- United States

- /

- Consumer Finance

- /

- NYSE:COF

Capital One (COF): Evaluating Valuation Following New T-Mobile Credit Card Launch

Reviewed by Simply Wall St

Capital One Financial (COF) has teamed up with T-Mobile to roll out the new T-Mobile Visa credit card. This move marks an expansion of Capital One's card partnership reach and opens up a fresh revenue stream through T-Mobile's large customer base.

See our latest analysis for Capital One Financial.

Capital One Financial’s latest moves are getting some attention, and it’s not just because of the T-Mobile partnership. Stronger credit card alliances have coincided with a 24.3% share price return year to date, and the 1-year total shareholder return is an impressive 21.2%. Longer-term momentum remains solid, with a 3-year total shareholder return topping 129%. This reflects continued confidence even as the market weighs buybacks and steady dividend hikes alongside this fresh growth story.

If you’re browsing for other compelling opportunities, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

The question investors face now is whether Capital One’s shares, which have recently surged, are still trading at a discount relative to underlying growth or if most of the upside is already reflected in the price.

Most Popular Narrative: 14.6% Undervalued

With Capital One Financial shares closing at $222.13 and the most popular narrative setting fair value at $260.24, the data-driven community sees notable headroom above the current price. That puts the spotlight on what is driving this bullish view.

Ongoing investments in technology, analytics, and premium offerings are expected to enhance efficiency, credit management, and market share while supporting future international expansion.

Curious how ambitious growth targets and bold efficiency upgrades feed into this valuation? One controversial set of projections could flip the narrative for years. Find out what numbers and assumptions tip the scales toward this fair value call.

Result: Fair Value of $260.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained technology spending or difficulty integrating Discover could limit profitability. This may make it harder for Capital One to meet optimistic analyst projections.

Find out about the key risks to this Capital One Financial narrative.

Another View: What Multiples Say

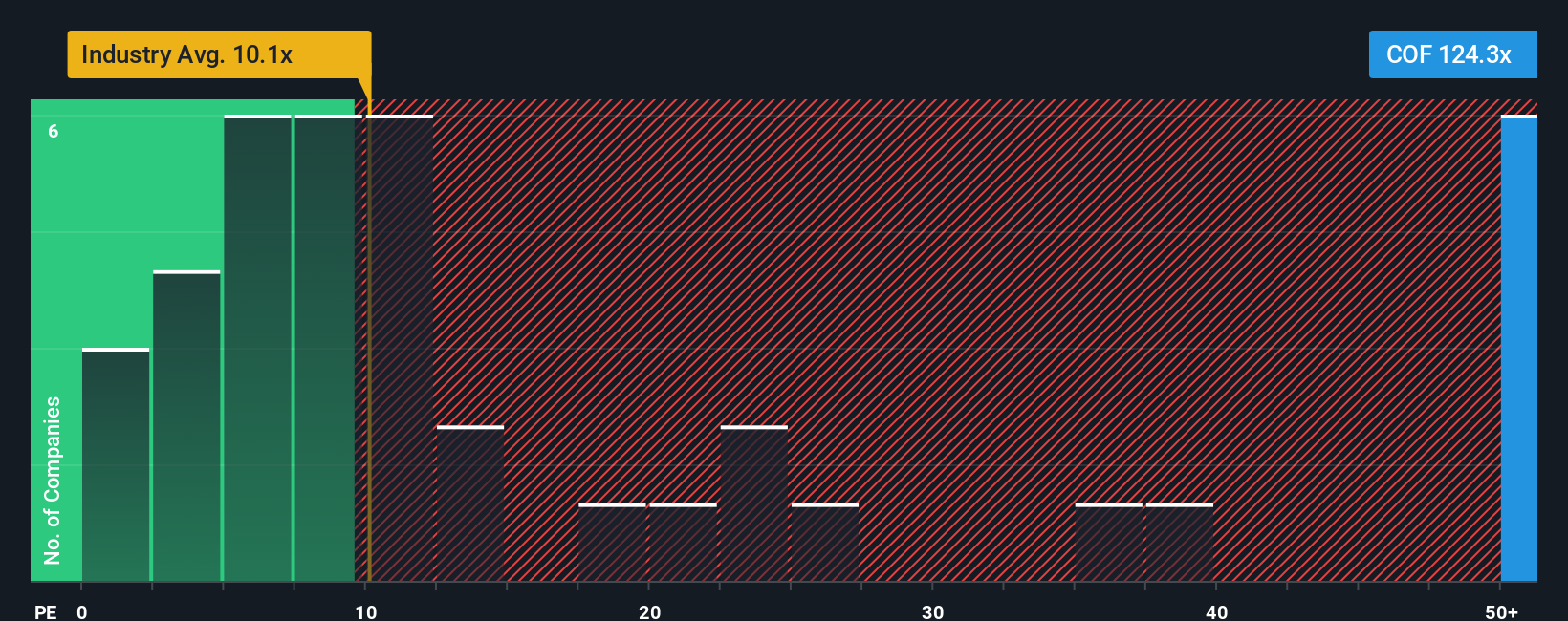

While the community sees Capital One as undervalued, a quick check of the price-to-earnings ratio tells a different story. The company trades at 122.7x earnings, which is sharply higher than its industry average of 10.8x and a fair ratio of 34.2x. This large gap suggests the market might be pricing in extra optimism, raising the risk that any slip in growth could weigh heavily on the stock. Does this valuation make the opportunity riskier than it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If you have a different perspective or want to dive into the numbers yourself, you can shape your own story in just a few minutes with Do it your way.

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one opportunity. Tap into fresh sectors and untapped potential. There is a world of promising stocks you could be missing.

- Fuel your portfolio’s growth by checking out these 882 undervalued stocks based on cash flows that may be trading at a rare bargain right now.

- Maximize your income stream when you review these 14 dividend stocks with yields > 3% offering attractive yields and steady returns above 3%.

- Ride the wave of innovation by unlocking these 27 AI penny stocks setting the pace in artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives