- United States

- /

- Consumer Finance

- /

- NYSE:COF

Is Now the Right Time for Capital One After Its 6.5% Weekly Surge?

Reviewed by Bailey Pemberton

If you have been watching Capital One Financial lately, you are not alone. There has been plenty to catch your eye. With the stock closing at $225.01 and riding an impressive 41.2% gain over the past year, it is no wonder many investors are asking if this is still the right time to jump in, hold steady, or even consider taking some profits. Over a 5-year run, the stock is up a whopping 236.0%, so momentum certainly favors those who have been patient.

What really stands out is the recent 6.5% jump just this past week, far outpacing its muted 0.4% gain over the last month. Some of this optimism has been boosted by encouraging developments in the economic environment. For instance, new signals from the Federal Reserve about rate stability have helped lift the entire financial sector, giving a sense of renewed confidence following months of uncertainty. Updated consumer credit regulations have also made headlines, with many seeing them as a sign that lenders like Capital One could continue to manage risk effectively. Although none of these headlines have caused drastic reactions on their own, together they create an atmosphere where investors increasingly see upside or at least less risk ahead.

As for valuation, Capital One’s value score currently sits at 2 out of 6 according to our checks, signaling the stock is undervalued in only a couple of key aspects so far. Is that enough to warrant more enthusiasm, or does it leave room for concern? That is exactly what we will unpack as we look at the different ways analysts measure value and why some methods might miss the bigger picture. Stick around for a breakdown of each approach, and keep an eye out for a smarter, more holistic way to judge Capital One’s true worth by the end of this article.

Capital One Financial scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Capital One Financial Excess Returns Analysis

The Excess Returns valuation model measures how much value a company generates above the required cost of equity. It focuses on profits that exceed what shareholders demand for their investment. For Capital One Financial, this model is particularly insightful because it evaluates both the effectiveness of management in generating returns and how efficiently the company reinvests those profits.

Currently, Capital One’s estimated Book Value stands at $170.53 per share, while the Stable EPS projection is $22.15 per share. These figures are supported by future Return on Equity estimates from a group of nine analysts, pointing to an average Return on Equity of 11.98% over the coming years. The cost of equity for the company is $16.18 per share, resulting in an annual Excess Return of $5.97 per share. The Stable Book Value is projected to rise to $184.90 per share, based on weighted forecasts from eight analysts.

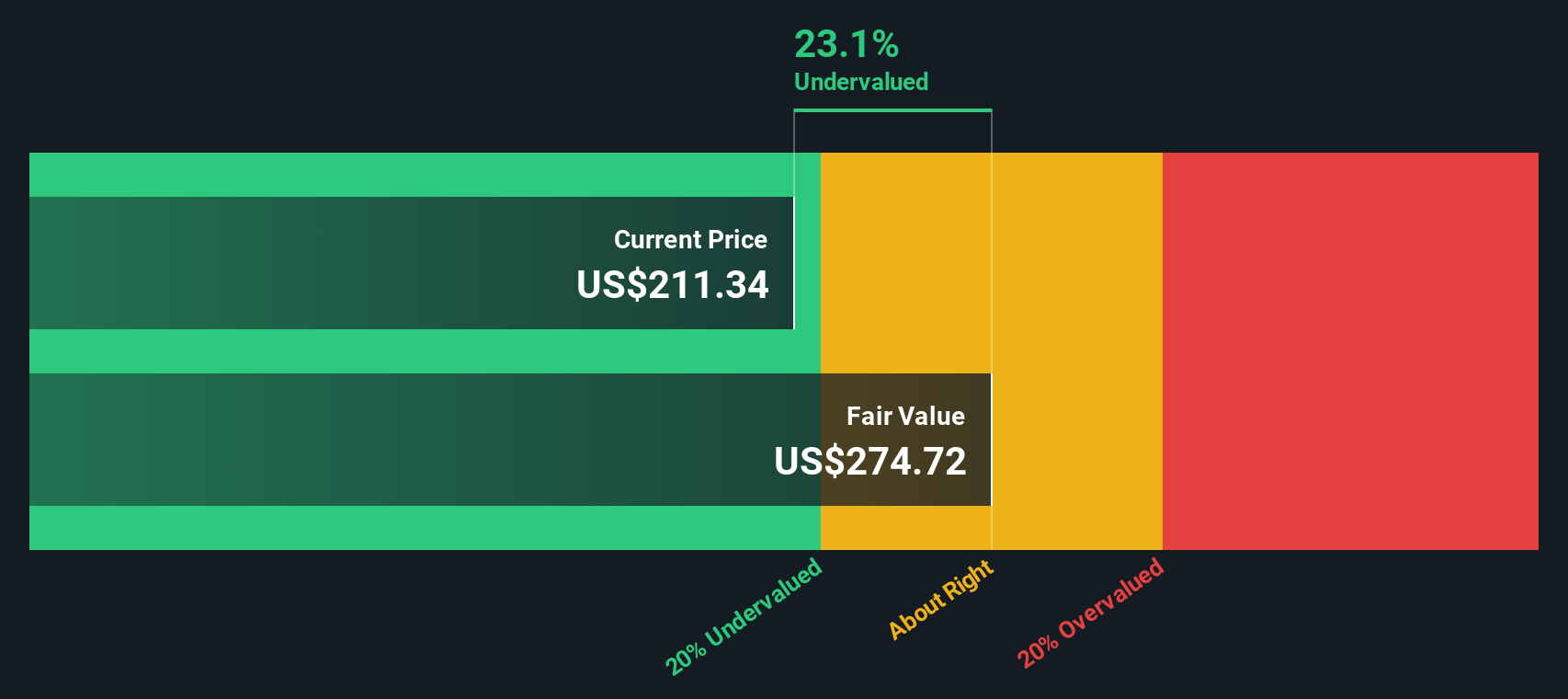

Based on the Excess Returns model, the intrinsic value is estimated at $290.18 per share. With Capital One Financial currently trading at $225.01, this suggests the stock is undervalued by around 22.5%. This sizable discount may appeal to long-term investors who believe in the company’s ability to generate returns over and above its capital cost.

Result: UNDERVALUED

Our Excess Returns analysis suggests Capital One Financial is undervalued by 22.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Capital One Financial Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like Capital One Financial. It compares a company’s stock price to its earnings per share and provides quick insight into how the market is valuing the company’s profitability. Investors often look to the PE ratio as a shorthand for whether a stock is cheap or expensive, especially for firms with consistent earnings.

Growth expectations and risk play a big role in shaping what a “normal” PE ratio should be. Companies with strong growth prospects or lower perceived risk may justify higher PE ratios, while slower-growing or riskier firms tend to trade at lower multiples. Comparing Capital One’s current PE ratio to industry averages and peers helps put its valuation in perspective.

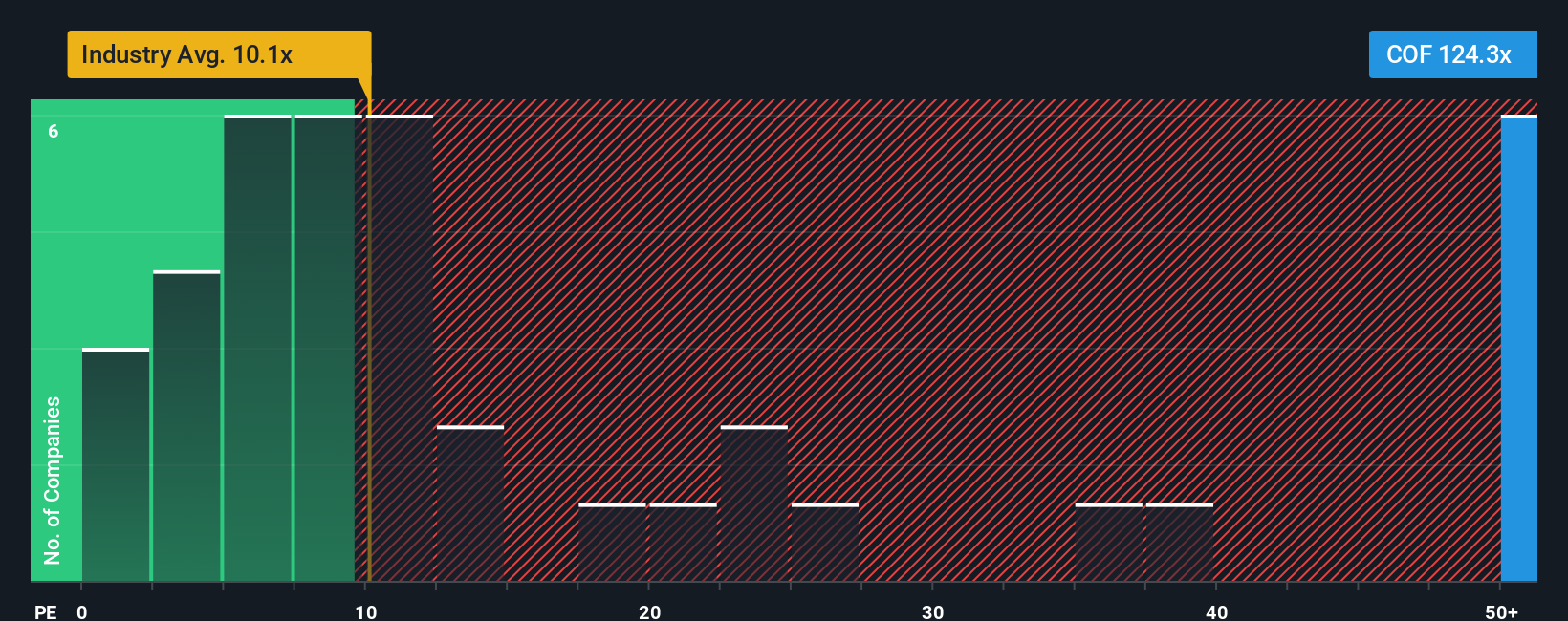

Right now, Capital One Financial trades at a PE ratio of 124.27x, which is dramatically higher than the Consumer Finance industry average of 10.31x and its peer average of 32.12x. At first glance, this steep multiple might imply the stock is highly overvalued. However, Simply Wall St's proprietary "Fair Ratio" of 34.32x offers a more nuanced judgment. The Fair Ratio is considered more thorough than simple peer or industry comparisons because it factors in not only growth and risk, but also the company’s profit margin, industry profile, and market capitalization.

When we stack up Capital One’s current PE against the Fair Ratio, the stock appears significantly overvalued by this measure. The gap suggests investors may be paying a premium that is not fully supported by the underlying fundamentals or future earnings outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Capital One Financial Narrative

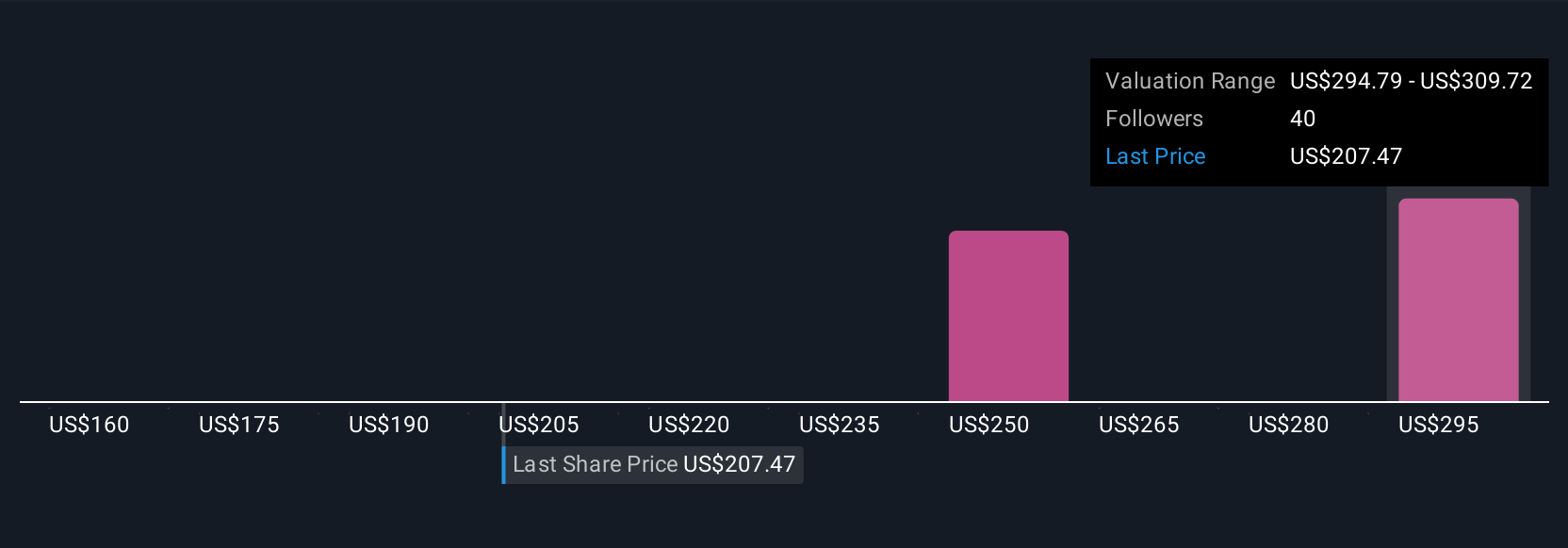

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your unique take, the story about what you believe a company like Capital One Financial will achieve in the future, captured through your own forecasts for things like revenue growth, profit margins, and fair value. Narratives let you tie together your perspective on the business with clear financial forecasts, making your investment case both personal and data-driven.

On Simply Wall St's platform, Narratives are easy for any investor to use and are already being shared and compared by millions on the Community page. Narratives help you visualize how your story translates into a fair value, and allow you to quickly compare it to the current market price so you can decide if now is the right time to buy, hold, or sell. The best part is Narratives update in real time as new information such as news events or earnings emerges, keeping your investment outlook relevant and actionable.

For example, two investors could have very different outlooks on Capital One Financial: one may believe in the optimistic story, expecting a fair value of $265.00 per share thanks to strong growth from integrations and technology, while another expects just $160.00, focusing on competition and higher expenses.

Do you think there's more to the story for Capital One Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives