- United States

- /

- Capital Markets

- /

- NYSE:FHI

Will Federated Hermes' (FHI) Enhanced Income ETF Shift Its Income Strategy Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Federated Hermes, Inc. launched the Enhanced Income ETF (CBOE: PAYR), an actively managed fund that combines high-dividend equity holdings with an options overlay strategy to generate monthly cash flow and manage risk.

- This product addition targets income-focused investors, particularly those nearing retirement, and leverages the expertise of two of Federated Hermes’ most experienced investment teams to deliver diversified income solutions.

- We'll explore how the addition of an income-oriented ETF leveraging call spread strategies affects Federated Hermes’ overall investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Federated Hermes Investment Narrative Recap

To be a shareholder in Federated Hermes, you need to believe in the company's ability to expand in income-oriented investment solutions while navigating industry fee pressures and shifting investor demand. The launch of the Enhanced Income ETF adds to its product diversity and supports income-focused growth themes, but it does not fundamentally change the near-term catalyst: continued strong performance and scale in money market and income products. The biggest risk remains ongoing fee compression and the challenge of retaining active management margins.

Among recent company developments, the introduction of the MDT Market Neutral ETF stands out. This fund, also targeting risk-managed, outcome-oriented investors, complements the Enhanced Income ETF by diversifying Federated Hermes’ actively managed ETF lineup, supporting growth in segments aligned with changing investor needs.

But even as Federated Hermes grows its income and risk-managed ETF offerings, investors should be aware of mounting fee compression pressures ...

Read the full narrative on Federated Hermes (it's free!)

Federated Hermes is projected to achieve $1.9 billion in revenue and $379.7 million in earnings by 2028. This outlook implies a 3.3% annual revenue growth and a $29.8 million earnings increase from current earnings of $349.9 million.

Uncover how Federated Hermes' forecasts yield a $51.86 fair value, in line with its current price.

Exploring Other Perspectives

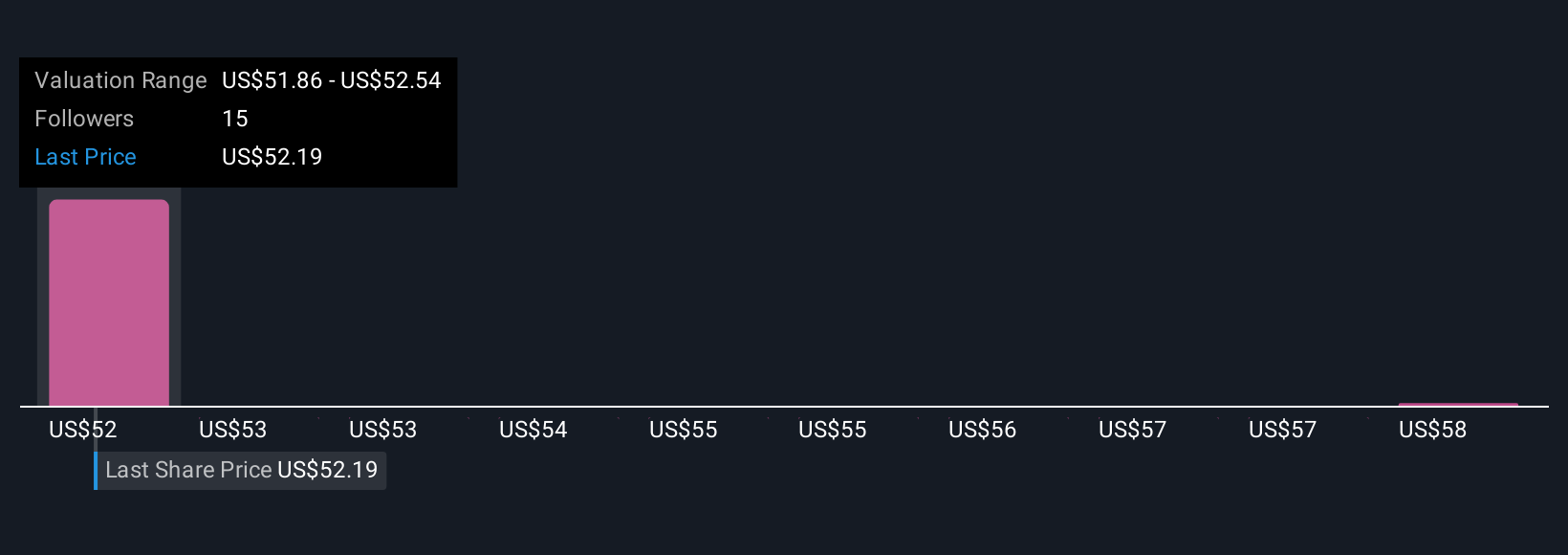

Four fair value estimates from the Simply Wall St Community range from US$51.86 to US$58.69 per share, reflecting varied outlooks across private investors. While opinions differ, ongoing industry fee compression could weigh on future margins and returns, prompting readers to compare these perspectives before making decisions.

Explore 4 other fair value estimates on Federated Hermes - why the stock might be worth just $51.86!

Build Your Own Federated Hermes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federated Hermes research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Federated Hermes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federated Hermes' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHI

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives