- United States

- /

- Mortgage REITs

- /

- NYSE:BXMT

Did BXMT’s Earnings Miss And Insider Tax Sale Just Reframe Blackstone Mortgage Trust’s Dividend Story?

Reviewed by Sasha Jovanovic

- In the past quarter, Blackstone Mortgage Trust reported third-quarter 2025 earnings per share of US$0.24, below the US$0.36 analyst forecast, while its CFO sold 506 shares under a Rule 10b5-1 plan to cover tax obligations on restricted stock awards.

- Despite the earnings shortfall, the company pointed to resilient real estate fundamentals, ongoing portfolio rotation, and a 14-year record of uninterrupted dividends as it works through impaired loans and redeploys capital.

- With earnings falling short of expectations yet management emphasizing portfolio rotation and dividend consistency, we’ll examine how this shapes Blackstone Mortgage Trust’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Blackstone Mortgage Trust Investment Narrative Recap

To own Blackstone Mortgage Trust, you need to believe its senior commercial real estate loans can keep funding a reliable dividend while it works through impaired assets. The latest earnings miss against forecasts underlines that the near term catalyst remains successful portfolio rotation, while the biggest risk is still the drag from impaired and non earning loans. This quarter’s results do not materially change that balance, but they do highlight how tight the margin for error is.

Against this backdrop, the continued declaration of a US$0.47 per share quarterly dividend stands out as the announcement most connected to the recent earnings shortfall. It reinforces management’s emphasis on dividend consistency even as the company manages US$970 million of impaired loans and redeploys capital, keeping attention squarely on whether future earnings can catch up with the current payout.

Yet investors should also be aware that if impaired loans take longer to resolve than expected, the pressure on margins and dividend coverage could...

Read the full narrative on Blackstone Mortgage Trust (it's free!)

Blackstone Mortgage Trust's narrative projects $547.4 million revenue and $513.3 million earnings by 2028. This requires 32.2% yearly revenue growth and an earnings increase of about $526 million from -$12.6 million today.

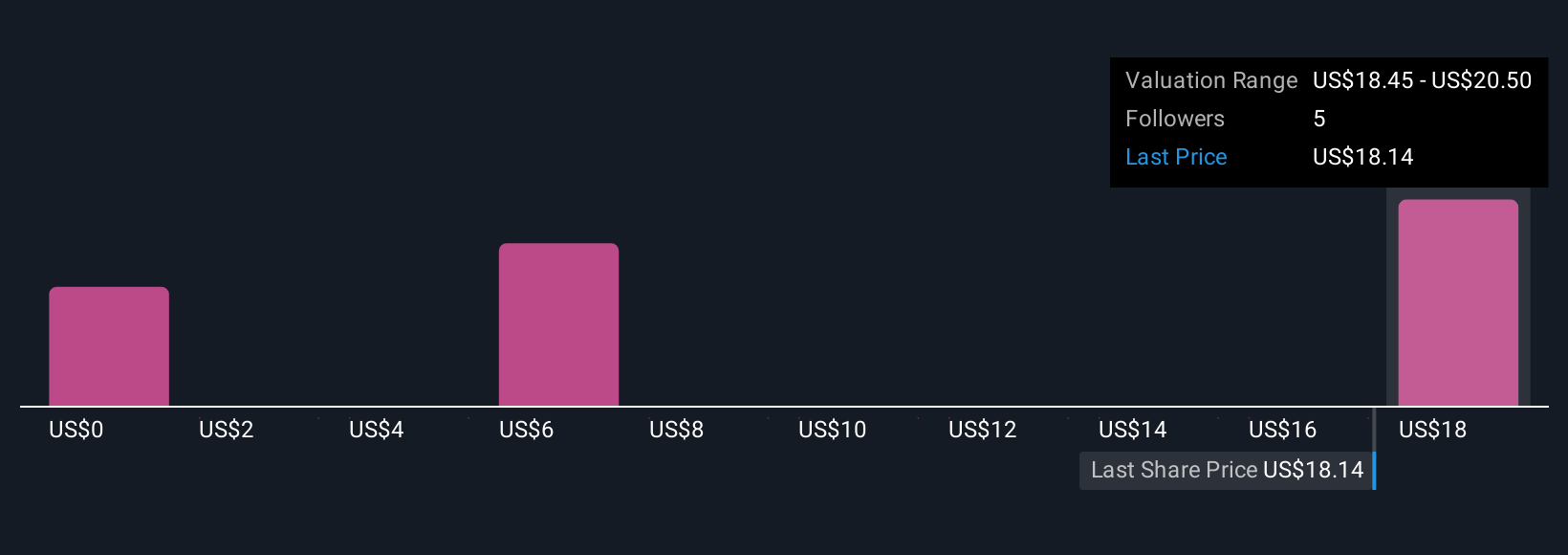

Uncover how Blackstone Mortgage Trust's forecasts yield a $20.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see fair value anywhere between US$2.05 and US$20.50, reflecting very different expectations. When you set those views against the ongoing work to resolve US$970 million of impaired loans, it becomes clear how important it is to consider several perspectives on BXMT’s future earnings power.

Explore 5 other fair value estimates on Blackstone Mortgage Trust - why the stock might be worth as much as $20.50!

Build Your Own Blackstone Mortgage Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blackstone Mortgage Trust research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Blackstone Mortgage Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Blackstone Mortgage Trust's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone Mortgage Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BXMT

Blackstone Mortgage Trust

A real estate finance company, originates senior loans collateralized by commercial properties in North America, Europe, and Australia.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026