- United States

- /

- Diversified Financial

- /

- NYSE:FOUR

Detroit Lions Partnership Could Be a Game Changer for Shift4 Payments (FOUR)

Reviewed by Simply Wall St

- Earlier this month, the Detroit Lions announced a partnership with Shift4 Payments to provide an integrated commerce solution at Ford Field, spanning ticketing, food and beverage, and retail transactions with Shift4's SkyTab Venue point-of-sale system and unified payments technologies.

- This collaboration highlights the growing adoption of Shift4’s end-to-end payment ecosystem in major sporting venues, reflecting the company’s expanding influence in the sports and entertainment industry.

- We’ll explore how powering payments for an NFL team supports Shift4’s multi-vertical growth narrative and integration across new markets.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Shift4 Payments Investment Narrative Recap

To own Shift4 Payments, an investor needs to believe that the company's integrated payment platform can keep winning share across industries, especially high-profile verticals like sports and entertainment. While the Detroit Lions partnership reinforces Shift4's strong reputation in event venues, its impact is not material to the immediate catalyst: the pace and success of ongoing international expansion, which remains the main driver, and the biggest risk if integration falters.

Of recent announcements, the Blue Origin collaboration stands out, showing Shift4's readiness to accept emerging payment technologies like cryptocurrencies. This flexibility in offering new digital payment solutions ties directly to one of the core catalysts: capitalizing on shifts toward cashless transactions as well as broader commerce adoption in new markets.

Yet, in contrast, investors should be aware of how dependence on sectors with slow sales, combined with the risk of underperforming acquisitions, could...

Read the full narrative on Shift4 Payments (it's free!)

Shift4 Payments' narrative projects $7.0 billion in revenue and $621.4 million in earnings by 2028. This requires a 24.4% yearly revenue growth and a $413.7 million increase in earnings from the current $207.7 million.

Uncover how Shift4 Payments' forecasts yield a $110.62 fair value, a 21% upside to its current price.

Exploring Other Perspectives

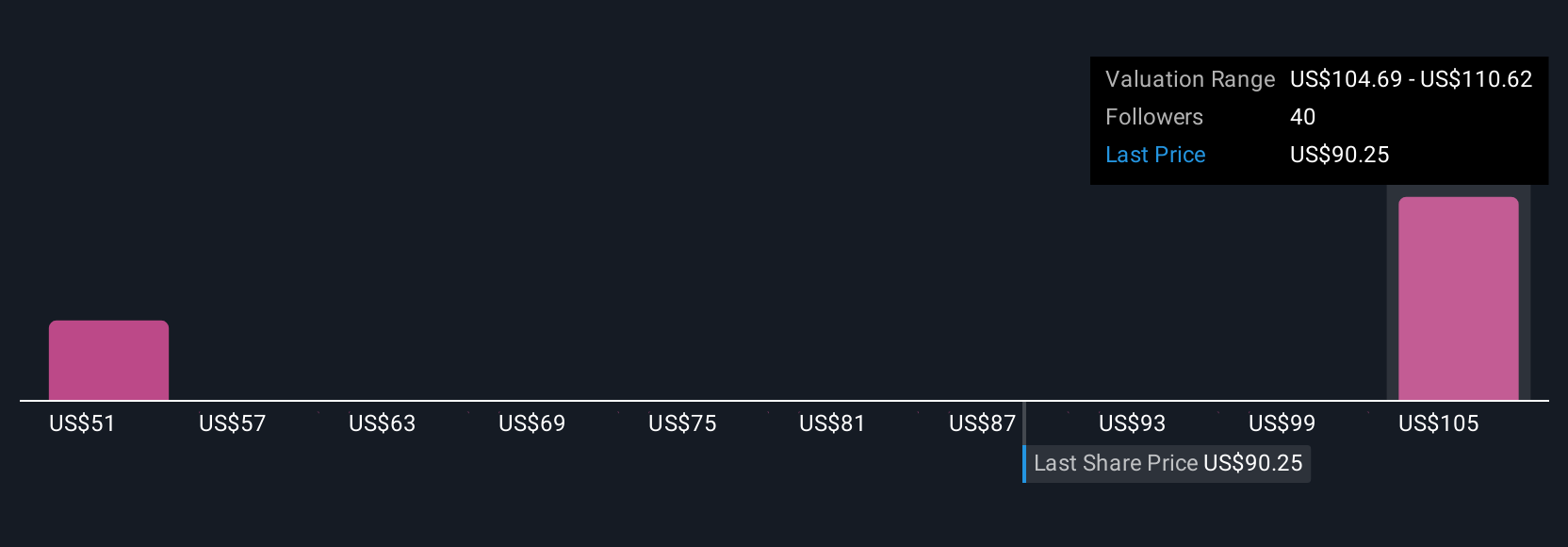

Simply Wall St Community members estimate a wide fair value range for Shift4 Payments, from US$51.35 to US$110.62, across only 3 perspectives. With rapid international expansion as a central catalyst, your view on future growth will likely shape your expectations for the company’s performance; consider how varied these opinions are.

Explore 3 other fair value estimates on Shift4 Payments - why the stock might be worth 44% less than the current price!

Build Your Own Shift4 Payments Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Shift4 Payments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Shift4 Payments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Shift4 Payments' overall financial health at a glance.

No Opportunity In Shift4 Payments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FOUR

Shift4 Payments

Engages in the provision of software and payment processing solutions in the United States and internationally.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives