- United States

- /

- Capital Markets

- /

- NYSE:EVR

A Fresh Look at Evercore’s Valuation After Standout Earnings and International Expansion

Reviewed by Simply Wall St

See our latest analysis for Evercore.

Despite an initial share price pop on Fed rate cut hopes earlier this month, Evercore’s stock has slipped following its earnings, even as the company posted outstanding quarterly results and accelerated its international expansion. That said, with a solid 13.8% share price return this year and a staggering 192.6% total shareholder return over the past three years, Evercore’s long-term momentum remains very much intact. This hints at ongoing growth potential as the market digests recent developments.

If you’re watching how leadership changes and strategic expansion can drive stock performance, take the next step and discover fast growing stocks with high insider ownership.

With Evercore’s recent earnings beat and high-profile executive additions, the question now is whether the stock still offers value for new investors or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: 9.6% Undervalued

Evercore's most widely followed valuation narrative puts its fair value at $347.88, which is notably above the recent closing price. This suggests the market has yet to fully recognize the potential upside implied by forward-looking earnings and growth assumptions.

The planned acquisition of Robey Warshaw, with deep, long-standing relationships among large multinational clients in Europe and especially the FTSE 100, will significantly expand Evercore's global footprint and sector expertise. The combination is expected to unlock meaningful revenue synergies as Evercore leverages its broader product set and Robey Warshaw's high-level C-suite relationships, supporting advisory revenue growth and improved earnings.

Curious what bold growth, margin, and valuation multiples underpin this optimistic target? The narrative’s blueprint is built on accelerating revenue, robust profit expansion, and future assumptions you won’t see in the headlines. Want to know how analysts expect dealmaking and international moves to boost next-generation profits? The complete story reveals the crucial numbers driving this fair value calculation.

Result: Fair Value of $347.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition and persistent high compensation costs could create challenges for Evercore’s ability to sustain profit margin growth in the years ahead.

Find out about the key risks to this Evercore narrative.

Another View: Market Ratios Raise New Questions

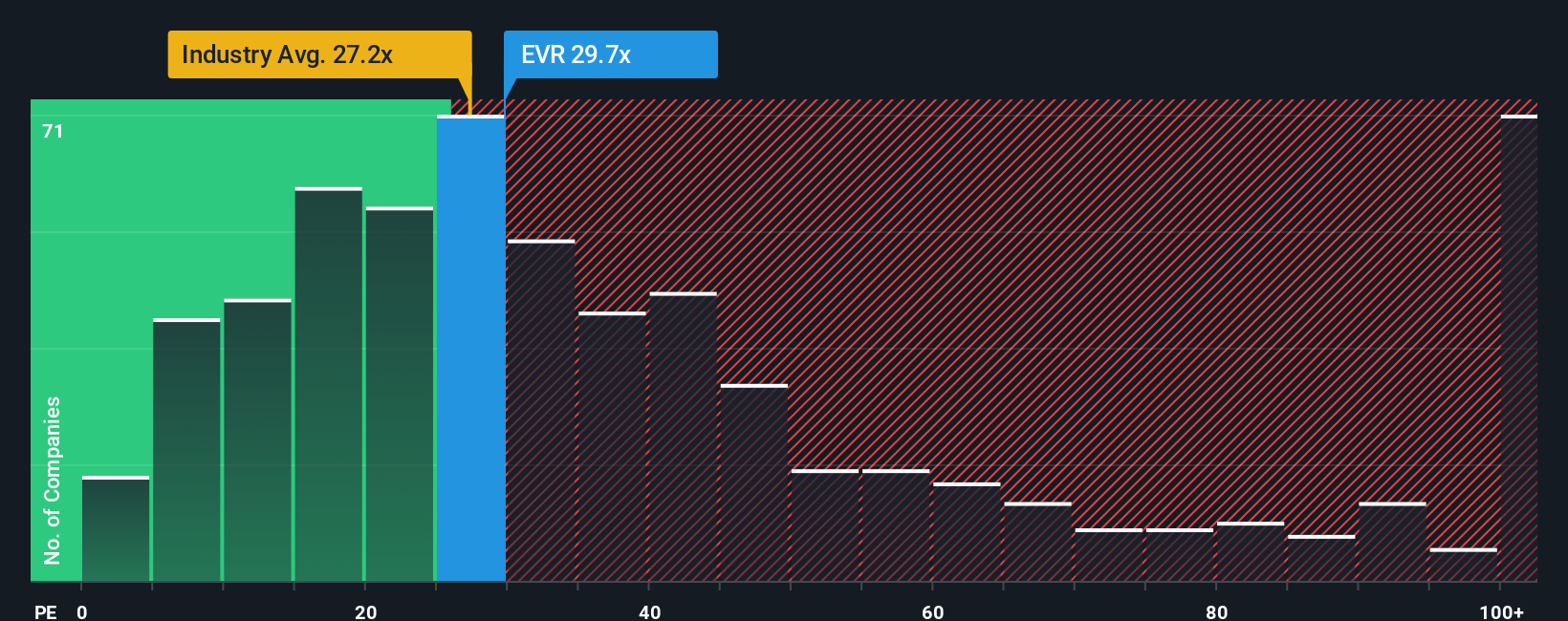

While the most popular narrative suggests Evercore is undervalued, our review of its price-to-earnings ratio tells a more cautious tale. Evercore trades at 23 times earnings, higher than its peer average of 19.1 and the fair ratio of 16.6. This gap suggests investors may be paying up for expected growth, which could expose them to downside if future performance disappoints. Is this premium justified, or could sentiment shift quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evercore Narrative

If you see the numbers differently or want to dig deeper on your own, you can build your personal narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Evercore.

Looking for more investment ideas?

Make your next smart move. Use the Simply Wall Street Screener to tap into powerful trends, hidden value, and emerging sectors with just a few clicks.

- Catch tomorrow’s breakthroughs early when you access these 26 AI penny stocks, capitalizing on artificial intelligence innovation across key industries.

- Lock in potential income streams by reviewing these 14 dividend stocks with yields > 3%, featuring companies with solid yields and dependable payouts.

- Stay ahead of the curve by evaluating these 932 undervalued stocks based on cash flows, positioned for long-term growth based on compelling cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evercore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EVR

Evercore

Operates as an independent investment banking firm in the Americas, Europe, Middle East, Africa, and Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026