- United States

- /

- Diversified Financial

- /

- NYSE:FIS

There's Reason For Concern Over Fidelity National Information Services, Inc.'s (NYSE:FIS) Price

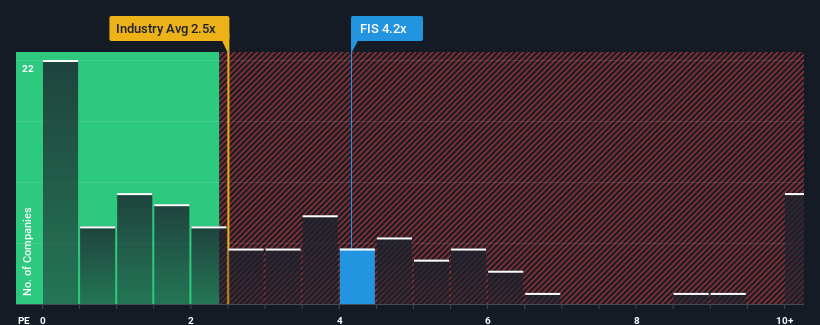

When you see that almost half of the companies in the Diversified Financial industry in the United States have price-to-sales ratios (or "P/S") below 2.5x, Fidelity National Information Services, Inc. (NYSE:FIS) looks to be giving off some sell signals with its 4.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Fidelity National Information Services

How Fidelity National Information Services Has Been Performing

Recent times haven't been great for Fidelity National Information Services as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fidelity National Information Services.Is There Enough Revenue Growth Forecasted For Fidelity National Information Services?

Fidelity National Information Services' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 22% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 3.7% per year over the next three years. With the industry predicted to deliver 6.4% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Fidelity National Information Services' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Fidelity National Information Services' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Fidelity National Information Services, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Fidelity National Information Services (1 makes us a bit uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of Fidelity National Information Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives