- United States

- /

- Diversified Financial

- /

- NYSE:FIS

The Bull Case For FIS Could Change Following Launch of Neural Treasury AI Suite and Industry Awards

Reviewed by Simply Wall St

- On September 4, 2025, FIS launched Neural Treasury, an AI-driven suite designed to transform treasury operations using machine learning, robotics, and the first large language model tailored for treasury functions.

- This development expands AI-driven treasury and liquidity management tools to a much broader range of companies, reinforcing FIS’s role as an industry leader amid rapid tech innovation and earning multiple top industry awards in 2025.

- We'll explore how the launch of Neural Treasury and industry recognition may influence FIS’s outlook and analyst expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Fidelity National Information Services Investment Narrative Recap

For shareholders of Fidelity National Information Services (FIS), confidence often hinges on the belief that the company can sustain its position as a leading fintech infrastructure provider while successfully modernizing its offerings through innovation, especially around AI and automation. The recent launch of Neural Treasury underscores FIS’s ongoing pursuit of technology-driven growth, aiming to capitalize on demand for advanced treasury and liquidity management solutions. However, it is too early to determine if this will meaningfully accelerate short-term revenue or earnings, given ongoing margin pressures and strong competition from fintech disruptors.

Among recent developments, the August introduction of FIS’s Optimized Reconciliation Service stands out. This tool, designed to automate reconciliation for financial institutions, complements Neural Treasury by focusing on efficiency and risk reduction within financial operations. Both product launches illustrate FIS’s push to deliver AI-powered solutions that address key client needs, an important catalyst as financial institutions look to modernize and as FIS seeks to boost adoption of its higher-value platforms.

In contrast, persistent competitive pressure from digital-native fintechs remains an information risk investors should be aware of, especially as...

Read the full narrative on Fidelity National Information Services (it's free!)

Fidelity National Information Services is projected to reach $11.7 billion in revenue and $2.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.3% and a substantial earnings increase of $2.24 billion from the current earnings of $158.0 million.

Uncover how Fidelity National Information Services' forecasts yield a $85.61 fair value, a 25% upside to its current price.

Exploring Other Perspectives

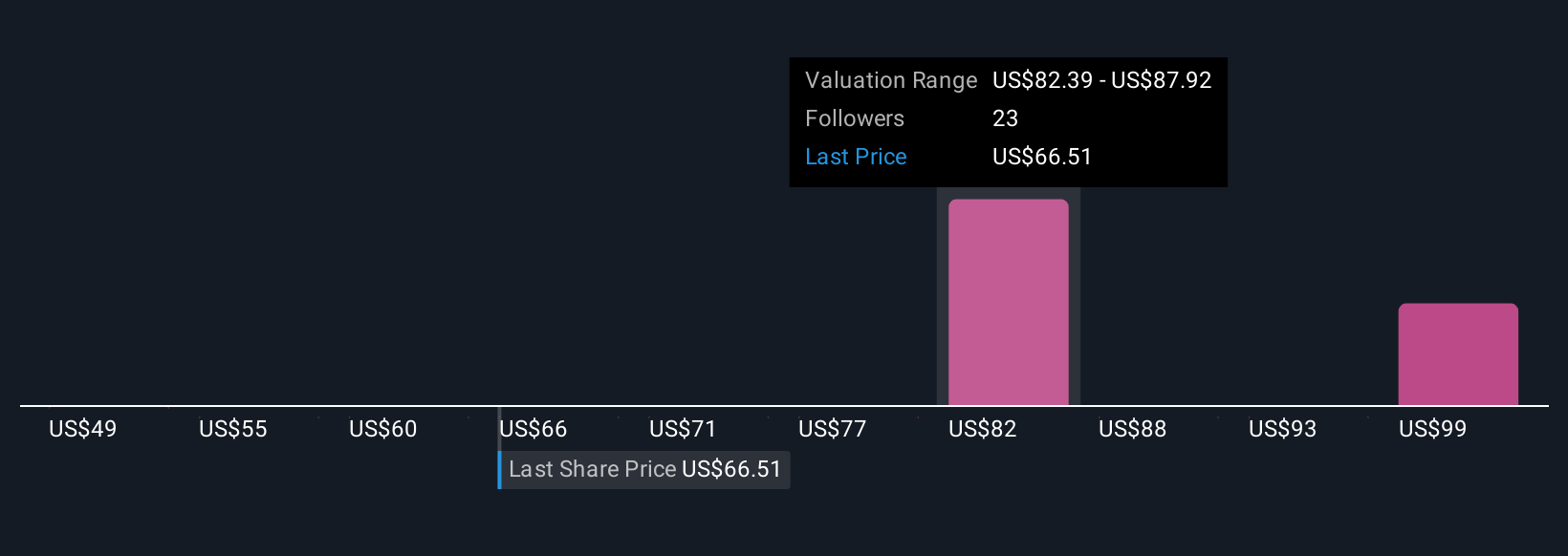

Simply Wall St Community members offered three fair value estimates for FIS, ranging widely from US$49.20 to US$104.63. While some anticipate substantial upside as AI solutions drive client demand, others highlight the ongoing risk from digital payment challengers and new technologies, reminding you that valuation opinions can differ sharply and are worth exploring alongside broader industry concerns.

Explore 3 other fair value estimates on Fidelity National Information Services - why the stock might be worth as much as 52% more than the current price!

Build Your Own Fidelity National Information Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelity National Information Services research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Fidelity National Information Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelity National Information Services' overall financial health at a glance.

No Opportunity In Fidelity National Information Services?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIS

Fidelity National Information Services

Fidelity National Information Services, Inc.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion