- United States

- /

- Consumer Finance

- /

- NYSE:FINV

FinVolution Group (FINV) Is Down 5.6% After Concentrated Ownership and Shareholder Visibility News – What's Changed

Reviewed by Simply Wall St

- Earlier this week, FinVolution Group's largest shareholder and leading executive, Shaofeng Gu, experienced a decrease in the value of his holdings due to a dip in the company's share price.

- The top four shareholders now control over half of the company, signaling concentrated ownership that could impact governance and future strategic decisions.

- We'll explore how this increased visibility of executive and major shareholder influence shapes the company’s investment narrative amid ongoing international expansion efforts.

FinVolution Group Investment Narrative Recap

To be a shareholder in FinVolution Group, one must see long-term value in the company’s international growth strategy, robust earnings, and focus on operational efficiency. The recent decline in Shaofeng Gu’s holdings and concentrated ownership is notable, but it does not materially impact the primary short-term catalyst, continued international revenue growth. The main risk remains that rapid expansion into new markets could pressure margins and delay profitability in those regions.

Among recent announcements, the company’s guidance for 2025 revenue of CNY 14.4 billion to CNY 15.0 billion stands out. This focus on ambitious, growth-oriented targets remains a key short-term catalyst, especially as FinVolution continues investing in international market expansion while managing shareholder interests and capital returns.

Yet with ownership so heavily concentrated at the top, investors should consider the long-term risks this could create if strategic alignment...

Read the full narrative on FinVolution Group (it's free!)

FinVolution Group's outlook anticipates revenues of CN¥18.5 billion and earnings of CN¥4.0 billion by 2028. This projection is based on an annual revenue growth rate of 11.3% and represents a CN¥1.4 billion increase in earnings from the current CN¥2.6 billion.

Exploring Other Perspectives

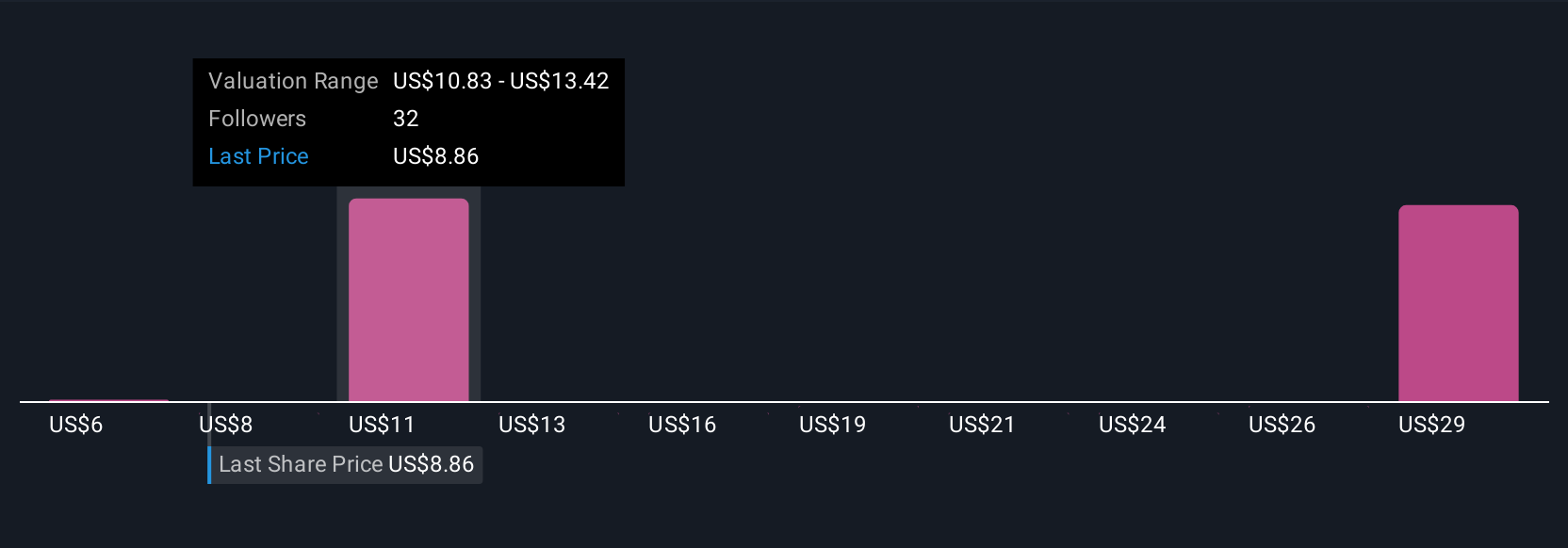

Simply Wall St Community members provided seven fair value estimates for FinVolution Group, ranging from US$5.66 to US$31.60 per share. While this signals a broad spread of investor expectations, significant investments in international growth could influence results in ways that differ from these forecasts, consider how this variety of viewpoints may impact your own assessment.

Build Your Own FinVolution Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FinVolution Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FinVolution Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FinVolution Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FINV

FinVolution Group

An investment holding company, operates in the online consumer finance industry in the People’s Republic of China, Indonesia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives