- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Evaluating Shift4 Payments (FOUR) After New Euro Bond Issue and Liberty Sports Group Tech Partnership

Reviewed by Simply Wall St

Shift4 Payments (FOUR) just tapped the euro bond market with €435 million of 5.5% senior notes due 2033, while also landing a multi year technology partnership across Liberty Sports Group venues.

See our latest analysis for Shift4 Payments.

Even with these growth moves, Shift4’s recent share price performance has been weak, with a 90 day share price return of minus 21.26 percent and a 1 year total shareholder return of minus 31.54 percent. This suggests sentiment has cooled despite solid multi year gains.

If this kind of payments and venue tech story has your attention, it might be worth exploring high growth tech and AI stocks to see which other high growth names are building momentum.

Yet with revenue still growing above 20 percent annually and the share price now trading at a steep discount to analyst targets, investors have to ask whether Shift4 is being mispriced or the market already sees its best growth ahead.

Most Popular Narrative: 28.2% Undervalued

With the narrative fair value sitting well above Shift4’s last close, the gap between modeled upside and current sentiment is hard to ignore.

The accelerating global shift to cashless and digital payments continues to expand transaction volumes in key Shift4 verticals (hospitality, sports/entertainment, luxury retail) and underpins long term double digit revenue growth projections.

Curious how this growth runway justifies a richer future earnings multiple and higher margins over time, even after recent estimate cuts, while still pointing to material upside?

Result: Fair Value of $95.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on recent international acquisitions or sustained weakness in key hospitality and restaurant end markets could quickly challenge this upside case.

Find out about the key risks to this Shift4 Payments narrative.

Another Angle on Valuation

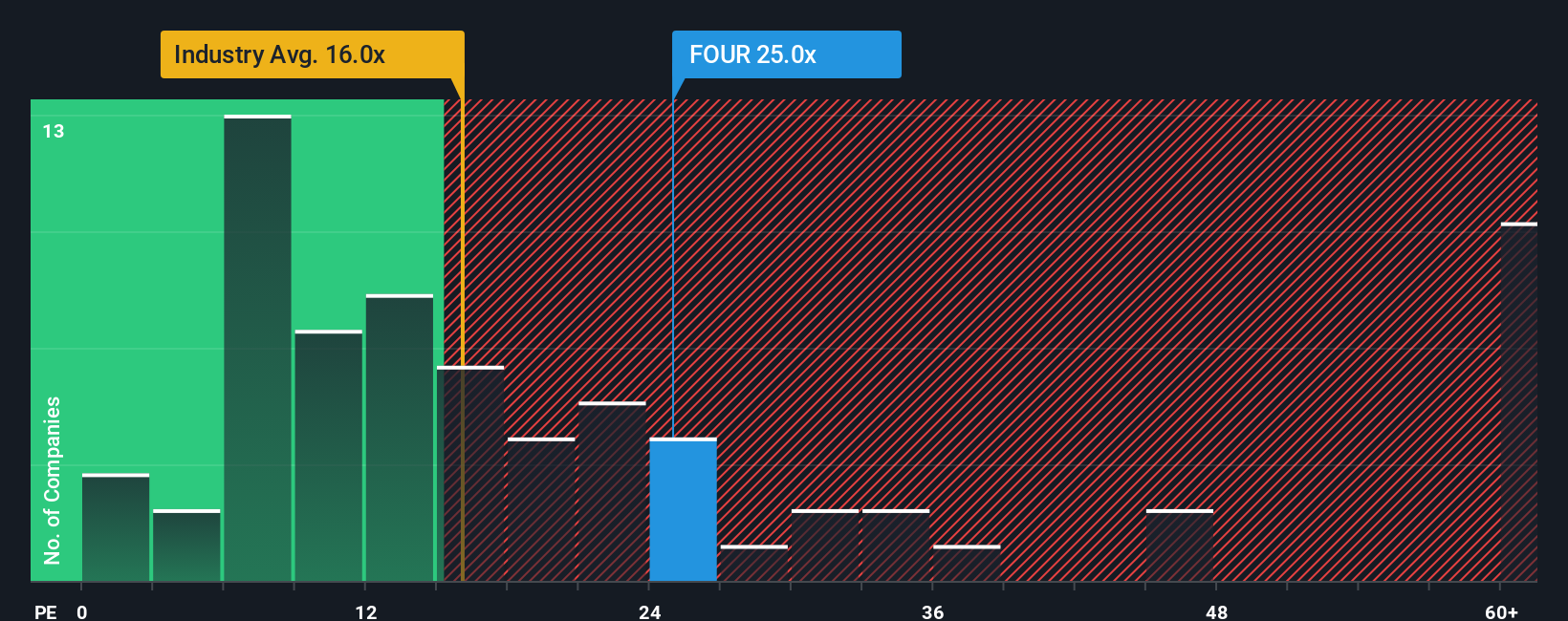

There is a snag in the upbeat fair value story. The current price implies a price to earnings ratio of 28.2 times, which sits above both the 25.6 times fair ratio and the 13.6 times industry average. That leaves less room for error if growth stumbles, or does it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Shift4 Payments Narrative

If you see things differently or prefer digging into the numbers yourself, you can build a personalized Shift4 view in minutes using Do it your way.

A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Shift4 might be on your radar already, but you may overlook other opportunities if you stop here instead of scanning additional high potential setups with the Simply Wall St Screener.

- Capture early stage momentum by targeting fast moving, higher risk candidates using these these 3603 penny stocks with strong financials that already show solid underlying financials.

- Position your portfolio at the heart of the automation boom by focusing on these 26 AI penny stocks that blend rapid growth with scalable business models.

- Identify potential bargains before the wider market by zeroing in on these 908 undervalued stocks based on cash flows that appear inexpensive relative to their long term cash flow prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>