- United States

- /

- Capital Markets

- /

- NYSE:DBRG

DigitalBridge (DBRG) Valuation in Focus as AI Data Center Momentum and Strategic Hires Drive Investor Interest

Reviewed by Kshitija Bhandaru

DigitalBridge Group (DBRG) has been in the spotlight following the appointment of Wendy Pryce as Managing Director, adding depth to its leadership as the company intensifies its focus on digital infrastructure and data center strategies.

See our latest analysis for DigitalBridge Group.

Wendy Pryce’s appointment comes during a pivotal time for DigitalBridge, as the company’s push into AI data infrastructure and its stake in Switch have kept investor interest elevated. Despite these growth stories, the 1-year total shareholder return stands at -27.05%, which highlights long-term underperformance. However, recent momentum has improved with a 90-day share price return of 3.34%.

If you’re ready to see what else is shaping the market beyond the headlines, now is a great opportunity to discover fast growing stocks with high insider ownership.

With analyst targets suggesting significant upside from current levels and fresh strategic moves in AI infrastructure, the question remains: does the recent activity signal a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 32% Undervalued

With the last closing price at $11.14 and the narrative fair value set at $16.50, analysts see substantial upside potential anchored in transformative growth expectations. This valuation is based on the belief that digital infrastructure demand will accelerate dramatically in coming years, boosting both the scale and profitability of DigitalBridge Group.

Ongoing global geographic expansion (for example, the Yondr acquisition with major projects in North America, Europe, and Asia) and the launch of new digital infrastructure platforms diversify the asset base and provide access to higher-growth markets. This in turn increases top-line growth and supports higher future carried interest and principal investment income.

Want to know which jaw-dropping growth projections help justify this price target? Hint: This narrative relies on an aggressive transformation of revenue, profit margins, and future earnings power. Find out what underpins the confidence in these disruptive expansion bets.

Result: Fair Value of $16.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and rapid technology shifts could dampen DigitalBridge’s projected gains. As a result, future earnings may be less predictable than current forecasts suggest.

Find out about the key risks to this DigitalBridge Group narrative.

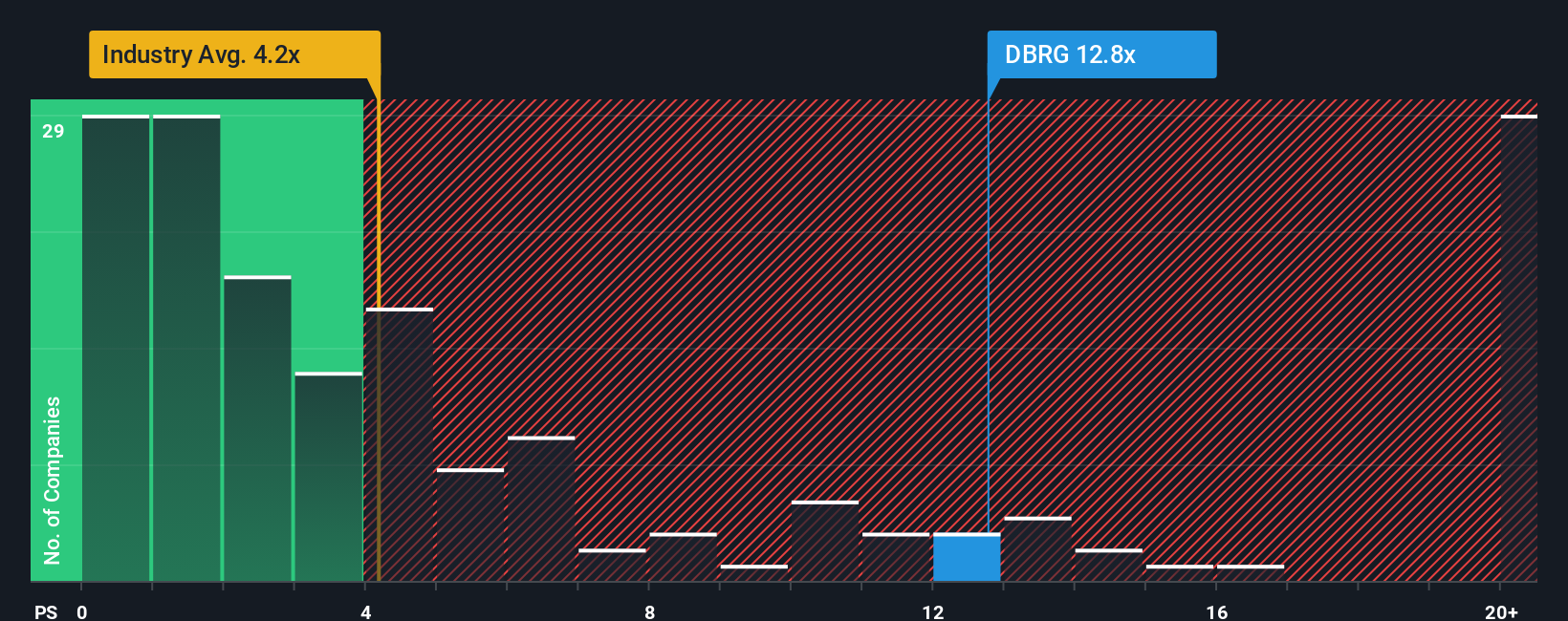

Another View: A Closer Look at Valuation Multiples

While the growth narrative looks compelling, valuation based on the company's price-to-sales ratio shows a different side. DigitalBridge trades at 11.7 times its sales, which is not only higher than the US Capital Markets industry average of 3.9x, but also exceeds its fair ratio of 4.2x. This means shares may be pricing in a lot of future success already, making the stock seem expensive compared to peers and where the market could ultimately settle. Could this signal downside risk if growth expectations are not fully met?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DigitalBridge Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DigitalBridge Group Narrative

If you want a different perspective or prefer to dive into the numbers yourself, you can build your own take in just a few minutes. Do it your way.

A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that great opportunities don’t wait. Unlock your next winning stock pick with handpicked ideas proven to reward forward-thinking portfolios.

- Seize a shot at high yields by finding these 19 dividend stocks with yields > 3% that consistently deliver attractive income above 3%.

- Capitalize on breakthroughs in AI by tracking these 24 AI penny stocks positioned to shape tomorrow’s technology landscape.

- Uncover strong upside potential by targeting these 893 undervalued stocks based on cash flows that could be trading below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBRG

DigitalBridge Group

DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives