- United States

- /

- Diversified Financial

- /

- NYSE:EQH

Equitable Holdings (EQH): Evaluating Valuation After Recent Pullback in Share Price

Reviewed by Kshitija Bhandaru

See our latest analysis for Equitable Holdings.

After a strong run last year, Equitable Holdings has recently faced a cooling period, with its share price falling 10.6% over the past month as risk sentiment shifts across the sector. Even so, the company’s 12.1% total shareholder return over the last twelve months and a remarkable 175% over five years suggest long-term momentum remains firmly intact.

If this recent dip has you curious about where else growth and strong insider conviction meet, it is a perfect chance to discover fast growing stocks with high insider ownership

With shares coming off their highs but long-term returns staying strong, the big question now is whether Equitable Holdings is trading below its true value or if the recent dip already factors in future growth prospects.

Most Popular Narrative: 25.9% Undervalued

Compared to its last close of $48.35, the most popular narrative puts Equitable Holdings' fair value closer to $65, setting expectations for substantial upside versus current market prices. This context reframes recent volatility and leads directly into the key catalyst highlighted within the narrative itself.

Product innovation (notably in RILAs, fee-based, and protection-focused annuities), along with first-mover advantages through partnerships with major asset managers such as BlackRock, AB, and JPMorgan, position Equitable to capture premium pricing, differentiate from competitors, and access new markets. This is expected to improve average margins and support long-term earnings growth.

Curious what ambitious financial leaps justify this bullish target? There is a bold earnings and margin transformation story reflected here, sustained by strategic partnerships and rapid product pivoting. What unusual assumptions unlock this premium? Click through to unpack the numbers that convinced the consensus.

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as increased competition in retirement solutions and possible outflows in asset management could pressure Equitable Holdings’ future profitability and growth.

Find out about the key risks to this Equitable Holdings narrative.

Another View: High Price, Higher Expectations?

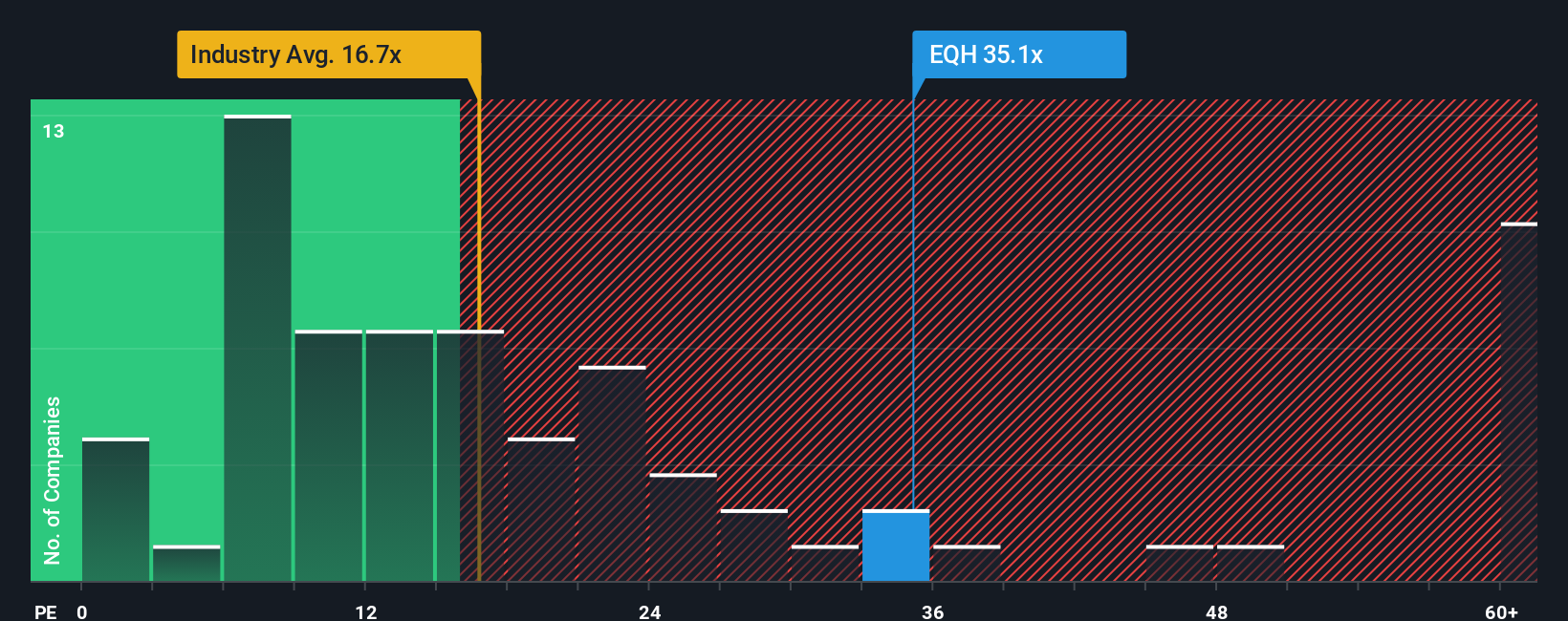

Using the price-to-earnings ratio as a reality check, Equitable Holdings looks far from a bargain. Trading at 33.8 times earnings, it stands well above both peer (15.8x) and industry (15.7x) averages. It is also higher than the fair ratio of 25.9x, which the market could drift toward. This gap points to a hefty valuation premium and raises questions about the risk investors may be shouldering at current prices.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equitable Holdings Narrative

If you are skeptical of the consensus or prefer hands-on analysis, you can independently assess the numbers and craft a narrative in just minutes, then Do it your way

A great starting point for your Equitable Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game by scanning smart opportunities beyond Equitable Holdings. Use these unique screeners to spot tomorrow’s standouts and keep your strategy ahead of the market.

- Strengthen your portfolio with reliable yield by checking out these 19 dividend stocks with yields > 3%, which delivers consistent returns above 3% and strong fundamentals.

- Join the artificial intelligence revolution and tap into the potential of these 24 AI penny stocks as they transform industries and drive growth with breakthrough innovations.

- Capitalize on undervalued gems by targeting these 891 undervalued stocks based on cash flows, presenting prime opportunities for long-term value and outperformance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equitable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQH

Equitable Holdings

Together with its consolidated subsidiaries, operates as a diversified financial services company worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives