- United States

- /

- Capital Markets

- /

- NYSE:EVR

Evercore (EVR) Valuation Check as It Expands into the Nordics with New Regional Leadership

Reviewed by Simply Wall St

Evercore (EVR) is leaning further into its global ambitions by appointing veteran dealmaker Lars Ingemarsson to lead a new Nordic franchise from Stockholm, its first office in the region and a fresh strategic beachhead.

See our latest analysis for Evercore.

The move into the Nordics lands at a time when Evercore’s share price has climbed to $327.39, with an 18.56 percent year to date share price return and a 216.78 percent three year total shareholder return. This suggests investors see this expansion as part of an ongoing growth story rather than a late cycle stretch.

If this kind of strategic expansion has you thinking more broadly about opportunities in financials and beyond, it could be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for potential outperformers.

But with the shares already near analyst targets after years of outsized returns and double digit growth, are investors still getting Evercore at a reasonable price, or is the market already banking on the next leg of expansion?

Most Popular Narrative Narrative: 5.9% Undervalued

With Evercore last closing at $327.39 against a narrative fair value of $347.88, the current setup frames this Nordic push as part of a broader rerating story.

The ongoing globalization of capital markets and an accelerating trend in cross-border M&A activity are providing an increasingly fertile environment for independent, conflict-free advisors like Evercore. The firm's continued expansion into key international markets, as evidenced by new offices and hiring in EMEA (France, Spain, Italy, Dubai, UK), positions it to capture an increasing share of growing advisory fee pools and drive top-line revenue over the long term.

Want to see the playbook behind that upside case? The narrative leans on punchy revenue growth, fatter margins, and a future earnings multiple that assumes real firepower. Curious how those moving parts combine into that fair value?

Result: Fair Value of $347.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched compensation costs and still cyclical M&A volumes mean that any slowdown in deal activity could quickly squeeze margins and derail that upside.

Find out about the key risks to this Evercore narrative.

Another Way to Look at Value

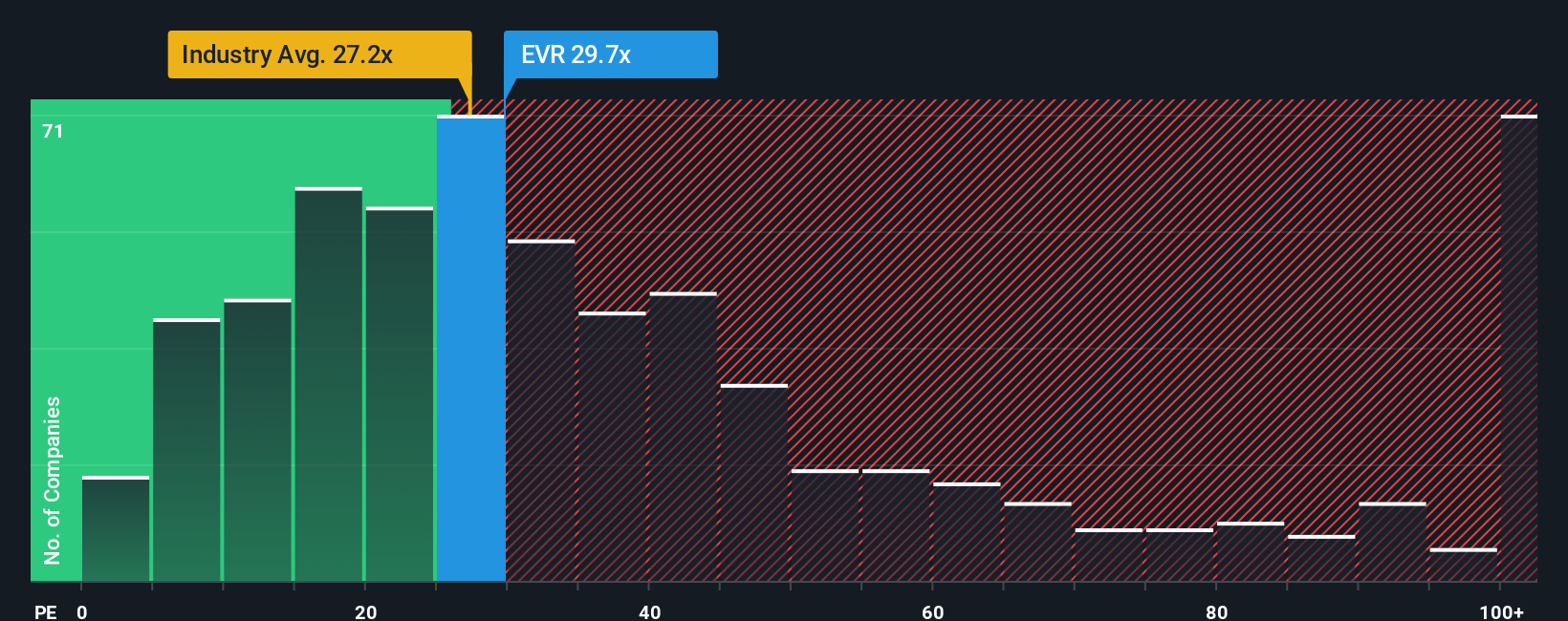

On a simple earnings lens, Evercore looks less forgiving. The stock trades around 24 times earnings, richer than the peer average of 19.6 times and the industry at 23.8 times, and well above a fair ratio of 17.4 times. That premium narrows the margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evercore Narrative

If you want to stress test these assumptions, or simply follow your own process, you can build a full narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Evercore.

Ready for your next investing edge?

Do not stop at a single opportunity, use the Simply Wall St Screener now to uncover fresh ideas that could easily outperform what is already on your radar.

- Seize potential mispricings by targeting quality companies trading below intrinsic value through these 920 undervalued stocks based on cash flows, before the rest of the market catches up.

- Capitalize on secular growth by focusing on innovation leaders in these 25 AI penny stocks that could reshape entire industries and long term return profiles.

- Lock in income streams by zeroing in on these 14 dividend stocks with yields > 3% that can strengthen your portfolio with consistent cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026