- United States

- /

- Consumer Finance

- /

- NYSE:ENVA

Enova International (ENVA): Assessing Valuation After Recent Pullback and Strong 1-Year Gains

Reviewed by Kshitija Bhandaru

Enova International (ENVA) stock has traded lower in the past week, with shares slipping 7%. This move comes as investors weigh recent financial results and assess growth prospects following a period of strong gains over the past year.

See our latest analysis for Enova International.

While Enova’s share price pulled back this week, the story over the past year is still one of standout performance, with a 1-year total shareholder return of 35%. Momentum may be cooling in the short term as investors digest recent developments, but the longer-term move has been significant.

If you’re curious about what else is gaining traction in today’s market, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Enova’s stock climbing so impressively over the past year, the key question for investors now is whether there is still room for upside, or if the market has already priced in future growth prospects. Is this a buying opportunity, or has the market moved ahead of itself?

Most Popular Narrative: 13.6% Undervalued

With Enova shares last closing at $113.26, the most widely followed narrative suggests a fair value of $131.12 and sees the stock as having meaningful upside. The narrative’s valuation is built on aggressive projections for revenue and earnings, supported by sector-shaping trends.

The ongoing migration of small businesses and consumers toward digital lending, supported by preferences for speed and convenience, continues to drive strong demand and originations for Enova. The company is well positioned with its online-only business model, which supports sustained top-line growth as reflected in record origination and revenue increases.

Unpack the catalysts behind this bullish outlook. The valuation hinges on bold assumptions about future earnings momentum and revenue acceleration that go beyond the company’s recent growth pace. Ready to see what projections really drive Enova’s price target? Dive in to uncover the full story, including the metrics behind this high-conviction view.

Result: Fair Value of $131.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory pressures or a shift in consumer appetite for nonprime lending could quickly change Enova's growth trajectory and challenge current bullish forecasts.

Find out about the key risks to this Enova International narrative.

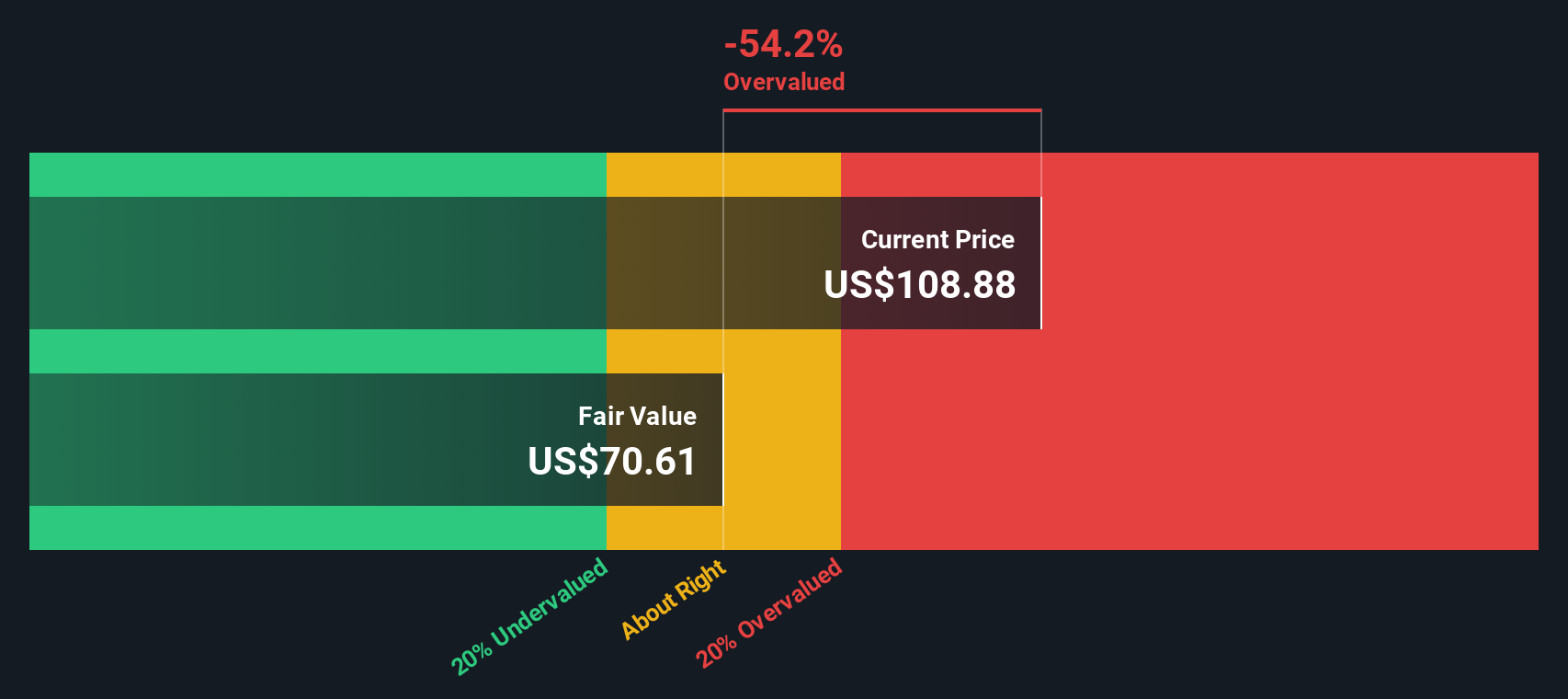

Another View: Discounted Cash Flow Checks the Hype

While the consensus narrative pegs Enova International as significantly undervalued, our DCF model tells a very different story. According to this approach, Enova’s current share price sits well above its estimated fair value. Does this mean expectations might have gotten ahead of reality? Or is the DCF missing something key about Enova’s growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enova International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enova International Narrative

If you see things differently, or want to dig into the numbers on your own terms, you can craft your own narrative in just minutes. Do it your way

A great starting point for your Enova International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip by. Supercharge your search with handpicked stock screens built for real investors looking for an edge beyond the obvious picks.

- Capture the potential of game-changing breakthroughs by seeking out innovation leaders among these 26 quantum computing stocks.

- Secure steady income opportunities with these 19 dividend stocks with yields > 3%, where strong yields and resilient business models meet your need for consistent returns.

- Tap into the explosive energy of the digital economy by evaluating high-upside contenders in these 78 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enova International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ENVA

Enova International

A technology and analytics company, provides online financial services in the United States, Brazil, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives