. On TaylorMade Acquisition Strategy

Reviewed by Simply Wall St

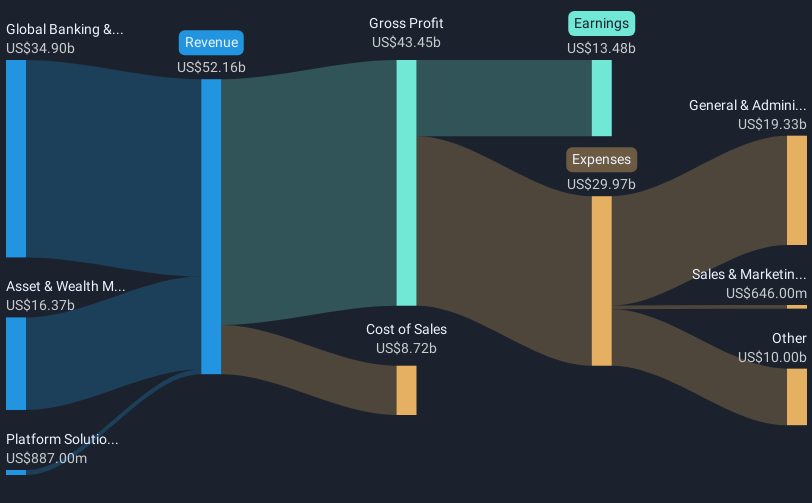

Goldman Sachs Group (GS) experienced a 36% rise in its share price over the last quarter. This substantial growth came as the company was engaged as the financial advisor for F&F Co. Ltd.'s potential acquisition of TaylorMade, amid positive market trends with the Dow Jones, S&P 500, and Nasdaq reaching all-time highs. GS also reported strong second-quarter earnings and a dividend increase, likely bolstering investor confidence. Additionally, the company’s inclusion in the Russell Top 50 Index potentially enhanced its market visibility, contributing to the upward momentum. Overall, these developments aligned well with the broader market's optimistic trajectory.

Every company has risks, and we've spotted 2 risks for Goldman Sachs Group you should know about.

The recent news regarding Goldman Sachs Group's involvement in advising F&F Co. Ltd.'s potential acquisition of TaylorMade aligns with the company's narrative of harnessing growth from mergers and acquisitions, along with digital transformation. These developments could potentially bolster their advisory revenues and shift earnings toward more stable, high-margin streams. With the recent strong quarterly share price surge, this could also reinforce investor confidence and further impact future forecasts positively.

Over the past five years, Goldman Sachs stocks have achieved a total return of 293.33%, including dividends, indicating robust long-term performance. This return stands in contrast to the company's recent outperformance against the US Capital Markets industry over the last year, where Goldman Sachs recorded higher earnings growth compared to industry averages.

The current price of US$708.26 surpasses the analyst consensus price target of US$691.63, implying a share price discount of 2.35%, which suggests that the market is optimistic about the company's future earnings forecast. However, it also signals that the shares are trading above the estimated fair value, indicating investor sentiment may be elevated following recent developments. The future impact on revenue and earnings remains contingent on ongoing M&A activity and the continued success of their digital initiatives.

Understand Goldman Sachs Group's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GS

Goldman Sachs Group

A financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals in the Americas, Europe, the Middle East, Africa, and Asia.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives