- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Corpay (CPAY) Valuation: Assessing Growth Potential After USCIS Navigator Launch and Fed Rate Cut Optimism

Reviewed by Simply Wall St

Corpay (NYSE:CPAY) shares climbed after the launch of USCIS Navigator, a payment automation tool designed for immigration law firms. The move coincided with investor optimism about possible Federal Reserve rate cuts, which fueled further market interest.

See our latest analysis for Corpay.

Corpay’s latest surge, up 7% over the past week, follows its innovative USCIS Navigator launch and growing optimism around Fed policy. While the year-to-date share price return stands at -14%, longer-term shareholders have seen a 54% total return over three years. This highlights both recent volatility and Corpay’s potential for durable growth as new products gain traction.

If you’re watching how payment innovators respond to shifting markets, this could be a perfect time to discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets and recent growth initiatives underway, investors may be wondering if Corpay is undervalued at today’s levels or if the market is already factoring in its next leg of expansion.

Most Popular Narrative: 16.6% Undervalued

Corpay’s most followed narrative sees a sizable gap between its fair value and current share price, driven by management’s execution and expansion into cross-border payments. Strong revenue forecasts and strategic partnerships have set the tone for bullish analyst assumptions.

Major new enterprise wins (such as the $1B+ monthly spend customer in payables), and improving customer retention rates from a stronger enterprise mix, are reducing churn and enabling more predictable, recurring revenues, likely driving higher future revenue growth and improving long-term operating margins.

What are the hidden assumptions fueling this discount? The narrative is betting on powerful earnings momentum, margin expansion, and a bold revenue trajectory few expect. The real story lies in the future financial leap. Find out what analysts think will shift the needle for Corpay.

Result: Fair Value of $350 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent concerns around stablecoins and growing competition in digital payments could challenge Corpay's growth story if these risks accelerate unexpectedly.

Find out about the key risks to this Corpay narrative.

Another View: Is the Market Overlooking Risks?

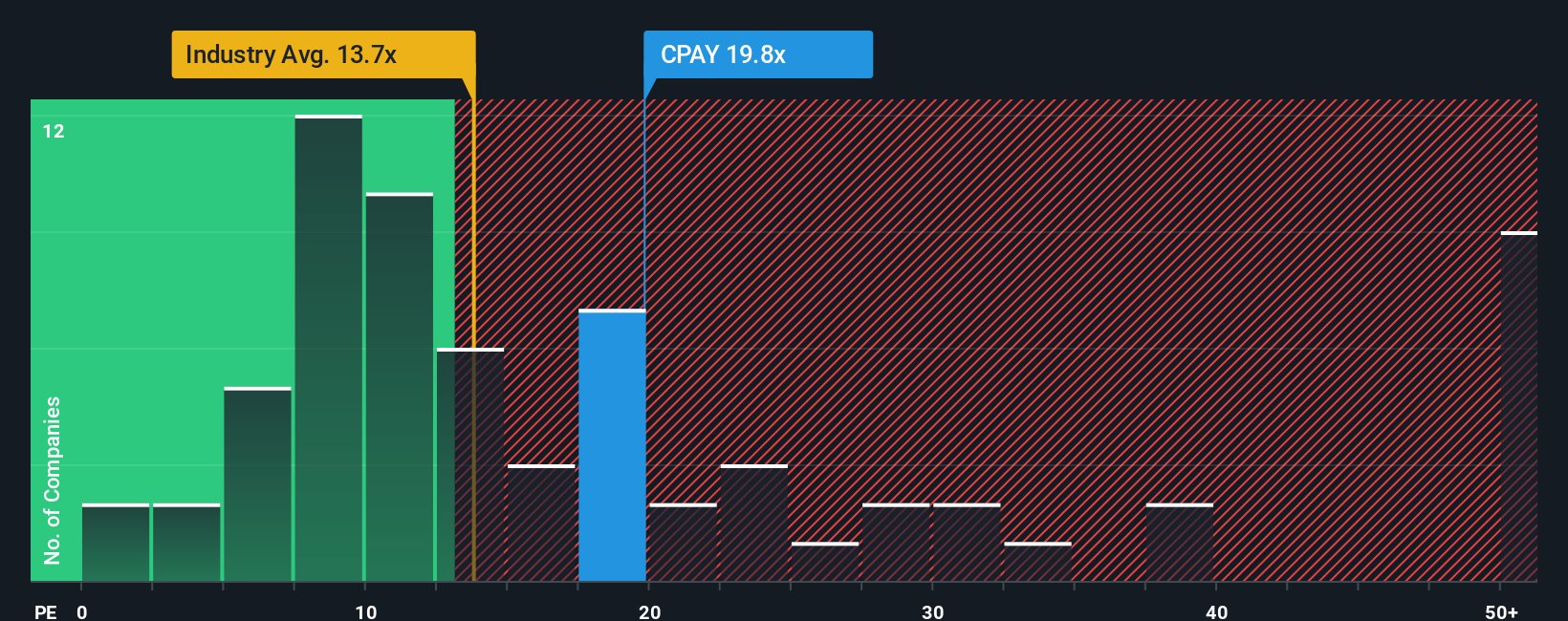

While the fair value estimate highlights an attractive discount, Corpay's earnings multiple tells a different story. Shares currently trade at 19.4 times earnings, which is well above the US industry average of 13.2 and just above the fair ratio of 18.9. This premium signals that investors may already be factoring in a lot of optimism, raising the risk if growth expectations fall short. Could this valuation leave little margin for error?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corpay Narrative

If you have a different perspective or want to dig deeper into Corpay’s numbers, take a hands-on approach and craft your own story in minutes: Do it your way

A great starting point for your Corpay research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Boost your portfolio’s potential by targeting stocks that fit your personal strategy. If you skip these handpicked lists, you could overlook tomorrow’s winners.

- Capture steady income and growth with these 14 dividend stocks with yields > 3%, which offers attractive yields above 3% for income-focused investors.

- Back the innovators shaping the future of medicine by selecting these 30 healthcare AI stocks, with leading advances in artificial intelligence applications for healthcare.

- Seize the potential in next-generation money systems through these 81 cryptocurrency and blockchain stocks, which is at the forefront of cryptocurrency and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026