- United States

- /

- Capital Markets

- /

- NYSE:DBRG

A Fresh Look at DigitalBridge (DBRG) Valuation as New Leadership Targets Data Center Growth

Reviewed by Kshitija Bhandaru

DigitalBridge Group (DBRG) just announced that Wendy Pryce will join as Managing Director, co-leading its push into stabilized data center strategies. This appointment comes as the company aims to capture rising demand fueled by digitalization and AI.

See our latest analysis for DigitalBridge Group.

Wendy Pryce’s arrival comes as DigitalBridge sharpens its focus on data center growth, tapping into surging demand tied to digital infrastructure and AI. While recent market jitters have weighed on some peers, DigitalBridge’s momentum shows through in its modest gains, with a positive 90-day share price return of 11% leading into a year-to-date advance. However, the one-year total shareholder return is still in negative territory, suggesting long-term performance has lagged even as the company pivots into higher-growth strategies.

If you’re tracking how companies are shifting with digitalization and strategic leadership changes, it’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets and signs of renewed strategic momentum, investors may wonder if there is genuine undervaluation here or if the current price already reflects DigitalBridge's future growth potential.

Most Popular Narrative: 28.6% Undervalued

Compared to its last close at $11.78, the most widely followed narrative points to significant upside, with a fair value estimate of $16.50. This sets up a stark contrast between current market skepticism and expectations for a dramatic earnings transformation.

*Ongoing global geographic expansion (e.g., Yondr acquisition with major projects in North America, Europe, and Asia) and launch of new digital infrastructure platforms diversify the asset base and provide access to higher-growth markets, increasing top-line growth and supporting higher future carried interest and principal investment income.*

Want the inside story behind this bullish outlook? There is a pivotal set of aggressive growth assumptions including expansion, margin jumps, and major scale that power this narrative’s fair value. Curious what bold figures underpin this big target? See what could fuel a massive re-rating for DigitalBridge.

Result: Fair Value of $16.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this outlook could be challenged if competitive pressures intensify or if high interest rates continue to constrain funding and capital deployment.

Find out about the key risks to this DigitalBridge Group narrative.

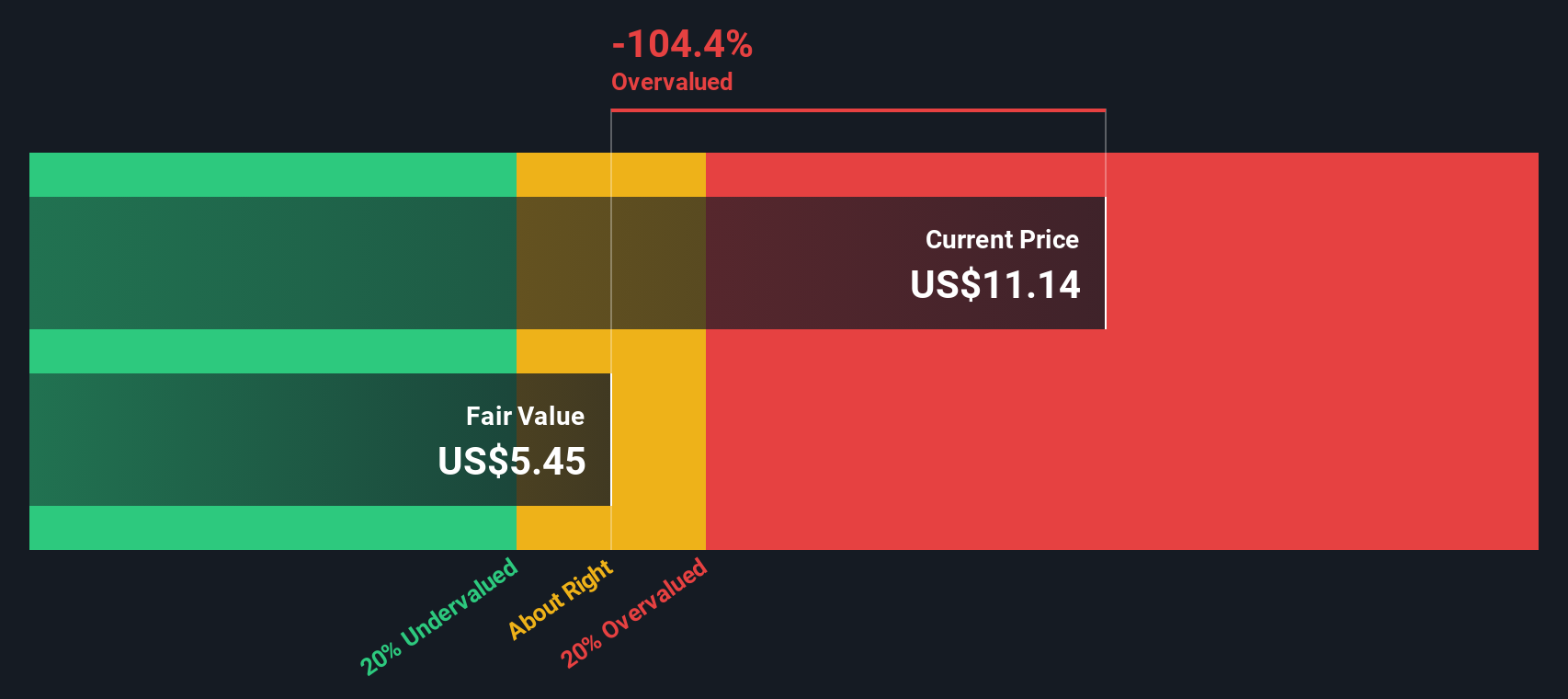

Another View: DCF Model Sends a Different Signal

While analyst price targets and growth trends imply DigitalBridge could be undervalued, our SWS DCF model tells a more cautious story. It calculates a fair value of just $5.52, which is far below today’s price. Does the market see unrealized potential, or is optimism glossing over continued risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DigitalBridge Group Narrative

If you have a different view or want to dig into the numbers firsthand, shaping your own analysis is quick and straightforward. In just a few minutes you can craft your own perspective. Do it your way

A great starting point for your DigitalBridge Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always on the lookout for tomorrow’s winners. Expand your horizons now and see what you could be missing with these top strategies:

- Unearth hidden opportunities by targeting strong financials with these 3563 penny stocks with strong financials that have solid track records and growth potential.

- Capture the pulse of innovation by finding game-changing companies driving breakthroughs with these 24 AI penny stocks in artificial intelligence.

- Boost your income game by choosing steady payers with these 19 dividend stocks with yields > 3% that offer yields greater than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DBRG

DigitalBridge Group

DigitalBridge (NYSE: DBRG) is a leading global alternative asset manager dedicated to investing in digital infrastructure.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives