- United States

- /

- Consumer Finance

- /

- NYSE:COF

Capital One (COF) Jumps 8.3% After $16B Buyback and Dividend Hike Post-Discover Merger

Reviewed by Sasha Jovanovic

- Earlier this week, Capital One Financial Corporation reported its third-quarter 2025 results, highlighting a rise in net income to US$3.19 billion and a significant increase in net interest income following the integration of Discover Financial Services.

- The company also announced a new US$16 billion share repurchase program and plans to raise its quarterly dividend, signaling continued focus on returning capital to shareholders after a major acquisition.

- We'll explore how Capital One's initiation of a substantial share buyback reflects on its evolving investment narrative after the Discover integration.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Capital One Financial Investment Narrative Recap

To own Capital One Financial, you need to believe that the Discover acquisition will unlock new revenue streams and operational efficiencies, helping the company to offset rising competition and integration costs. The latest strong net income results and a new US$16 billion share buyback program may support investor confidence, but execution risks and higher net charge-offs continue to be the most important short-term challenge. The recent news materially highlights progress on cost and revenue synergies, but credit risk pressures remain front and center.

Among the latest announcements, the US$16 billion share repurchase plan stands out as particularly relevant given the current focus on realizing acquisition synergies. This move underscores management’s intent to support shareholder returns even as Capital One invests heavily in technology, integration, and expanded card network operations to achieve its long-term goals.

However, investors should also be aware that while the Discover integration is progressing, rising net charge-offs may present challenges if credit quality weakens and...

Read the full narrative on Capital One Financial (it's free!)

Capital One Financial's narrative projects $66.2 billion revenue and $16.9 billion earnings by 2028. This requires 32.7% yearly revenue growth and a $12.3 billion earnings increase from $4.6 billion today.

Uncover how Capital One Financial's forecasts yield a $258.57 fair value, a 18% upside to its current price.

Exploring Other Perspectives

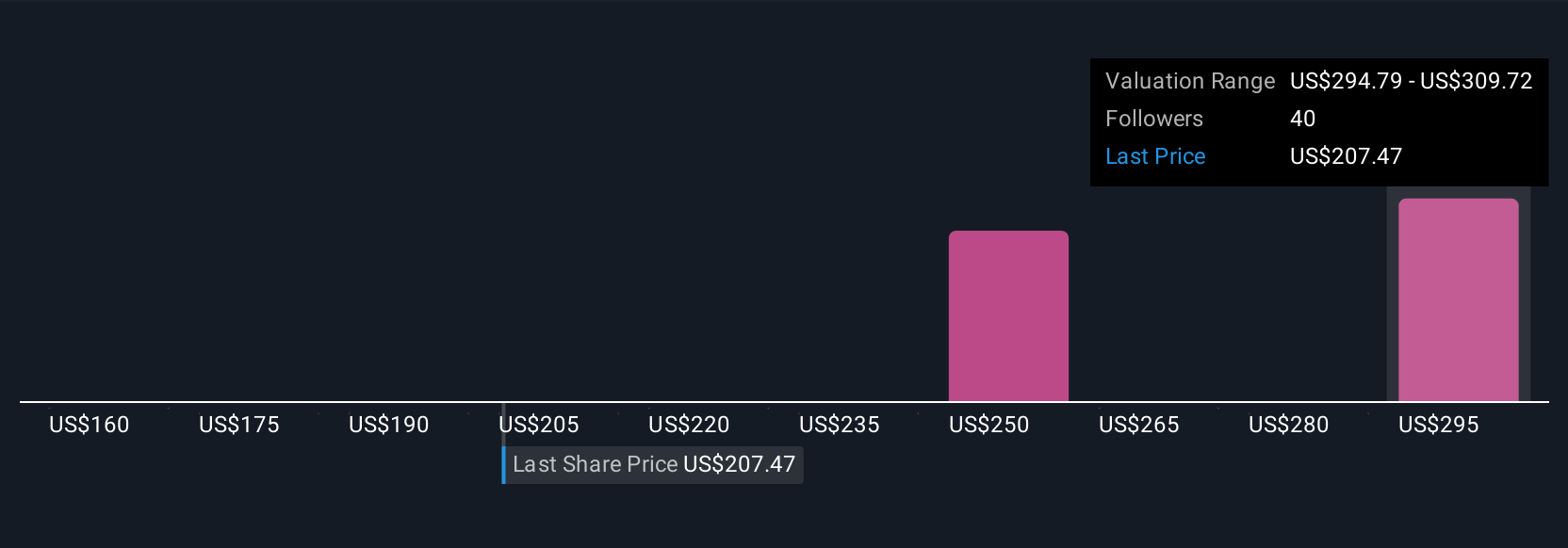

Five fair value estimates from the Simply Wall St Community range from US$160 to US$291 per share, highlighting wide-ranging investor opinions. With integration execution in focus after the Discover deal, your outlook may shift depending on how you see the company's ability to manage costs and grow revenue.

Explore 5 other fair value estimates on Capital One Financial - why the stock might be worth as much as 32% more than the current price!

Build Your Own Capital One Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Capital One Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital One Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives