- United States

- /

- Diversified Financial

- /

- NYSE:FI

How Recent Market Volatility Impacts Fiserv’s Valuation in 2025

Reviewed by Bailey Pemberton

If you are on the fence about Fiserv, you are not the only one. The payment technology giant’s stock has been on a bit of a rollercoaster lately, dropping 4.1% in just the last week and sliding 7.4% over the past month. Year to date, Fiserv is down a substantial 39.3%. Even with that tough stretch, the picture changes when you broaden out: over three years the stock boasts a 27.0% gain, and over five, it’s still up 17.2%. That kind of performance whiplash can leave plenty of investors wondering if now is the time to buy, hold, or look elsewhere.

Recent shifts in market sentiment, especially in tech and fintech stocks, have contributed to some of the volatility. Broader market debates about the future of digital payments make Fiserv particularly sensitive to changes in investor risk appetite. With these swings, though, there may be opportunities for patient investors focused on the fundamentals, especially if the underlying business remains sound.

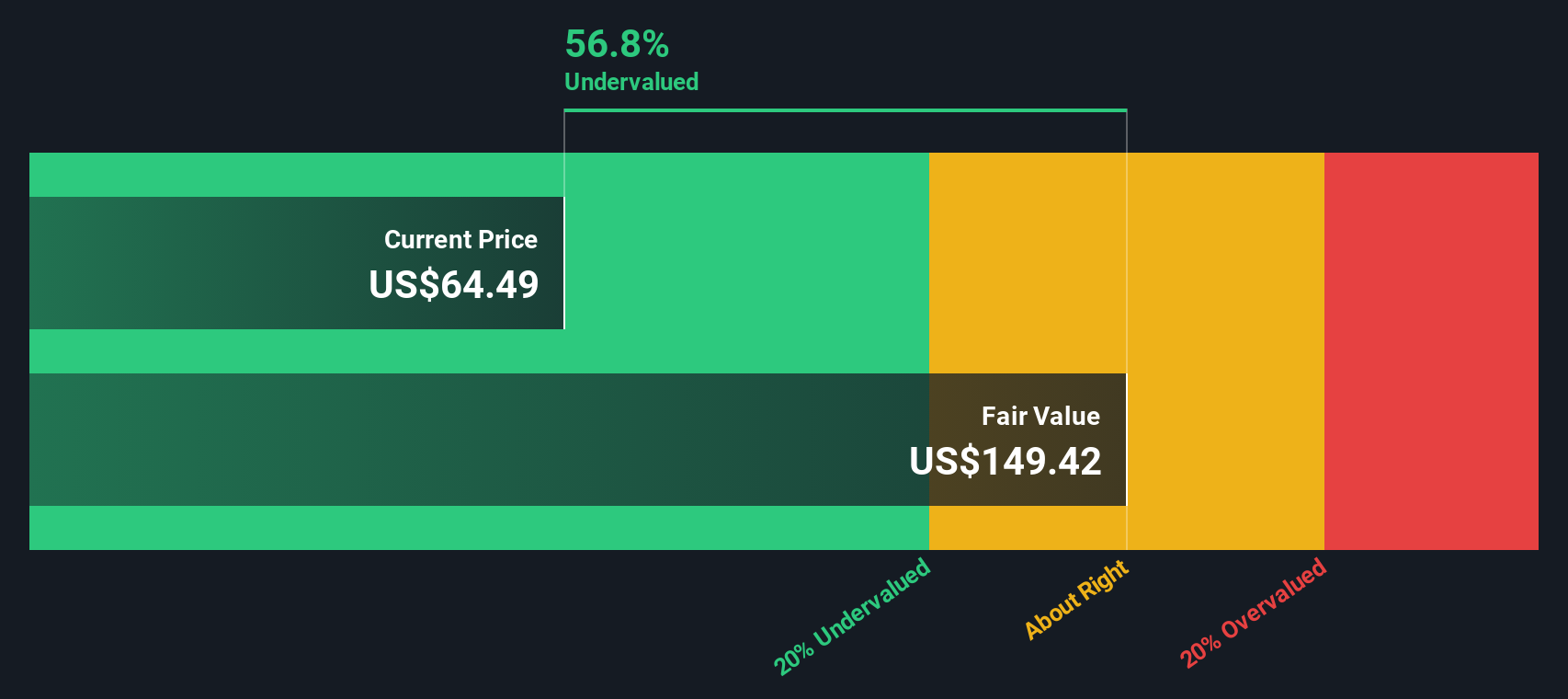

Valuation is one of the best places to start for that deeper dive. Right now, Fiserv scores a 4 out of 6 on our value checklist, meaning it is currently undervalued in four key areas. For anyone trying to weigh up whether the dip is justified or overdone, that value score could make all the difference.

But how exactly did Fiserv earn that score, and what does it mean for your decision? Let’s break down the valuation checks first, then we will look at an even better way to put value into context, just for this company.

Why Fiserv is lagging behind its peers

Approach 1: Fiserv Excess Returns Analysis

The Excess Returns model evaluates how effectively a company puts its capital to work by examining what return is generated above the typical cost of equity. For Fiserv, this approach offers insight into the company's ability to create shareholder value beyond what investors would expect for merely bearing risk.

The data shows impressive figures. Fiserv has a Book Value of $46.35 per share and a Stable EPS of $12.75 per share, based on weighted future Return on Equity estimates from six analysts. The Cost of Equity stands at $4.32 per share, resulting in an Excess Return of $8.44 per share. Average Return on Equity for the company is a strong 24.52%. Looking ahead, the Stable Book Value is estimated at $52.02 per share based on projections from four analysts.

This model estimates the intrinsic value of Fiserv stock at $213.55 per share. Compared to its current market price, this implies that Fiserv is trading at a steep 41.4% discount. The numbers suggest that investors may have overlooked the business's ability to generate superior returns on capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests Fiserv is undervalued by 41.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

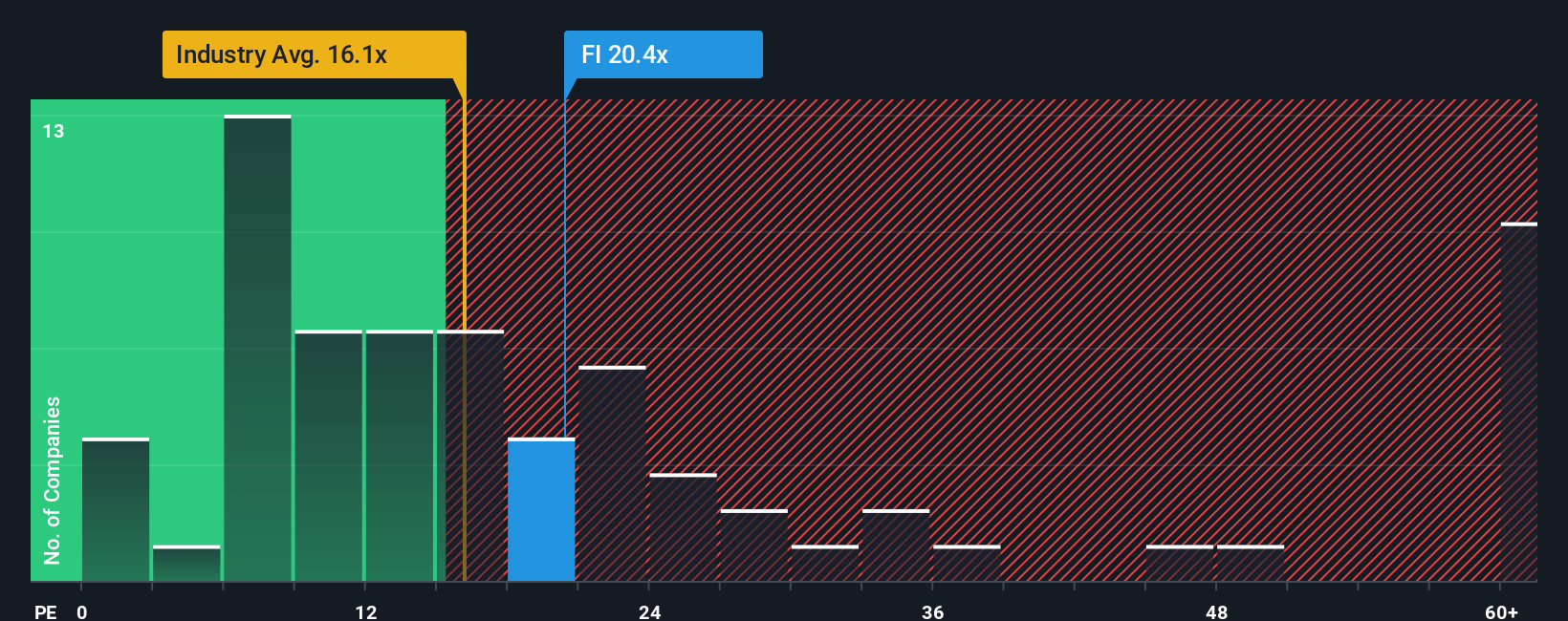

Approach 2: Fiserv Price vs Earnings

When valuing a profitable company like Fiserv, the Price-to-Earnings (PE) ratio is a widely used and insightful metric. The PE ratio relates a company’s share price to its earnings per share, capturing how much investors are willing to pay for each dollar of profit. For established businesses in the financial technology space, the PE ratio is especially suitable because it reflects both earnings quality and market expectations about future growth.

The standard for what counts as a “normal” or “fair” PE ratio depends a lot on how fast a company is expected to grow and the risks involved in its business model. Higher growth potential or lower risk typically justifies higher PE multiples, while slow growth or elevated risks can pull that number down. Comparing Fiserv’s current valuation, its PE ratio stands at 20.12x. For context, this is higher than the industry average of 16.09x and the peer group average of 16.11x. At first glance, this might make Fiserv appear a bit pricey compared to its diversification-focused financial peers.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This measure weighs not only Fiserv’s growth prospects and risks, but also its profit margins, market cap and the specifics of its industry environment. In Fiserv’s case, the Fair Ratio is estimated at 21.11x, just slightly above the current PE multiple. This nuanced comparison goes well beyond the simplicity of peer or industry averages. It captures the unique drivers and potential of Fiserv’s business model.

With the current PE ratio so close to the Fair Ratio, the data suggests Fiserv is valued about right in the market at the moment. Investors can take some comfort that there is no clear indication of significant undervaluation or overvaluation based on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

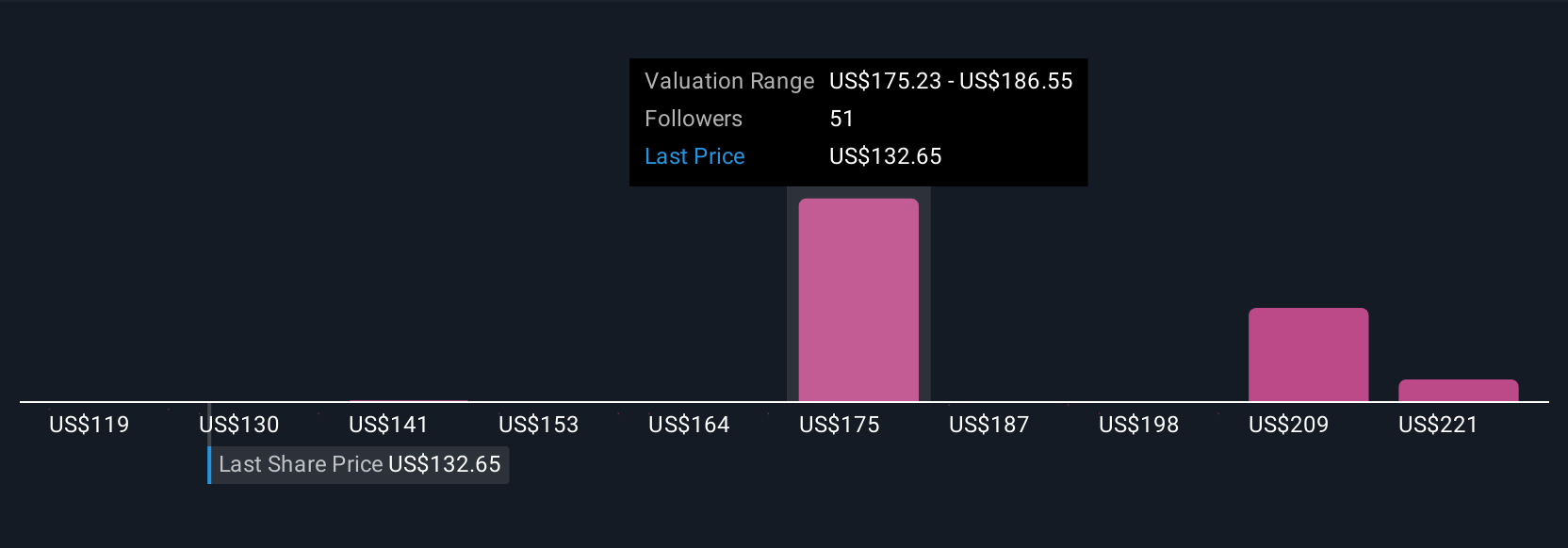

Upgrade Your Decision Making: Choose your Fiserv Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is more than just a number; it is the story you believe about Fiserv’s future, clearly linking your perspective on the company’s opportunities and challenges to a set of financial forecasts and an estimated fair value.

Narratives are a simple and intuitive tool, available for free on the Simply Wall St Community page, allowing millions of investors to quickly translate their research, forecasts, and opinions into a clear investment thesis. By comparing a Narrative’s fair value to Fiserv’s current share price, investors can easily see if their story signals a buy or a sell, and revisit their view as conditions change.

Because Narratives update automatically when new news or earnings come out, you build a living case for your investment that is always rooted in the latest data. For example, one investor may believe in Fiserv’s global payments expansion and set a high fair value of $250, while another might worry about slowing product rollouts or margin pressure and set theirs as low as $125. Narratives capture all these perspectives, helping you make decisions that fit the story you see unfolding.

Do you think there's more to the story for Fiserv? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FI

Fiserv

Provides payments and financial services technology solutions in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives