- United States

- /

- Mortgage REITs

- /

- NYSE:DX

Is Dynex Capital Still Worth a Look After Its 23% Surge in 2024?

Reviewed by Bailey Pemberton

Figuring out what to do with Dynex Capital stock? You are definitely not alone, and the numbers are giving investors plenty to talk about. Dynex Capital has quietly posted an impressive 23.5% gain over the last year, building on a multi-year performance that includes a near 70% jump since three years ago. After a period of steady growth, the stock has recently closed at $12.98. These gains reflect more than just company fundamentals, as investor perception towards interest rates and real estate markets has shifted, bringing renewed attention to mortgage REITs like Dynex.

In the last month alone, Dynex shares have climbed 3.6%, extending a solid 3.0% advance year-to-date. Shorter-term, the last week saw a modest 2.0% uptick, signaling ongoing optimism among traders, even if broader financial markets have shown some volatility. While these price moves suggest Dynex may have more room to run, the real question for investors is whether the stock remains undervalued or if the recent rally is already baking in growth expectations.

Looking at several key valuation methods, Dynex Capital currently scores a 1 out of 6 on the undervaluation scale. That means by traditional standards, it is only considered undervalued by one check. Of course, these scores do not tell the whole story. Next, let us break down which valuation approaches actually matter most. And even if you are familiar with the standard metrics, there is one approach at the end of this article you should not miss.

Dynex Capital scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Dynex Capital Excess Returns Analysis

The Excess Returns valuation model evaluates a company by comparing the profitability it earns on its equity against the cost of that equity, focusing on the value generated above the required return. This approach is particularly useful for financial companies like Dynex Capital, as it accounts for how effectively shareholder money is put to work.

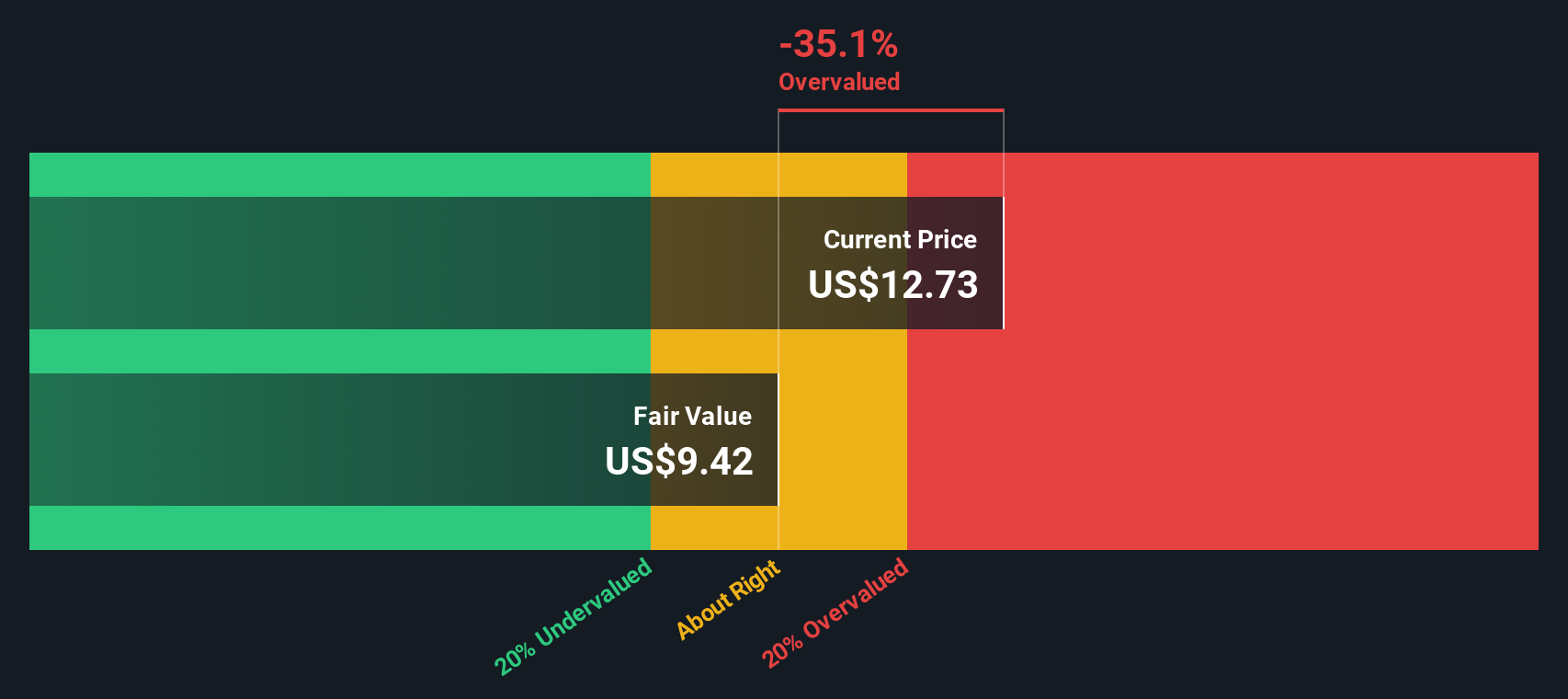

For Dynex Capital, recent figures show a Book Value of $11.98 per share and a Stable EPS of $0.96 per share, based on the median return on equity during the past five years. The average Return on Equity sits at 7.84%, while the estimated Cost of Equity is $1.12 per share. This results in a negative Excess Return of $-0.16 per share, suggesting the company is not currently generating returns in excess of what shareholders require. Looking ahead, analysts forecast a Stable Book Value of $12.26 per share, incorporating future estimates from five key analysts.

The model's calculation yields an intrinsic value of $9.64 per share. With Dynex Capital's latest closing price at $12.98, this implies the stock is approximately 34.7% overvalued at current prices.

Result: OVERVALUED

Our Excess Returns analysis suggests Dynex Capital may be overvalued by 34.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Dynex Capital Price vs Earnings

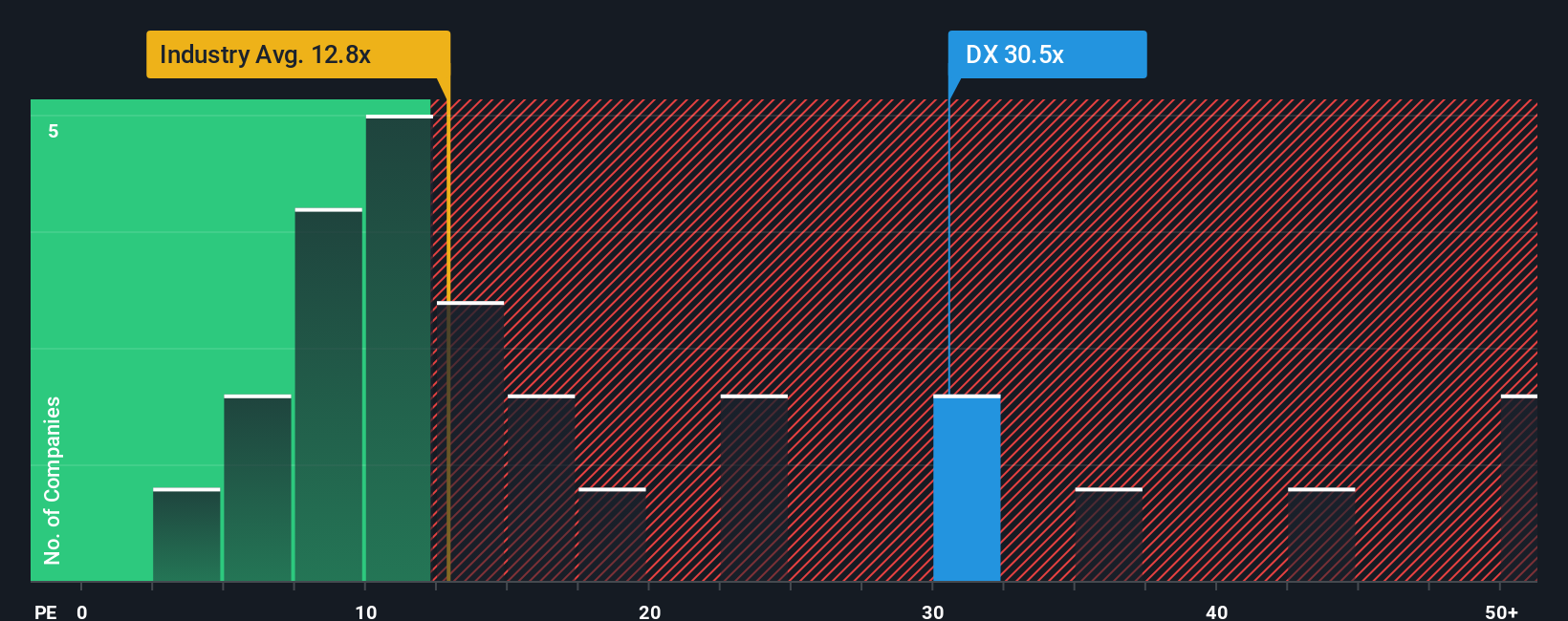

Price-to-Earnings (PE) ratio is an essential metric for valuing profitable companies like Dynex Capital because it ties a company’s stock price to its actual earnings. This provides a quick window into how much investors are paying for each dollar of profit. A PE ratio makes it easier to compare businesses of different sizes and helps quantify the market’s growth expectations and risk appetite. Higher growth and lower risk usually justify a higher PE, while lower growth or higher risk warrant a lower one.

Dynex Capital currently trades at a PE ratio of 29.6x, well above the Mortgage REITs industry average of 12.7x and the typical peer group average of 11.7x. At first glance, this makes Dynex appear expensive compared to its competitors. However, using only industry averages or comparable companies may miss nuances like the company’s growth outlook, profit margins, risk profile, and size. All of these factors can meaningfully affect a fair valuation multiple.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio takes into account not only industry context but also the company’s expected earnings growth, profitability, risks, and market capitalization. For Dynex Capital, the Fair Ratio is 52.8x, which is substantially higher than its actual PE of 29.6x. This wide gap suggests that, relative to its fundamentals and outlook, the market is undervaluing Dynex Capital’s future earnings power at today’s prices.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Dynex Capital Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful approach that lets you combine your perspective on a company, such as your own story about Dynex Capital, with concrete numbers such as your assumptions for future earnings, margins, or fair value. Narratives connect the dots between a company’s backstory, your financial forecast, and what you believe the stock should be worth.

On Simply Wall St’s Community page, millions of investors are already using Narratives to see how their view of a stock lines up with real market data. This easy-to-use tool allows you to compare your calculated Fair Value with the current Price, helping you make more confident decisions to buy, hold, or sell. Narratives are always up to date, automatically refreshing when new events such as earnings announcements or news come out.

For example, one investor might see Dynex Capital’s fair value as low as $8 per share based on projected challenges, while another projects it as high as $16, expecting stronger long-term returns. Narratives empower you to choose the perspective and the strategy that fits your investment thesis best.

Do you think there's more to the story for Dynex Capital? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DX

Dynex Capital

A mortgage real estate investment trust, invests in mortgage-backed securities (MBS) in the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives