- United States

- /

- Capital Markets

- /

- NYSE:DBRG

Will New Data Center Leadership and Strategy Shift Change DigitalBridge Group's (DBRG) Narrative?

Reviewed by Sasha Jovanovic

- Recently, DigitalBridge Group, Inc. announced that Wendy Pryce has been appointed as Managing Director to co-lead the company's new stabilized data center strategies, where she will focus on global real estate investor relations and expanding data center operations.

- This decision highlights DigitalBridge's intention to accelerate real estate-focused growth and strengthen global partnerships as demand rises for stabilized data centers, driven by digital transformation and the widespread adoption of AI and cloud technologies.

- We'll examine how DigitalBridge's leadership addition and sharpened data center strategy could shape its long-term investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DigitalBridge Group Investment Narrative Recap

To be a DigitalBridge shareholder today, you need to believe in the long-term growth of digital infrastructure, especially the demand for data centers powered by AI and cloud adoption. The recent appointment of Wendy Pryce as Managing Director underscores a focused push in stabilized data center strategies, but is unlikely to materially shift the most immediate catalyst, capitalizing on AI-driven demand, or address the biggest near-term risk: intensifying competition squeezing fee and acquisition yields.

The recent partnership with Franklin Templeton and others to expand private infrastructure solutions aligns with these catalysts, reinforcing DigitalBridge’s ambition to serve the accelerating needs for energy and data infrastructure. Combined with talent additions and technology investments, these moves may support earnings predictability, though how much immediate impact they will have remains to be seen.

By contrast, investors should also remain aware of competition from large-scale asset managers and REITs potentially pressuring margins and...

Read the full narrative on DigitalBridge Group (it's free!)

DigitalBridge Group is projected to achieve $493.7 million in revenue and $197.3 million in earnings by 2028. This outlook is based on a 41.7% annual revenue growth rate and an increase in earnings of $195.6 million from the current $1.7 million.

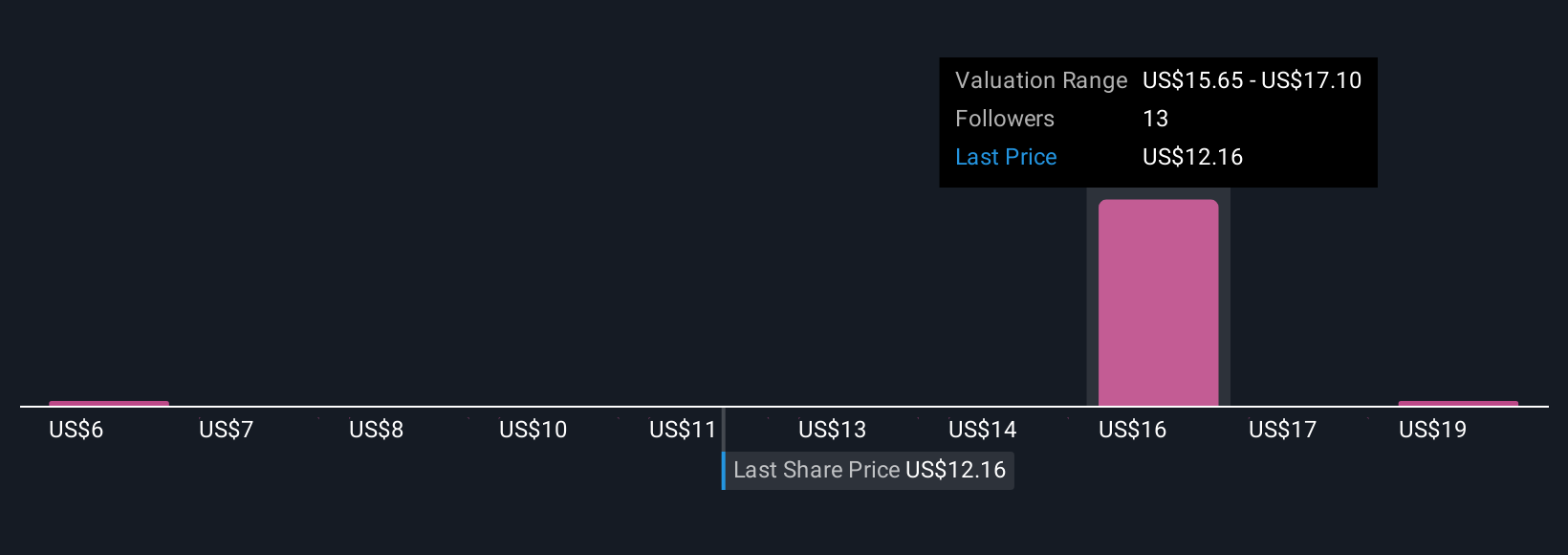

Uncover how DigitalBridge Group's forecasts yield a $16.50 fair value, a 40% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three members of the Simply Wall St Community range widely, from US$5.52 to US$20 per share. As some see opportunity in DigitalBridge’s expanding digital infrastructure bets, others caution that fee compression and margin pressure remain real concerns for future profitability.

Explore 3 other fair value estimates on DigitalBridge Group - why the stock might be worth as much as 70% more than the current price!

Build Your Own DigitalBridge Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free DigitalBridge Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DigitalBridge Group's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBRG

DigitalBridge Group

DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives