- United States

- /

- Consumer Finance

- /

- NYSE:COF

Capital One (COF): Evaluating Valuation After Earnings Beat, Discover Deal Progress, and $16B Buyback Announcement

Reviewed by Simply Wall St

Capital One Financial (COF) delivered third-quarter earnings that eclipsed analyst forecasts, driven by progress integrating Discover Financial Services and domestic credit card growth. The company reinforced confidence by authorizing a $16 billion buyback and planning a larger quarterly dividend.

See our latest analysis for Capital One Financial.

On the heels of upbeat earnings, Capital One’s stock has kept up a brisk pace. Its share price has climbed nearly 26% year-to-date, while total shareholder return reached a striking 38% over the past year. With momentum recharged by the Discover deal and capital plans, investors appear to be warming up to COF’s growth prospects.

If this surge in banking confidence has you curious about broader opportunities, take the next step and discover fast growing stocks with high insider ownership.

Yet with shares trading near record highs and recent analyst price targets only moderately above current levels, the pivotal question is whether Capital One is still undervalued or if the market is already pricing in all future growth.

Most Popular Narrative: 13% Undervalued

Capital One Financial's most widely tracked valuation narrative sees fair value well above the current share price. This gap is driven by bullish projections tied to integration successes and new revenue streams. Investors are watching closely as the company pivots post-Discover acquisition and aims to capture sustainable earnings growth.

The combination with Discover positions Capital One to leverage proprietary payments network infrastructure. This enables it to migrate Capital One debit and some credit card volume to the unregulated Discover network. This transition is expected to generate substantial incremental fee income and interchange revenue over time as scale, acceptance, and brand investments are realized.

Curious what’s fueling this compelling fair value call? There are bold growth assumptions and a surprisingly ambitious outlook for margins and earnings power beneath the surface. Which numbers anchor this story, and what is the future earnings curve investors are betting on? The answers lie within the narrative’s detailed projections. Explore what justifies that upside.

Result: Fair Value of $258.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration costs from the Discover deal and intense market competition could challenge Capital One’s bullish outlook and slow its margin expansion.

Find out about the key risks to this Capital One Financial narrative.

Another View: What Do Market Multiples Say?

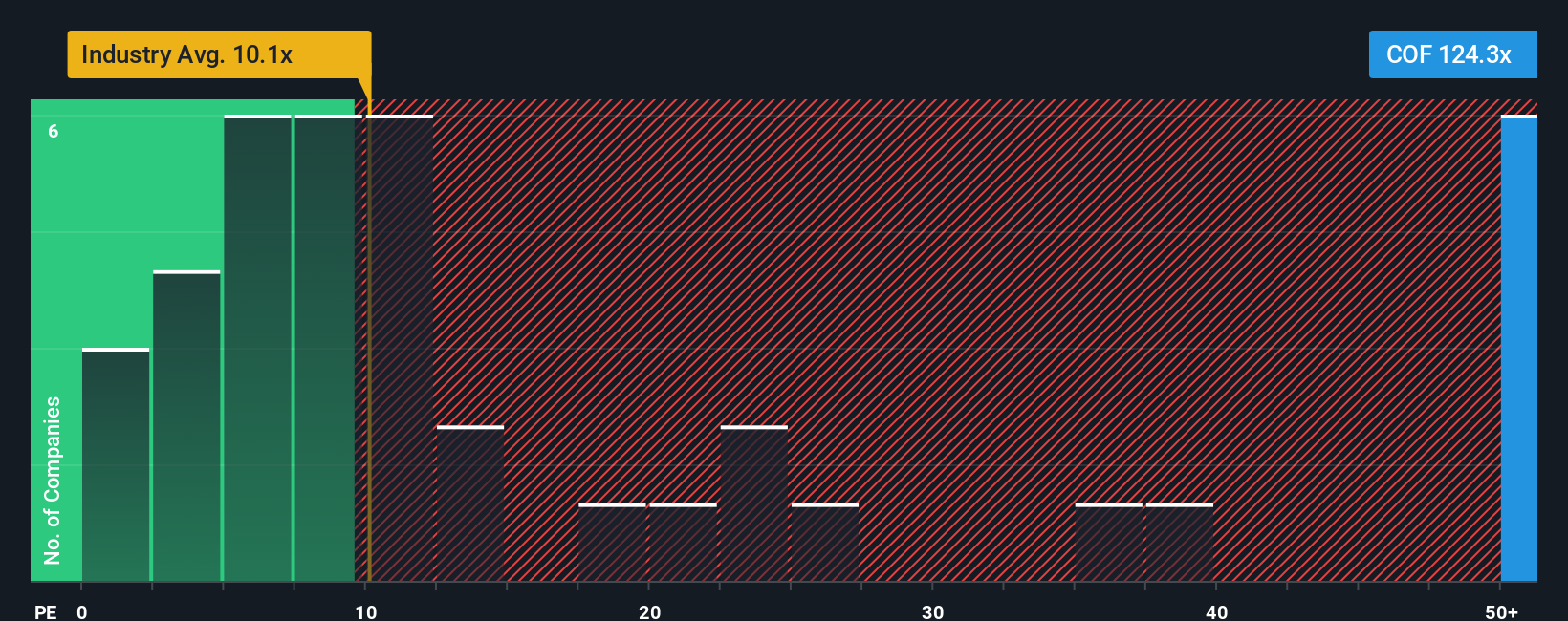

While analyst consensus points to Capital One being fairly valued, a look at its price-to-earnings ratio offers a different perspective. Shares trade at 124.3 times earnings, which is much higher than the industry’s 10.1x and peer average of 32.1x, as well as the market's fair ratio of 34.3x. This sizable gap signals that investors are pricing in a lot of optimism, raising questions about whether Capital One is truly undervalued or if expectations have outpaced reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital One Financial Narrative

If you have a different take or want to dive into the data yourself, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your Capital One Financial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let exciting opportunities slip by when there are so many promising companies out there. Use the Simply Wall Street Screener to spot tomorrow’s winners today.

- Capitalize on emerging financial trends by checking out these 3556 penny stocks with strong financials, which reveals hidden gems with strong fundamentals and real growth potential.

- Boost your portfolio’s income potential by exploring these 17 dividend stocks with yields > 3%, a curated selection of stocks offering yields greater than 3%.

- Seize the potential in the next wave of healthcare transformation with these 33 healthcare AI stocks, featuring pioneering AI-driven medical innovators.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COF

Capital One Financial

Operates as the financial services holding company for the Capital One, National Association, which engages in the provision of various financial products and services in the United States, Canada, and the United Kingdom.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives