- United States

- /

- Consumer Finance

- /

- NYSE:GDOT

Did Business Growth Power Green Dot's (NYSE:GDOT) Share Price Gain of 200%?

It hasn't been the best quarter for Green Dot Corporation (NYSE:GDOT) shareholders, since the share price has fallen 23% in that time. But in stark contrast, the returns over the last half decade have impressed. In fact, the share price is 200% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

View our latest analysis for Green Dot

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

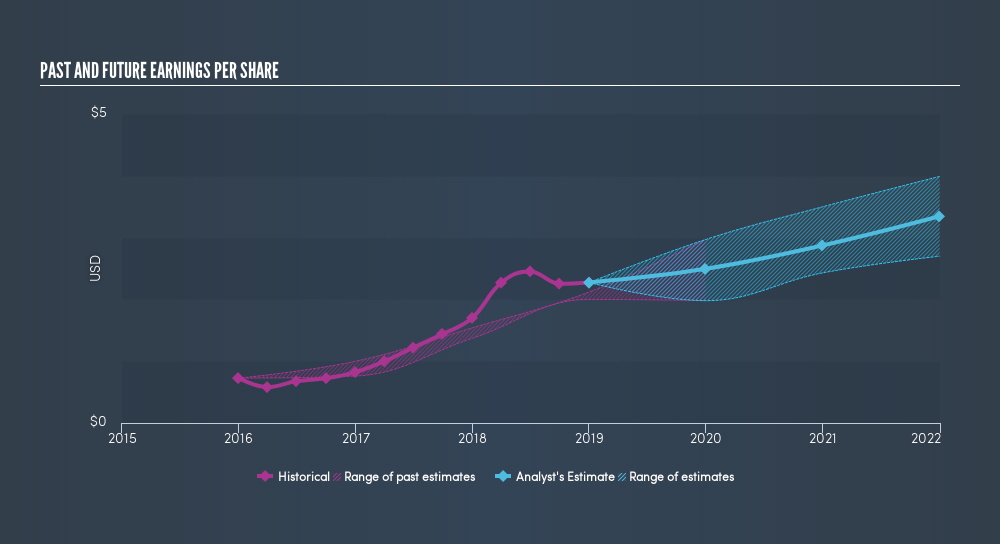

During five years of share price growth, Green Dot achieved compound earnings per share (EPS) growth of 24% per year. This EPS growth is remarkably close to the 25% average annual increase in the share price. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Indeed, it would appear the share price is reacting to the EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Green Dot has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Green Dot stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

While the broader market gained around 8.7% in the last year, Green Dot shareholders lost 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 25% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you would like to research Green Dot in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:GDOT

Green Dot

A financial technology and registered bank holding company, provides various financial services to consumers and businesses in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives