- United States

- /

- Capital Markets

- /

- NYSE:FDS

The Bull Case For FactSet (FDS) Could Change Following AI Liquidity Integration With Jefferies and IntelligentCross

Reviewed by Sasha Jovanovic

- FactSet announced the general availability of IntelligentCross' JumpStart functionality within its Portware execution management system, providing users direct access to Jefferies' low-touch algorithmic liquidity through a collaboration with IntelligentCross and Jefferies.

- This integration makes FactSet the first among its peers to offer direct buy-side access to IntelligentCross' AI-driven liquidity, highlighting the company's focus on confidential order execution and innovative trading solutions.

- We’ll now examine how this unique AI-powered liquidity integration could influence FactSet’s broader investment narrative and growth outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

FactSet Research Systems Investment Narrative Recap

Owning shares of FactSet typically requires confidence in its ability to innovate across financial data and trading workflows, capture buy-side demand, and translate new integrations into product adoption. The recent addition of IntelligentCross' AI-powered JumpStart to Portware could support FactSet’s position as a first-mover in advanced order execution, but it is unlikely to materially shift the most immediate catalyst, successfully scaling recent acquisitions to deliver cross-sell revenue. The most pressing risk remains the sluggish banking and asset management environment, which continues to pressure net margin growth and client budgets.

Among the latest updates, FactSet’s integration of MarketAxess’ AI-powered CP+ bond data into its Workstation platform closely parallels the IntelligentCross announcement. Both highlight how new, real-time AI data solutions can help FactSet unlock greater buy-side engagement and incremental ASV growth, supporting its broader focus on differentiated technology and client workflow expansion.

However, investors should be mindful that despite these product innovations, the persistent uncertainty in the banking sector could still...

Read the full narrative on FactSet Research Systems (it's free!)

FactSet Research Systems' narrative projects $2.7 billion revenue and $730.7 million earnings by 2028. This requires 5.7% yearly revenue growth and a $197.8 million earnings increase from $532.9 million.

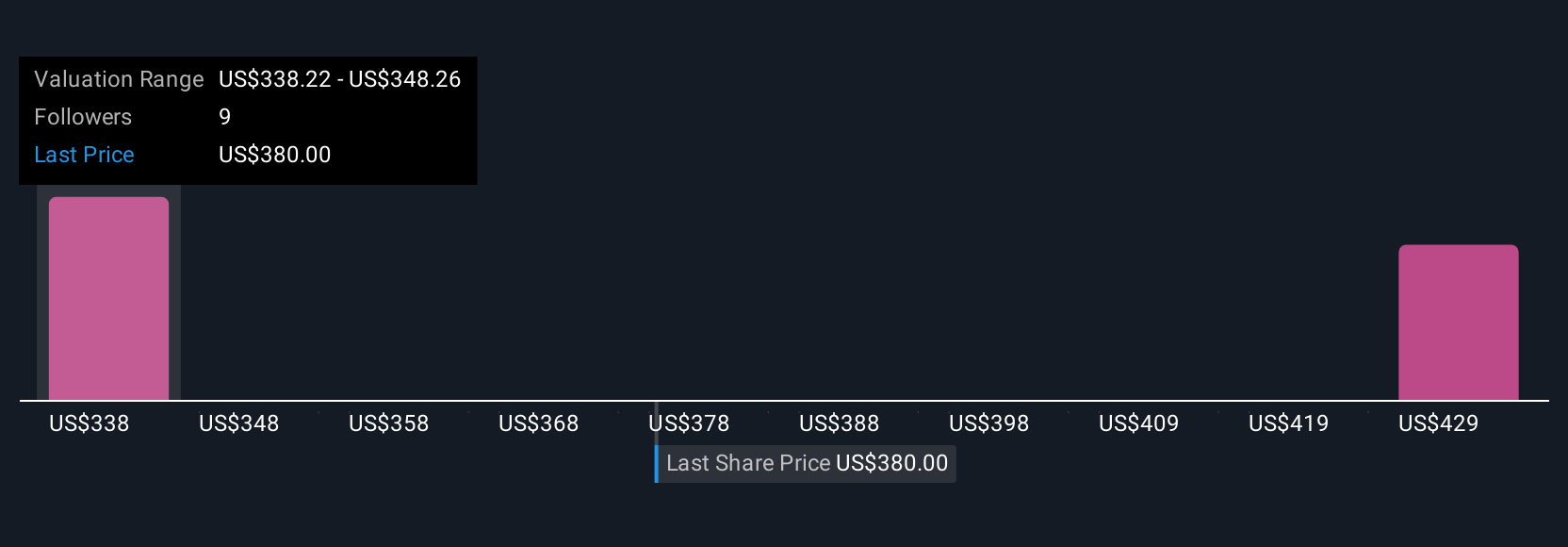

Uncover how FactSet Research Systems' forecasts yield a $339.25 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community members range from US$276.99 to US$339.25 per share. While many are focused on new product adoption, ongoing challenges in key client sectors could weigh on FactSet’s near-term results, explore how your outlook aligns with these varied perspectives.

Explore 3 other fair value estimates on FactSet Research Systems - why the stock might be worth just $276.99!

Build Your Own FactSet Research Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FactSet Research Systems research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free FactSet Research Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FactSet Research Systems' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDS

FactSet Research Systems

Operates as a financial digital platform and enterprise solutions provider for the investment community worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives