- United States

- /

- Medical Equipment

- /

- NasdaqGM:GUTS

Spotlight On Fractyl Health And Two Other Intriguing Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market grapples with the impact of new tariffs and economic uncertainties, investors are increasingly looking for opportunities beyond well-known names. Penny stocks, a term that might seem outdated, still hold relevance as they often represent smaller or newer companies with potential for growth at lower price points. In this article, we explore three intriguing penny stocks that stand out for their financial strength and offer promising opportunities for those seeking under-the-radar investments.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| Safe Bulkers (NYSE:SB) | $3.69 | $393.82M | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $118.58M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.8306 | $6.19M | ★★★★★☆ |

| Permianville Royalty Trust (NYSE:PVL) | $1.48 | $47.85M | ★★★★★★ |

| Tuya (NYSE:TUYA) | $3.22 | $2.01B | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8171 | $73.08M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.14 | $23.06M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $3.87 | $151.42M | ★★★★★☆ |

| TETRA Technologies (NYSE:TTI) | $3.63 | $501.77M | ★★★★☆☆ |

Click here to see the full list of 751 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Fractyl Health (NasdaqGM:GUTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fractyl Health, Inc. is a metabolic therapeutics company focused on developing treatments for type 2 diabetes and obesity, with a market cap of $75.03 million.

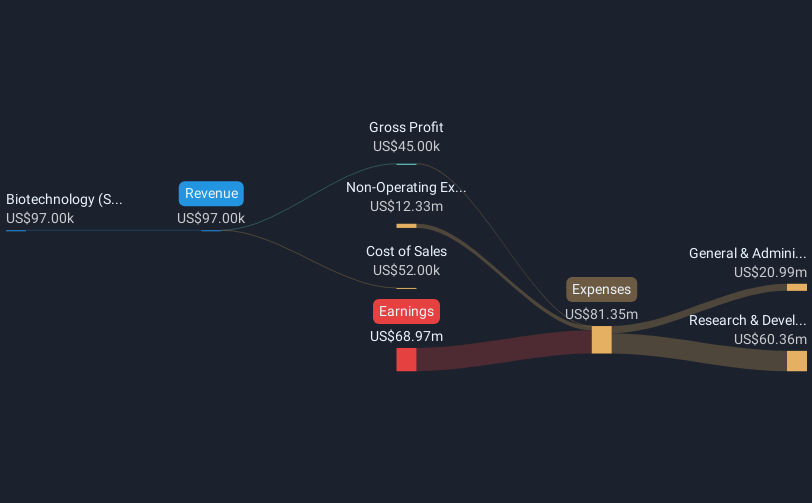

Operations: The company's revenue is primarily derived from its Biotechnology (Startups) segment, amounting to $0.097 million.

Market Cap: $75.03M

Fractyl Health, Inc., a metabolic therapeutics company with a market cap of US$75.03 million, is pre-revenue with sales of only US$0.093 million for 2024. The company recently announced promising developments in its REMAIN-1 study and Rejuva gene therapy platform, which have garnered significant interest and scientific recognition. Despite being unprofitable with a net loss of US$68.69 million in 2024, Fractyl has sufficient cash runway to sustain operations into 2026 while advancing key clinical milestones. Recent filings for equity offerings aim to raise capital, potentially diluting current shareholders but bolstering financial resources for future growth initiatives.

- Take a closer look at Fractyl Health's potential here in our financial health report.

- Evaluate Fractyl Health's prospects by accessing our earnings growth report.

Quince Therapeutics (NasdaqGS:QNCX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quince Therapeutics, Inc. is a biopharmaceutical company dedicated to acquiring, developing, and commercializing therapeutics for patients with debilitating and rare diseases, with a market cap of $63.80 million.

Operations: Quince Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $63.8M

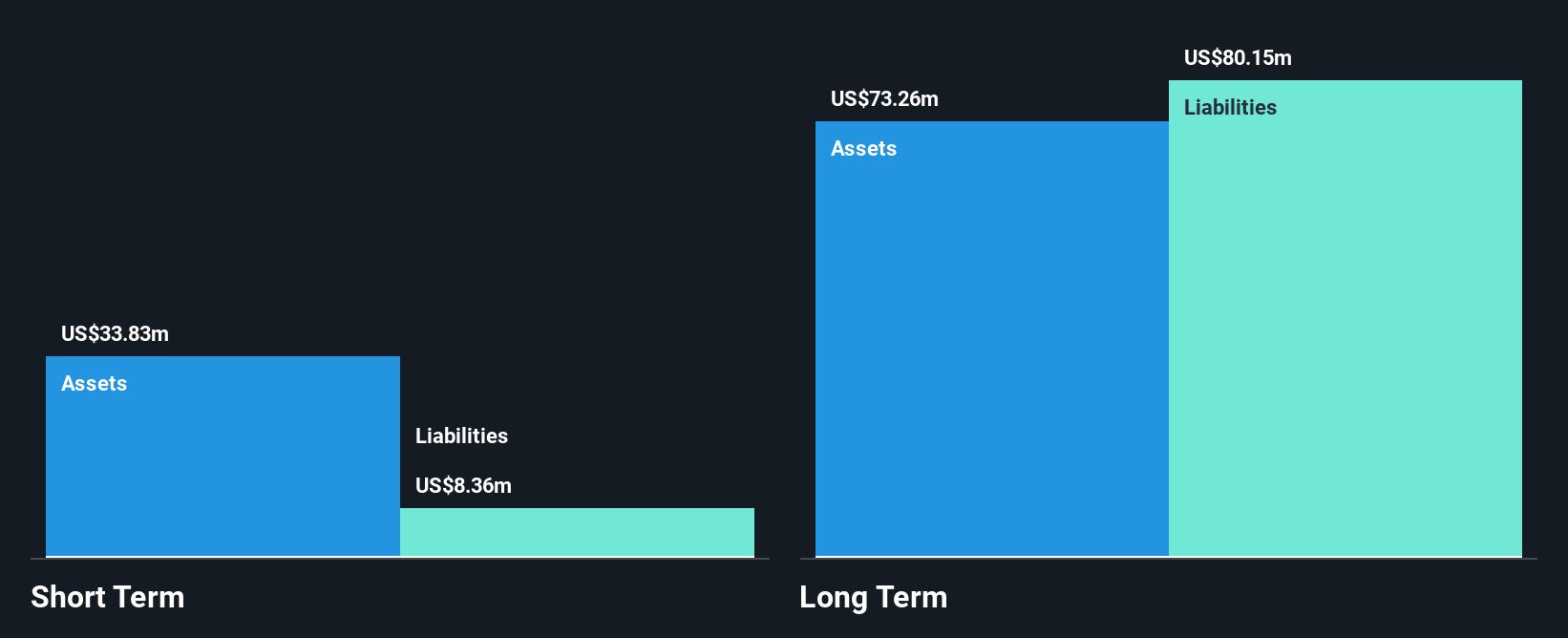

Quince Therapeutics, Inc., with a market cap of US$63.80 million, is pre-revenue and focused on developing treatments for rare diseases like Ataxia-Telangiectasia (A-T). Recent announcements include the publication of long-term safety data for EryDex and plans to enroll patients in a Phase 3 trial under FDA's Fast Track designation. Although unprofitable, Quince has more cash than debt but faces challenges with short-term assets unable to cover long-term liabilities. The company recently filed for equity offerings totaling US$275 million to support its pipeline, which may lead to shareholder dilution but enhance financial flexibility.

- Navigate through the intricacies of Quince Therapeutics with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Quince Therapeutics' future.

Granite Point Mortgage Trust (NYSE:GPMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Granite Point Mortgage Trust Inc. is a real estate investment trust that focuses on originating, investing in, and managing senior floating-rate commercial mortgage loans and other debt-related commercial real estate investments in the United States, with a market cap of approximately $144.60 million.

Operations: Granite Point Mortgage Trust Inc. does not report distinct revenue segments, focusing instead on senior floating-rate commercial mortgage loans and other debt-related real estate investments within the United States.

Market Cap: $144.6M

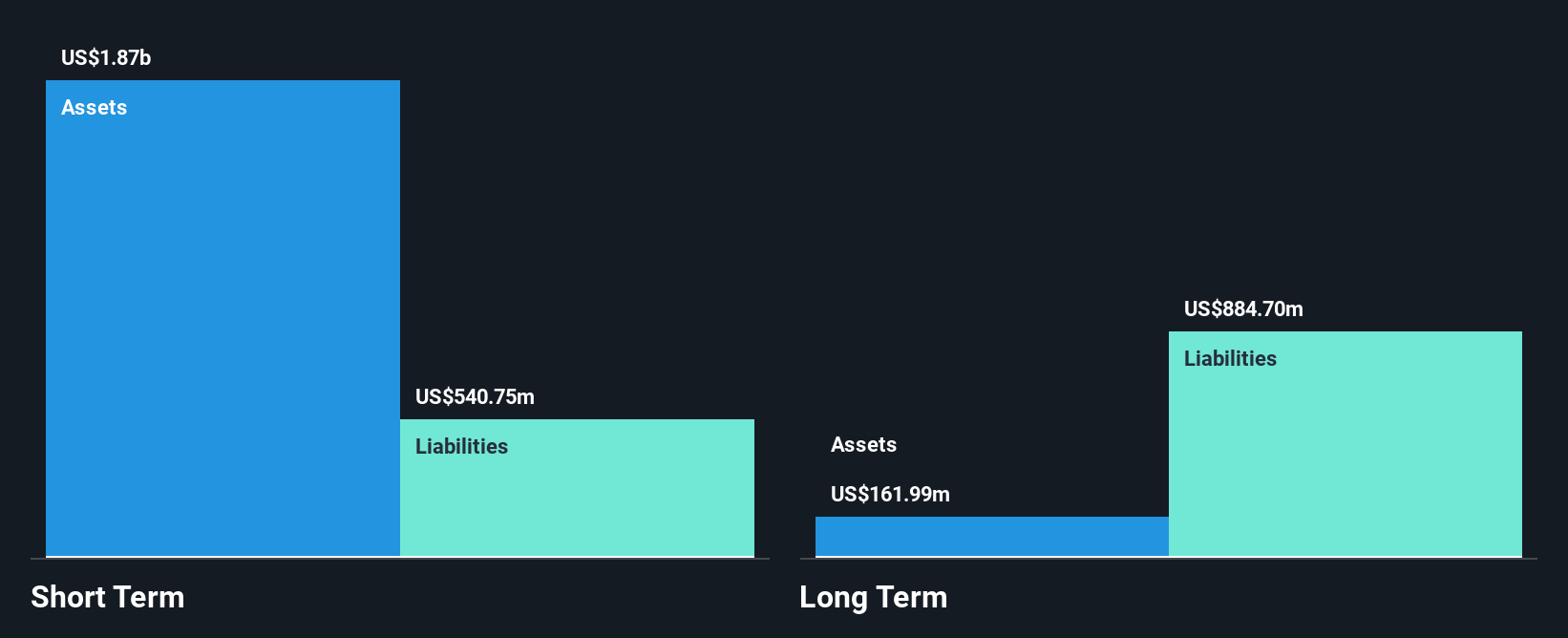

Granite Point Mortgage Trust Inc., with a market cap of approximately US$144.60 million, is unprofitable and generates less than US$1 million in revenue. Despite its financial challenges, the company has a seasoned management team and board, with average tenures of 7.2 and 7.8 years, respectively. Recent earnings reports reveal increased losses for both the quarter and full year ending December 2024, yet Granite Point maintains a sufficient cash runway exceeding three years due to positive free cash flow. The company recently completed a significant share buyback program while facing high debt levels relative to equity at 223.7%.

- Click to explore a detailed breakdown of our findings in Granite Point Mortgage Trust's financial health report.

- Gain insights into Granite Point Mortgage Trust's future direction by reviewing our growth report.

Where To Now?

- Discover the full array of 751 US Penny Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:GUTS

Fractyl Health

A metabolic therapeutics company, develops therapies for the treatment of type 2 diabetes (T2D) and obesity.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives